CIBC Private Wealth Group LLC raised its position in shares of Vertiv Holdings Co (NYSE:VRT - Free Report) by 10,482.2% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 846,471 shares of the company's stock after buying an additional 838,472 shares during the quarter. CIBC Private Wealth Group LLC owned about 0.23% of Vertiv worth $96,168,000 at the end of the most recent quarter.

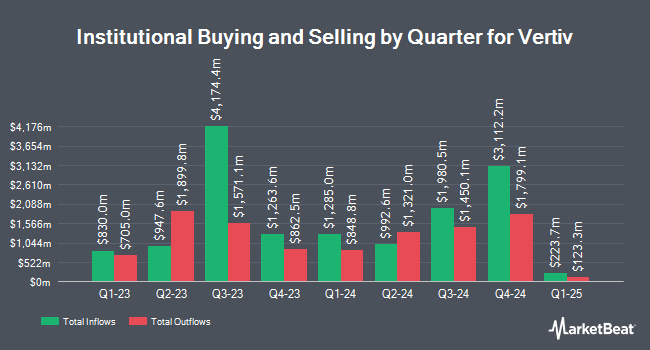

Several other institutional investors and hedge funds have also made changes to their positions in VRT. Norges Bank acquired a new stake in Vertiv during the fourth quarter worth about $391,777,000. Jennison Associates LLC lifted its position in Vertiv by 68.6% in the fourth quarter. Jennison Associates LLC now owns 7,754,347 shares of the company's stock worth $880,971,000 after purchasing an additional 3,153,932 shares during the period. Wellington Management Group LLP lifted its holdings in shares of Vertiv by 271.0% in the third quarter. Wellington Management Group LLP now owns 3,915,446 shares of the company's stock valued at $389,548,000 after buying an additional 2,860,181 shares during the period. Arrowstreet Capital Limited Partnership boosted its position in shares of Vertiv by 136.9% during the 4th quarter. Arrowstreet Capital Limited Partnership now owns 3,336,862 shares of the company's stock valued at $379,101,000 after purchasing an additional 1,928,275 shares in the last quarter. Finally, Vanguard Group Inc. boosted its holdings in Vertiv by 3.5% during the fourth quarter. Vanguard Group Inc. now owns 36,356,089 shares of the company's stock worth $4,130,415,000 after buying an additional 1,244,780 shares in the last quarter. 89.92% of the stock is owned by institutional investors and hedge funds.

Vertiv Stock Up 4.3 %

Shares of Vertiv stock traded up $3.09 during trading on Tuesday, hitting $75.29. 10,125,749 shares of the stock traded hands, compared to its average volume of 8,772,375. The company has a fifty day moving average price of $101.47 and a two-hundred day moving average price of $111.58. Vertiv Holdings Co has a twelve month low of $62.40 and a twelve month high of $155.84. The stock has a market cap of $28.67 billion, a P/E ratio of 58.82, a PEG ratio of 1.07 and a beta of 1.71. The company has a debt-to-equity ratio of 1.19, a quick ratio of 1.02 and a current ratio of 1.65.

Vertiv (NYSE:VRT - Get Free Report) last posted its earnings results on Wednesday, February 12th. The company reported $0.99 EPS for the quarter, topping the consensus estimate of $0.84 by $0.15. Vertiv had a net margin of 6.19% and a return on equity of 61.41%. During the same quarter in the prior year, the business earned $0.56 EPS. Equities research analysts predict that Vertiv Holdings Co will post 3.59 EPS for the current fiscal year.

Vertiv Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Thursday, March 27th. Investors of record on Tuesday, March 18th were issued a $0.0375 dividend. The ex-dividend date of this dividend was Tuesday, March 18th. This represents a $0.15 annualized dividend and a yield of 0.20%. Vertiv's dividend payout ratio (DPR) is presently 11.72%.

Wall Street Analyst Weigh In

VRT has been the subject of several analyst reports. Morgan Stanley started coverage on Vertiv in a report on Monday, January 6th. They set an "overweight" rating and a $150.00 target price for the company. Royal Bank of Canada started coverage on Vertiv in a report on Friday, March 7th. They set an "outperform" rating and a $121.00 price objective on the stock. Melius downgraded shares of Vertiv from a "buy" rating to a "hold" rating and set a $125.00 target price on the stock. in a research report on Tuesday, January 28th. Melius Research restated a "hold" rating and issued a $125.00 price target on shares of Vertiv in a research report on Tuesday, January 28th. Finally, Barclays lowered their price objective on shares of Vertiv from $111.00 to $100.00 and set an "equal weight" rating on the stock in a research report on Wednesday, March 26th. Four investment analysts have rated the stock with a hold rating and eleven have given a buy rating to the company. According to data from MarketBeat.com, Vertiv currently has a consensus rating of "Moderate Buy" and a consensus price target of $135.33.

View Our Latest Research Report on VRT

Vertiv Company Profile

(

Free Report)

Vertiv Holdings Co, together with its subsidiaries, designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

See Also

Before you consider Vertiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertiv wasn't on the list.

While Vertiv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.