World Investment Advisors LLC grew its stake in Chubb Limited (NYSE:CB - Free Report) by 895.5% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 32,183 shares of the financial services provider's stock after acquiring an additional 28,950 shares during the quarter. World Investment Advisors LLC's holdings in Chubb were worth $9,281,000 at the end of the most recent quarter.

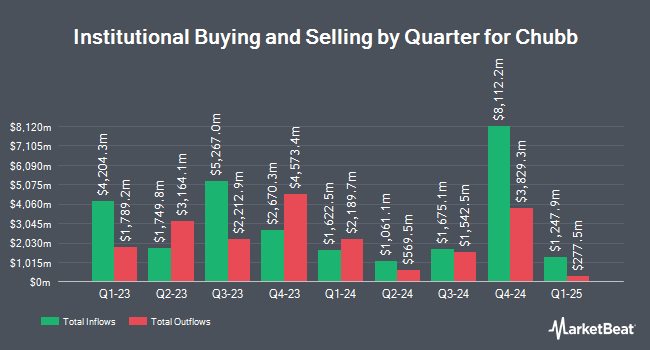

Several other hedge funds have also added to or reduced their stakes in the stock. FMR LLC boosted its holdings in Chubb by 7.3% in the third quarter. FMR LLC now owns 15,576,485 shares of the financial services provider's stock worth $4,492,103,000 after acquiring an additional 1,052,999 shares in the last quarter. Ameriprise Financial Inc. boosted its holdings in Chubb by 1.3% in the second quarter. Ameriprise Financial Inc. now owns 4,933,389 shares of the financial services provider's stock worth $1,258,202,000 after acquiring an additional 63,891 shares in the last quarter. Legal & General Group Plc boosted its holdings in Chubb by 2.9% in the second quarter. Legal & General Group Plc now owns 3,679,874 shares of the financial services provider's stock worth $938,663,000 after acquiring an additional 104,986 shares in the last quarter. Raymond James & Associates boosted its holdings in Chubb by 2.9% in the second quarter. Raymond James & Associates now owns 3,051,081 shares of the financial services provider's stock worth $778,270,000 after acquiring an additional 87,059 shares in the last quarter. Finally, Dimensional Fund Advisors LP boosted its holdings in Chubb by 7.5% in the second quarter. Dimensional Fund Advisors LP now owns 2,297,706 shares of the financial services provider's stock worth $586,207,000 after acquiring an additional 160,335 shares in the last quarter. 83.81% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

CB has been the subject of several recent analyst reports. JPMorgan Chase & Co. boosted their price target on Chubb from $291.00 to $294.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 30th. Jefferies Financial Group boosted their price target on Chubb from $294.00 to $295.00 and gave the stock a "hold" rating in a research note on Wednesday, October 9th. JMP Securities boosted their price target on Chubb from $300.00 to $325.00 and gave the stock a "market outperform" rating in a research note on Wednesday, October 30th. Wells Fargo & Company boosted their price target on Chubb from $266.00 to $268.00 and gave the stock an "equal weight" rating in a research note on Tuesday, November 5th. Finally, Barclays initiated coverage on Chubb in a research note on Wednesday, September 4th. They issued an "overweight" rating and a $349.00 price target for the company. Two equities research analysts have rated the stock with a sell rating, eleven have assigned a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, Chubb currently has an average rating of "Hold" and an average target price of $287.37.

Read Our Latest Research Report on Chubb

Chubb Stock Performance

CB traded down $0.94 during midday trading on Thursday, reaching $275.28. The company had a trading volume of 1,216,594 shares, compared to its average volume of 1,599,546. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.21. The business has a 50-day moving average of $286.01 and a two-hundred day moving average of $276.64. The company has a market cap of $110.96 billion, a P/E ratio of 11.32, a P/E/G ratio of 6.59 and a beta of 0.67. Chubb Limited has a 1 year low of $216.90 and a 1 year high of $302.05.

Chubb (NYSE:CB - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The financial services provider reported $5.72 EPS for the quarter, topping analysts' consensus estimates of $4.98 by $0.74. The business had revenue of $13.83 billion during the quarter, compared to analysts' expectations of $14.16 billion. Chubb had a return on equity of 15.46% and a net margin of 18.32%. The business's quarterly revenue was up 5.5% on a year-over-year basis. During the same quarter in the prior year, the business posted $4.95 earnings per share. As a group, equities research analysts predict that Chubb Limited will post 21.82 earnings per share for the current fiscal year.

Chubb Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, January 3rd. Shareholders of record on Friday, December 13th will be given a $0.91 dividend. This represents a $3.64 dividend on an annualized basis and a yield of 1.32%. The ex-dividend date is Friday, December 13th. Chubb's payout ratio is 14.91%.

Chubb Company Profile

(

Free Report)

Chubb Limited provides insurance and reinsurance products worldwide. The company's North America Commercial P&C Insurance segment offers commercial property, casualty, workers' compensation, package policies, risk management, financial lines, marine, construction, environmental, medical risk, cyber risk, surety, and casualty; and group accident and health insurance to large, middle market, and small commercial businesses.

See Also

Before you consider Chubb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chubb wasn't on the list.

While Chubb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.