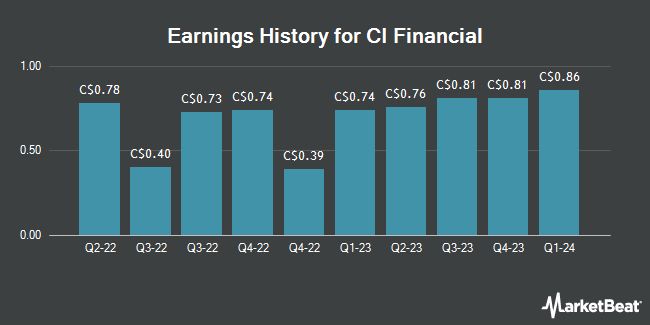

CI Financial (TSE:CIX - Get Free Report) is set to post its quarterly earnings results before the market opens on Thursday, November 14th.

CI Financial (TSE:CIX - Get Free Report) last released its earnings results on Thursday, August 8th. The company reported C$0.90 earnings per share (EPS) for the quarter. The firm had revenue of C$985.96 million for the quarter. CI Financial had a negative return on equity of 4.48% and a negative net margin of 1.54%.

CI Financial Stock Performance

CIX stock traded up C$0.03 during trading on Thursday, hitting C$23.86. 205,137 shares of the company traded hands, compared to its average volume of 427,108. The company has a market cap of C$3.37 billion, a PE ratio of -88.26, a P/E/G ratio of 0.04 and a beta of 1.67. The company has a debt-to-equity ratio of 577.47, a current ratio of 0.34 and a quick ratio of 0.17. The stock's 50-day simple moving average is C$19.47 and its 200 day simple moving average is C$16.88. CI Financial has a 1 year low of C$13.44 and a 1 year high of C$24.07.

Analyst Upgrades and Downgrades

A number of research firms recently commented on CIX. TD Securities decreased their price objective on CI Financial from C$21.00 to C$20.00 and set a "buy" rating on the stock in a report on Wednesday, July 17th. Jefferies Financial Group increased their target price on shares of CI Financial from C$20.00 to C$27.00 and gave the stock a "buy" rating in a report on Friday, November 1st. Four research analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat, CI Financial currently has an average rating of "Moderate Buy" and a consensus target price of C$20.25.

View Our Latest Stock Analysis on CIX

CI Financial Company Profile

(

Get Free Report)

CI Financial Corp. is a publicly owned asset management holding company. Through its subsidiaries, the firm manages separate client focused equity, fixed income, and alternative investments portfolios. It also manages mutual funds, hedge funds, and fund of funds for its clients through its subsidiaries.

Featured Stories

Before you consider CI Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CI Financial wasn't on the list.

While CI Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.