Churchill Downs (NASDAQ:CHDN - Get Free Report)'s stock had its "market outperform" rating reiterated by investment analysts at JMP Securities in a research report issued to clients and investors on Thursday,Benzinga reports. They currently have a $166.00 price target on the stock. JMP Securities' target price indicates a potential upside of 25.05% from the stock's current price.

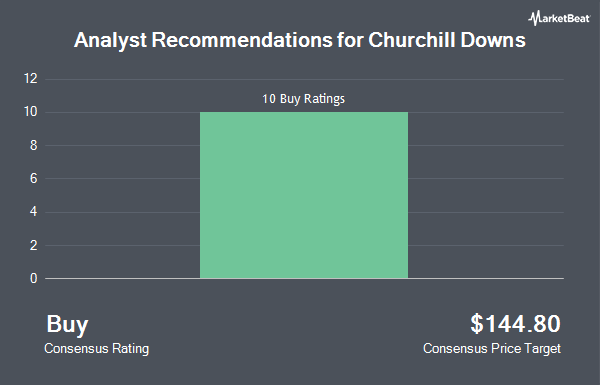

A number of other brokerages have also issued reports on CHDN. Wells Fargo & Company upped their target price on Churchill Downs from $161.00 to $168.00 and gave the company an "overweight" rating in a research report on Thursday, October 17th. StockNews.com raised shares of Churchill Downs from a "sell" rating to a "hold" rating in a report on Wednesday, November 6th. Truist Financial reiterated a "buy" rating and set a $165.00 target price (down previously from $166.00) on shares of Churchill Downs in a research note on Friday, October 25th. Finally, Mizuho reduced their price target on shares of Churchill Downs from $157.00 to $151.00 and set an "outperform" rating on the stock in a research report on Tuesday, October 22nd. One analyst has rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $160.88.

Read Our Latest Stock Analysis on Churchill Downs

Churchill Downs Stock Up 2.5 %

Shares of CHDN traded up $3.20 during midday trading on Thursday, reaching $132.75. 494,063 shares of the company were exchanged, compared to its average volume of 432,415. The company has a current ratio of 0.55, a quick ratio of 0.55 and a debt-to-equity ratio of 4.35. Churchill Downs has a 1-year low of $111.10 and a 1-year high of $150.21. The company has a market cap of $9.76 billion, a price-to-earnings ratio of 24.18, a P/E/G ratio of 3.84 and a beta of 0.95. The stock has a 50-day moving average price of $139.48 and a 200-day moving average price of $138.53.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last released its quarterly earnings results on Wednesday, October 23rd. The company reported $0.97 EPS for the quarter, topping the consensus estimate of $0.96 by $0.01. Churchill Downs had a return on equity of 45.48% and a net margin of 15.45%. The firm had revenue of $628.50 million for the quarter, compared to analyst estimates of $627.90 million. During the same period in the previous year, the company posted $0.87 EPS. Churchill Downs's revenue for the quarter was up 9.8% on a year-over-year basis. Research analysts expect that Churchill Downs will post 5.86 earnings per share for the current year.

Hedge Funds Weigh In On Churchill Downs

Several large investors have recently bought and sold shares of CHDN. William Blair Investment Management LLC acquired a new position in shares of Churchill Downs during the second quarter valued at approximately $125,418,000. Westfield Capital Management Co. LP boosted its stake in Churchill Downs by 100.0% during the 3rd quarter. Westfield Capital Management Co. LP now owns 763,561 shares of the company's stock valued at $103,241,000 after purchasing an additional 381,754 shares in the last quarter. Kovitz Investment Group Partners LLC acquired a new position in shares of Churchill Downs during the 3rd quarter valued at $18,368,000. State Street Corp raised its stake in shares of Churchill Downs by 5.8% in the 3rd quarter. State Street Corp now owns 2,078,031 shares of the company's stock worth $280,971,000 after buying an additional 114,018 shares in the last quarter. Finally, WCM Investment Management LLC bought a new stake in shares of Churchill Downs in the 3rd quarter worth $15,231,000. Institutional investors and hedge funds own 82.59% of the company's stock.

Churchill Downs Company Profile

(

Get Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Featured Articles

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.