CIBC Asset Management Inc increased its position in shares of NXP Semiconductors (NASDAQ:NXPI - Free Report) by 3.2% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 74,287 shares of the semiconductor provider's stock after buying an additional 2,276 shares during the period. CIBC Asset Management Inc's holdings in NXP Semiconductors were worth $15,441,000 at the end of the most recent quarter.

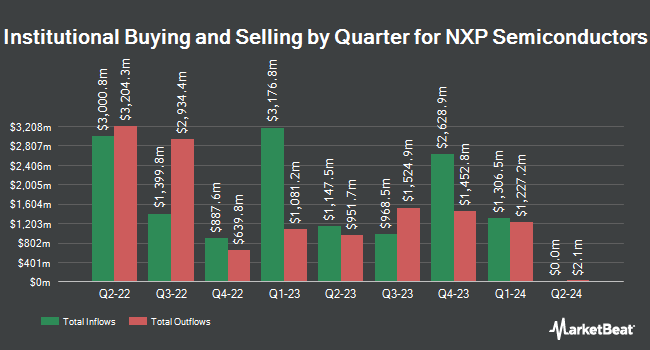

Several other institutional investors and hedge funds have also recently made changes to their positions in NXPI. Strategic Financial Concepts LLC bought a new stake in shares of NXP Semiconductors in the 4th quarter valued at about $46,000. Allworth Financial LP increased its holdings in NXP Semiconductors by 150.8% during the fourth quarter. Allworth Financial LP now owns 3,566 shares of the semiconductor provider's stock valued at $771,000 after buying an additional 2,144 shares during the period. Principal Securities Inc. increased its holdings in NXP Semiconductors by 8.7% during the fourth quarter. Principal Securities Inc. now owns 4,179 shares of the semiconductor provider's stock valued at $869,000 after buying an additional 334 shares during the period. Seascape Capital Management raised its stake in NXP Semiconductors by 2.2% in the fourth quarter. Seascape Capital Management now owns 14,752 shares of the semiconductor provider's stock worth $3,066,000 after buying an additional 319 shares in the last quarter. Finally, Congress Asset Management Co. lifted its holdings in NXP Semiconductors by 0.3% during the fourth quarter. Congress Asset Management Co. now owns 523,573 shares of the semiconductor provider's stock worth $108,825,000 after buying an additional 1,581 shares during the period. 90.54% of the stock is currently owned by institutional investors.

NXP Semiconductors Stock Performance

Shares of NASDAQ:NXPI traded down $9.34 during trading on Friday, hitting $236.52. The stock had a trading volume of 5,304,408 shares, compared to its average volume of 2,894,500. The company has a quick ratio of 1.60, a current ratio of 2.36 and a debt-to-equity ratio of 1.09. NXP Semiconductors has a 12-month low of $198.21 and a 12-month high of $296.08. The stock has a market capitalization of $60.11 billion, a price-to-earnings ratio of 24.31, a price-to-earnings-growth ratio of 3.01 and a beta of 1.46. The stock has a 50-day simple moving average of $214.86 and a two-hundred day simple moving average of $227.99.

Wall Street Analyst Weigh In

A number of brokerages have recently issued reports on NXPI. TD Cowen cut their price target on NXP Semiconductors from $300.00 to $285.00 and set a "buy" rating on the stock in a report on Friday, November 8th. Barclays cut their target price on NXP Semiconductors from $280.00 to $230.00 and set an "overweight" rating on the stock in a research note on Friday, January 17th. Citigroup raised shares of NXP Semiconductors from a "neutral" rating to a "buy" rating and increased their price target for the company from $210.00 to $290.00 in a research report on Thursday. StockNews.com downgraded shares of NXP Semiconductors from a "buy" rating to a "hold" rating in a research report on Wednesday, January 29th. Finally, The Goldman Sachs Group upgraded shares of NXP Semiconductors from a "neutral" rating to a "buy" rating and reduced their price objective for the stock from $260.00 to $257.00 in a research note on Friday, January 10th. Four equities research analysts have rated the stock with a hold rating and sixteen have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $267.00.

Get Our Latest Stock Report on NXPI

NXP Semiconductors Profile

(

Free Report)

NXP Semiconductors N.V. offers various semiconductor products. The company's product portfolio includes microcontrollers; application processors, including i.MX application processors, and i.MX 8 and 9 family of applications processors; communication processors; wireless connectivity solutions, such as near field communications, ultra-wideband, Bluetooth low-energy, Zigbee, and Wi-Fi and Wi-Fi/Bluetooth integrated SoCs; analog and interface devices; radio frequency power amplifiers; and security controllers, as well as semiconductor-based environmental and inertial sensors, including pressure, inertial, magnetic, and gyroscopic sensors.

Further Reading

Before you consider NXP Semiconductors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NXP Semiconductors wasn't on the list.

While NXP Semiconductors currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.