CIBC Asset Management Inc grew its stake in shares of Fortinet, Inc. (NASDAQ:FTNT - Free Report) by 5.7% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 222,191 shares of the software maker's stock after acquiring an additional 11,943 shares during the period. CIBC Asset Management Inc's holdings in Fortinet were worth $17,231,000 at the end of the most recent quarter.

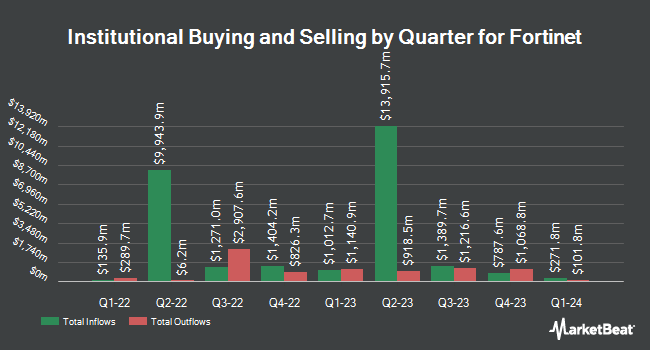

A number of other institutional investors also recently made changes to their positions in the company. Vanguard Group Inc. boosted its position in shares of Fortinet by 1.2% in the first quarter. Vanguard Group Inc. now owns 68,052,487 shares of the software maker's stock valued at $4,648,665,000 after acquiring an additional 779,271 shares during the period. Price T Rowe Associates Inc. MD grew its position in shares of Fortinet by 664.8% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 35,137,089 shares of the software maker's stock worth $2,400,215,000 after purchasing an additional 30,542,551 shares in the last quarter. Swedbank AB boosted its stake in shares of Fortinet by 1.7% in the second quarter. Swedbank AB now owns 8,156,797 shares of the software maker's stock valued at $491,610,000 after buying an additional 134,366 shares during the period. Marshall Wace LLP boosted its stake in shares of Fortinet by 198.5% in the second quarter. Marshall Wace LLP now owns 6,238,856 shares of the software maker's stock valued at $376,016,000 after buying an additional 4,148,520 shares during the period. Finally, Van ECK Associates Corp grew its position in Fortinet by 94.9% during the second quarter. Van ECK Associates Corp now owns 5,755,599 shares of the software maker's stock worth $346,890,000 after buying an additional 2,802,446 shares in the last quarter. Institutional investors own 83.71% of the company's stock.

Fortinet Stock Down 0.3 %

Fortinet stock traded down $0.26 during trading on Friday, hitting $94.20. 5,916,022 shares of the company were exchanged, compared to its average volume of 5,497,884. The company has a current ratio of 1.34, a quick ratio of 1.25 and a debt-to-equity ratio of 1.09. The business's 50 day moving average is $80.76 and its 200 day moving average is $69.24. Fortinet, Inc. has a 52 week low of $49.97 and a 52 week high of $100.59. The company has a market capitalization of $72.20 billion, a P/E ratio of 47.58, a PEG ratio of 2.93 and a beta of 1.00.

Insider Buying and Selling at Fortinet

In other news, CEO Ken Xie sold 23,307 shares of the business's stock in a transaction that occurred on Wednesday, October 16th. The shares were sold at an average price of $81.89, for a total value of $1,908,610.23. Following the sale, the chief executive officer now owns 48,915,530 shares of the company's stock, valued at $4,005,692,751.70. The trade was a 0.05 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Corporate insiders own 18.00% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently weighed in on the company. Raymond James upped their target price on Fortinet from $85.00 to $95.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Hsbc Global Res raised shares of Fortinet from a "hold" rating to a "strong-buy" rating in a research report on Monday, November 11th. DZ Bank raised shares of Fortinet from a "sell" rating to a "hold" rating and set a $65.00 target price on the stock in a report on Thursday, August 8th. Susquehanna upped their price target on shares of Fortinet from $65.00 to $70.00 and gave the stock a "neutral" rating in a report on Thursday, August 8th. Finally, Truist Financial increased their price target on shares of Fortinet from $70.00 to $85.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. One analyst has rated the stock with a sell rating, nineteen have issued a hold rating, twelve have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Fortinet has a consensus rating of "Hold" and a consensus price target of $79.52.

View Our Latest Stock Report on Fortinet

About Fortinet

(

Free Report)

Fortinet, Inc provides cybersecurity and convergence of networking and security solutions worldwide. It offers secure networking solutions focus on the convergence of networking and security; network firewall solutions that consist of FortiGate data centers, hyperscale, and distributed firewalls, as well as encrypted applications; wireless LAN solutions; and secure connectivity solutions, including FortiSwitch secure ethernet switches, FortiAP wireless local area network access points, FortiExtender 5G connectivity gateways, and other products.

Read More

Before you consider Fortinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortinet wasn't on the list.

While Fortinet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.