Bombardier, Inc. Class B (TSE:BBD.B - Get Free Report) had its target price lowered by research analysts at CIBC from C$134.00 to C$131.00 in a research report issued to clients and investors on Friday,BayStreet.CA reports. CIBC's target price would suggest a potential upside of 32.30% from the company's previous close.

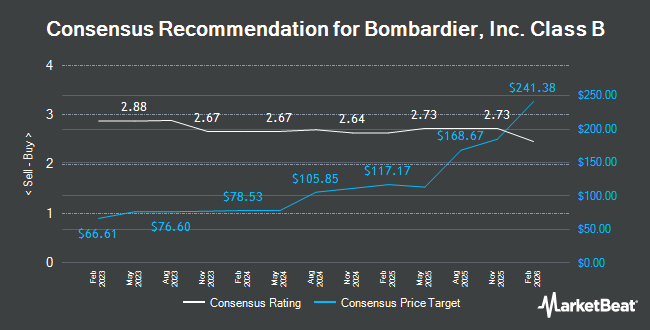

A number of other research firms also recently weighed in on BBD.B. National Bankshares lifted their price target on shares of Bombardier, Inc. Class B from C$128.00 to C$130.00 in a research report on Friday. Barclays boosted their price objective on shares of Bombardier, Inc. Class B from C$70.00 to C$90.00 in a research report on Tuesday, July 30th. National Bank Financial boosted their price objective on shares of Bombardier, Inc. Class B to C$128.00 and gave the company an "outperform" rating in a research report on Thursday, October 10th. Finally, Scotiabank downgraded shares of Bombardier, Inc. Class B from an "outperform" rating to a "sector perform" rating and set a C$120.00 price objective for the company. in a research report on Friday, November 1st. Two equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of C$114.33.

Check Out Our Latest Stock Report on BBD.B

Bombardier, Inc. Class B Trading Up 0.1 %

Shares of TSE:BBD.B traded up C$0.05 during midday trading on Friday, hitting C$99.02. The company had a trading volume of 187,449 shares, compared to its average volume of 432,922. Bombardier, Inc. Class B has a 12 month low of C$44.29 and a 12 month high of C$113.60. The stock has a market cap of C$8.57 billion, a price-to-earnings ratio of 25.65, a PEG ratio of 6.26 and a beta of 2.98. The firm has a fifty day simple moving average of C$98.91 and a 200 day simple moving average of C$87.86.

Insider Activity

In other news, Senior Officer Eve Laurier sold 4,000 shares of the stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of C$91.57, for a total transaction of C$366,280.00. In other news, Senior Officer Barton Wade Demosky sold 6,000 shares of Bombardier, Inc. Class B stock in a transaction dated Thursday, August 15th. The stock was sold at an average price of C$89.00, for a total value of C$534,000.00. Also, Senior Officer Eve Laurier sold 4,000 shares of the business's stock in a transaction that occurred on Tuesday, August 27th. The stock was sold at an average price of C$91.57, for a total value of C$366,280.00. Corporate insiders own 1.66% of the company's stock.

Bombardier, Inc. Class B Company Profile

(

Get Free Report)

Bombardier Inc, together with its subsidiaries, manufactures and sells transportation equipment worldwide.

Bombardier Inc was incorporated in 1902 and is based in Dorval, Canada.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bombardier, Inc. Class B, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bombardier, Inc. Class B wasn't on the list.

While Bombardier, Inc. Class B currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.