Intech Investment Management LLC lessened its stake in Churchill Downs Incorporated (NASDAQ:CHDN - Free Report) by 51.2% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 4,617 shares of the company's stock after selling 4,843 shares during the quarter. Intech Investment Management LLC's holdings in Churchill Downs were worth $624,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

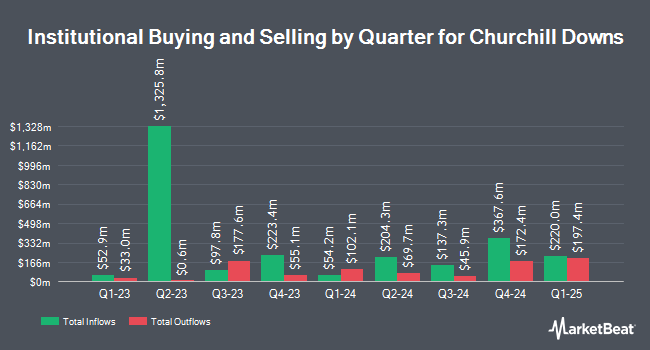

A number of other hedge funds also recently bought and sold shares of CHDN. Harbor Capital Advisors Inc. raised its holdings in Churchill Downs by 259.3% in the second quarter. Harbor Capital Advisors Inc. now owns 19,857 shares of the company's stock worth $2,772,000 after buying an additional 14,331 shares during the last quarter. Aigen Investment Management LP purchased a new position in Churchill Downs in the 3rd quarter worth approximately $516,000. Assenagon Asset Management S.A. lifted its position in Churchill Downs by 10,126.1% in the 2nd quarter. Assenagon Asset Management S.A. now owns 195,829 shares of the company's stock valued at $27,338,000 after acquiring an additional 193,914 shares in the last quarter. Point72 Asset Management L.P. boosted its stake in Churchill Downs by 66.8% during the 2nd quarter. Point72 Asset Management L.P. now owns 250,319 shares of the company's stock valued at $34,944,000 after purchasing an additional 100,230 shares during the last quarter. Finally, Oppenheimer Asset Management Inc. bought a new stake in shares of Churchill Downs in the 2nd quarter worth $794,000. Institutional investors own 82.59% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on CHDN. Bank of America raised Churchill Downs from a "neutral" rating to a "buy" rating and upped their price target for the company from $145.00 to $155.00 in a report on Monday, August 12th. JMP Securities restated a "market outperform" rating and set a $166.00 target price on shares of Churchill Downs in a research note on Monday, October 14th. Mizuho reduced their price target on shares of Churchill Downs from $157.00 to $151.00 and set an "outperform" rating for the company in a research note on Tuesday, October 22nd. Wells Fargo & Company increased their price objective on shares of Churchill Downs from $161.00 to $168.00 and gave the company an "overweight" rating in a research report on Thursday, October 17th. Finally, Truist Financial reaffirmed a "buy" rating and issued a $165.00 target price (down previously from $166.00) on shares of Churchill Downs in a research report on Friday, October 25th. One research analyst has rated the stock with a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $160.88.

Get Our Latest Stock Report on Churchill Downs

Churchill Downs Stock Performance

CHDN traded up $1.89 during trading on Friday, hitting $142.11. The company's stock had a trading volume of 286,627 shares, compared to its average volume of 428,770. The company has a quick ratio of 0.55, a current ratio of 0.55 and a debt-to-equity ratio of 4.35. Churchill Downs Incorporated has a one year low of $111.10 and a one year high of $150.21. The business's 50 day simple moving average is $139.18 and its 200-day simple moving average is $138.14. The firm has a market cap of $10.45 billion, a PE ratio of 25.89, a P/E/G ratio of 3.94 and a beta of 0.96.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last posted its quarterly earnings results on Wednesday, October 23rd. The company reported $0.97 EPS for the quarter, beating the consensus estimate of $0.96 by $0.01. The business had revenue of $628.50 million during the quarter, compared to analyst estimates of $627.90 million. Churchill Downs had a net margin of 15.45% and a return on equity of 45.48%. The company's quarterly revenue was up 9.8% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.87 EPS. As a group, sell-side analysts predict that Churchill Downs Incorporated will post 5.86 EPS for the current fiscal year.

Churchill Downs Increases Dividend

The business also recently announced an annual dividend, which will be paid on Friday, January 3rd. Shareholders of record on Friday, December 6th will be given a dividend of $0.409 per share. This represents a yield of 0.29%. The ex-dividend date is Friday, December 6th. This is a boost from Churchill Downs's previous annual dividend of $0.38. Churchill Downs's dividend payout ratio (DPR) is 6.92%.

About Churchill Downs

(

Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Read More

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.