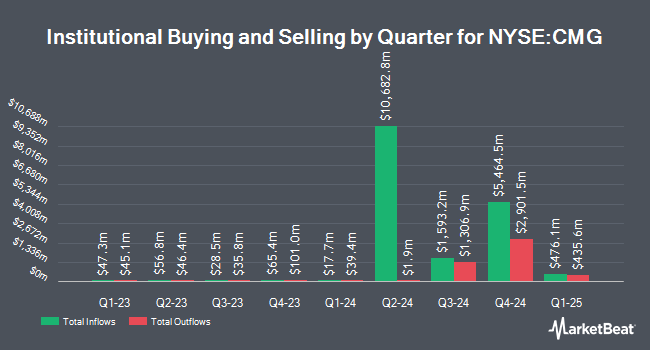

CIBC Asset Management Inc lifted its stake in Chipotle Mexican Grill, Inc. (NYSE:CMG - Free Report) by 8.0% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 199,610 shares of the restaurant operator's stock after acquiring an additional 14,868 shares during the period. CIBC Asset Management Inc's holdings in Chipotle Mexican Grill were worth $11,502,000 at the end of the most recent reporting period.

Other large investors have also added to or reduced their stakes in the company. Nwam LLC purchased a new position in shares of Chipotle Mexican Grill during the 1st quarter valued at $220,000. O Shaughnessy Asset Management LLC grew its position in Chipotle Mexican Grill by 19.7% during the first quarter. O Shaughnessy Asset Management LLC now owns 1,990 shares of the restaurant operator's stock worth $5,784,000 after buying an additional 327 shares in the last quarter. Seven Eight Capital LP grew its position in Chipotle Mexican Grill by 1,058.7% during the first quarter. Seven Eight Capital LP now owns 1,599 shares of the restaurant operator's stock worth $4,648,000 after buying an additional 1,461 shares in the last quarter. Clearbridge Investments LLC increased its stake in Chipotle Mexican Grill by 1.0% in the 1st quarter. Clearbridge Investments LLC now owns 3,422 shares of the restaurant operator's stock worth $9,947,000 after acquiring an additional 34 shares during the last quarter. Finally, UniSuper Management Pty Ltd raised its holdings in shares of Chipotle Mexican Grill by 216.5% in the 1st quarter. UniSuper Management Pty Ltd now owns 728 shares of the restaurant operator's stock valued at $2,116,000 after acquiring an additional 498 shares in the last quarter. Institutional investors own 91.31% of the company's stock.

Analysts Set New Price Targets

Several research analysts have recently commented on CMG shares. Barclays boosted their price objective on Chipotle Mexican Grill from $55.00 to $60.00 and gave the stock an "equal weight" rating in a report on Wednesday, October 30th. Raymond James dropped their target price on Chipotle Mexican Grill from $70.00 to $62.50 and set an "outperform" rating for the company in a research report on Thursday, July 25th. Evercore ISI increased their price target on shares of Chipotle Mexican Grill from $59.00 to $70.00 and gave the company an "outperform" rating in a research report on Tuesday, October 15th. The Goldman Sachs Group lowered their price objective on shares of Chipotle Mexican Grill from $74.60 to $67.00 and set a "buy" rating for the company in a report on Thursday, July 25th. Finally, Citigroup cut their price objective on shares of Chipotle Mexican Grill from $71.00 to $70.00 and set a "buy" rating for the company in a research note on Wednesday, October 30th. Ten research analysts have rated the stock with a hold rating and eighteen have given a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $65.27.

Get Our Latest Research Report on CMG

Chipotle Mexican Grill Trading Down 2.1 %

Shares of CMG stock traded down $1.28 during midday trading on Friday, reaching $58.63. 6,743,957 shares of the stock were exchanged, compared to its average volume of 11,741,678. The firm has a market cap of $79.89 billion, a PE ratio of 54.57, a price-to-earnings-growth ratio of 2.36 and a beta of 1.26. The company's 50 day moving average is $58.02 and its two-hundred day moving average is $81.18. Chipotle Mexican Grill, Inc. has a 1 year low of $43.10 and a 1 year high of $69.26.

Chipotle Mexican Grill (NYSE:CMG - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The restaurant operator reported $0.27 earnings per share for the quarter, topping the consensus estimate of $0.25 by $0.02. The company had revenue of $2.79 billion for the quarter, compared to analysts' expectations of $2.82 billion. Chipotle Mexican Grill had a return on equity of 43.20% and a net margin of 13.51%. The firm's revenue for the quarter was up 13.0% on a year-over-year basis. During the same period in the prior year, the firm earned $0.23 earnings per share. As a group, equities analysts expect that Chipotle Mexican Grill, Inc. will post 1.11 EPS for the current fiscal year.

Insider Buying and Selling

In related news, Director Robin S. Hickenlooper sold 1,790 shares of the firm's stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $56.38, for a total transaction of $100,920.20. Following the completion of the sale, the director now owns 41,510 shares of the company's stock, valued at $2,340,333.80. This trade represents a 4.13 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Curtis E. Garner sold 15,750 shares of Chipotle Mexican Grill stock in a transaction on Wednesday, September 11th. The stock was sold at an average price of $55.02, for a total value of $866,565.00. Following the completion of the sale, the insider now directly owns 473,514 shares of the company's stock, valued at approximately $26,052,740.28. The trade was a 3.22 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 33,290 shares of company stock worth $1,866,023 in the last three months. 1.02% of the stock is owned by corporate insiders.

Chipotle Mexican Grill Profile

(

Free Report)

Chipotle Mexican Grill, Inc, together with its subsidiaries, owns and operates Chipotle Mexican Grill restaurants. It sells food and beverages through offering burritos, burrito bowls, quesadillas, tacos, and salads. The company also provides delivery and related services its app and website. It has operations in the United States, Canada, France, Germany, and the United Kingdom.

Read More

Before you consider Chipotle Mexican Grill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipotle Mexican Grill wasn't on the list.

While Chipotle Mexican Grill currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.