Converge Technology Solutions (TSE:CTS - Get Free Report) had its target price upped by research analysts at CIBC from C$5.50 to C$6.00 in a note issued to investors on Thursday,BayStreet.CA reports. CIBC's price objective points to a potential upside of 0.84% from the stock's previous close.

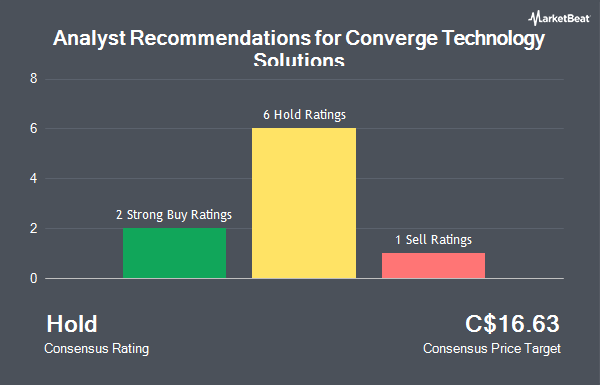

CTS has been the subject of a number of other research reports. Stifel Canada upgraded Converge Technology Solutions to a "strong-buy" rating in a report on Wednesday, January 15th. Cormark raised shares of Converge Technology Solutions from a "hold" rating to a "moderate buy" rating in a research report on Monday, January 13th. Scotiabank upped their target price on Converge Technology Solutions from C$5.50 to C$6.00 in a report on Wednesday, April 2nd. Ventum Financial cut shares of Converge Technology Solutions from a "buy" rating to a "tender" rating and lowered their price target for the company from C$6.00 to C$5.50 in a research report on Monday, February 10th. Finally, Desjardins cut shares of Converge Technology Solutions from a "buy" rating to a "tender" rating and upped their price objective for the stock from C$5.00 to C$5.50 in a report on Friday, March 7th. One research analyst has rated the stock with a sell rating, six have issued a hold rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, Converge Technology Solutions currently has an average rating of "Hold" and an average target price of C$16.63.

Read Our Latest Stock Report on CTS

Converge Technology Solutions Price Performance

Shares of Converge Technology Solutions stock remained flat at C$5.95 during trading on Thursday. 1,791,051 shares of the stock were exchanged, compared to its average volume of 1,606,039. The company has a market cap of C$1.12 billion, a P/E ratio of -7.14, a price-to-earnings-growth ratio of 0.14 and a beta of 1.81. The firm has a 50-day simple moving average of C$5.17 and a 200-day simple moving average of C$4.21. The company has a current ratio of 0.96, a quick ratio of 0.68 and a debt-to-equity ratio of 85.78. Converge Technology Solutions has a 12 month low of C$2.90 and a 12 month high of C$6.06.

About Converge Technology Solutions

(

Get Free Report)

Converge Technology Solutions Corp is a Canadian company building a platform of regionally focused Hybrid IT infrastructure providers that deliver best-of-breed solutions and services in the United States. The solutions provided include multi-cloud solutions, the blockchain, resiliency, and managed services, enabling the company to address the business and IT issues that public and private-sector organizations face.

Recommended Stories

Before you consider Converge Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Converge Technology Solutions wasn't on the list.

While Converge Technology Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.