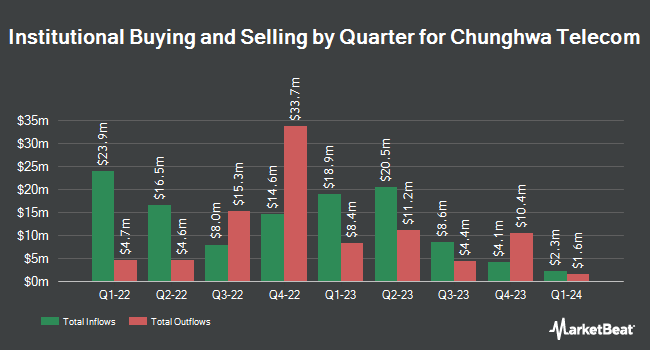

American Century Companies Inc. increased its stake in shares of Chunghwa Telecom Co., Ltd. (NYSE:CHT - Free Report) by 15.3% during the fourth quarter, according to its most recent filing with the SEC. The institutional investor owned 255,122 shares of the utilities provider's stock after purchasing an additional 33,831 shares during the period. American Century Companies Inc.'s holdings in Chunghwa Telecom were worth $9,605,000 as of its most recent SEC filing.

Several other large investors have also added to or reduced their stakes in the stock. Sierra Ocean LLC purchased a new stake in shares of Chunghwa Telecom in the fourth quarter worth about $54,000. GAMMA Investing LLC lifted its stake in Chunghwa Telecom by 71.4% in the 4th quarter. GAMMA Investing LLC now owns 3,085 shares of the utilities provider's stock worth $116,000 after purchasing an additional 1,285 shares in the last quarter. R Squared Ltd purchased a new stake in Chunghwa Telecom in the 4th quarter worth approximately $127,000. V Square Quantitative Management LLC boosted its holdings in Chunghwa Telecom by 31.0% in the 4th quarter. V Square Quantitative Management LLC now owns 4,065 shares of the utilities provider's stock valued at $153,000 after purchasing an additional 961 shares during the period. Finally, Lindbrook Capital LLC grew its position in shares of Chunghwa Telecom by 35.6% during the 4th quarter. Lindbrook Capital LLC now owns 5,257 shares of the utilities provider's stock valued at $198,000 after purchasing an additional 1,379 shares in the last quarter. Institutional investors own 2.11% of the company's stock.

Analyst Upgrades and Downgrades

Separately, StockNews.com raised Chunghwa Telecom from a "hold" rating to a "buy" rating in a research note on Monday, March 17th.

View Our Latest Analysis on Chunghwa Telecom

Chunghwa Telecom Price Performance

NYSE CHT traded down $1.04 during trading hours on Monday, reaching $37.76. 175,958 shares of the stock traded hands, compared to its average volume of 95,031. The stock has a 50 day simple moving average of $38.90 and a two-hundred day simple moving average of $38.41. Chunghwa Telecom Co., Ltd. has a 1 year low of $35.92 and a 1 year high of $40.62. The company has a debt-to-equity ratio of 0.06, a current ratio of 1.47 and a quick ratio of 1.29. The company has a market cap of $29.29 billion, a price-to-earnings ratio of 25.34, a price-to-earnings-growth ratio of 21.42 and a beta of 0.22.

Chunghwa Telecom (NYSE:CHT - Get Free Report) last announced its quarterly earnings data on Thursday, January 23rd. The utilities provider reported $0.36 earnings per share for the quarter. Chunghwa Telecom had a return on equity of 9.53% and a net margin of 16.18%. On average, analysts predict that Chunghwa Telecom Co., Ltd. will post 1.44 EPS for the current fiscal year.

Chunghwa Telecom Company Profile

(

Free Report)

Chunghwa Telecom Co, Ltd., together with its subsidiaries, provides telecommunication services in Taiwan and internationally. It operates through Consumer Business, Enterprise Business, International Business, and Others segments. The company offers local, domestic long distance, and international long distance fixed-line telephone services; mobile services such as prepaid and postpaid plans; broadband plans; and internet and data services.

Featured Stories

Before you consider Chunghwa Telecom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chunghwa Telecom wasn't on the list.

While Chunghwa Telecom currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.