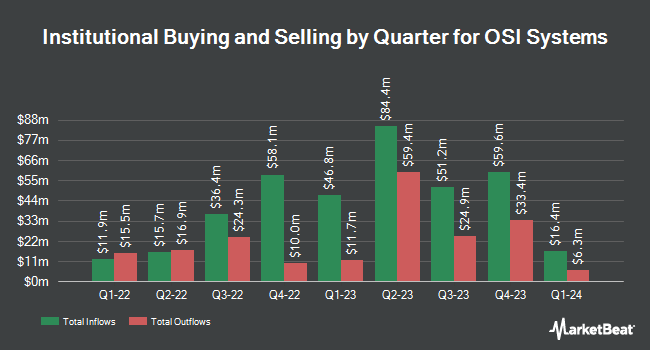

Cibc World Markets Corp acquired a new position in OSI Systems, Inc. (NASDAQ:OSIS - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 1,484 shares of the technology company's stock, valued at approximately $248,000.

Several other large investors also recently made changes to their positions in the business. FMR LLC boosted its holdings in OSI Systems by 4,891.4% in the third quarter. FMR LLC now owns 644,396 shares of the technology company's stock valued at $97,839,000 after acquiring an additional 631,486 shares during the last quarter. World Investment Advisors LLC acquired a new stake in shares of OSI Systems during the 3rd quarter worth approximately $16,713,000. Swedbank AB bought a new stake in shares of OSI Systems during the fourth quarter worth approximately $8,372,000. Telemark Asset Management LLC acquired a new position in OSI Systems in the fourth quarter valued at approximately $8,372,000. Finally, First Eagle Investment Management LLC bought a new position in OSI Systems in the fourth quarter valued at approximately $6,011,000. Institutional investors own 89.21% of the company's stock.

Insiders Place Their Bets

In related news, insider Paul Keith Morben sold 155 shares of the company's stock in a transaction dated Thursday, January 30th. The shares were sold at an average price of $199.36, for a total value of $30,900.80. Following the transaction, the insider now owns 10,077 shares in the company, valued at approximately $2,008,950.72. This represents a 1.51 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Gerald M. Chizever sold 2,701 shares of OSI Systems stock in a transaction that occurred on Monday, January 27th. The shares were sold at an average price of $195.83, for a total transaction of $528,936.83. Following the completion of the sale, the director now owns 5,000 shares of the company's stock, valued at approximately $979,150. The trade was a 35.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 5.20% of the company's stock.

OSI Systems Stock Down 2.9 %

Shares of NASDAQ OSIS traded down $5.79 during midday trading on Friday, reaching $193.32. The company's stock had a trading volume of 172,142 shares, compared to its average volume of 175,453. OSI Systems, Inc. has a fifty-two week low of $126.57 and a fifty-two week high of $220.00. The stock has a 50 day simple moving average of $196.64 and a 200-day simple moving average of $171.11. The stock has a market capitalization of $3.25 billion, a price-to-earnings ratio of 24.88, a PEG ratio of 1.81 and a beta of 1.20. The company has a current ratio of 1.88, a quick ratio of 1.25 and a debt-to-equity ratio of 0.56.

OSI Systems (NASDAQ:OSIS - Get Free Report) last released its earnings results on Thursday, January 23rd. The technology company reported $2.42 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.34 by $0.08. OSI Systems had a return on equity of 18.22% and a net margin of 8.15%. Equities research analysts predict that OSI Systems, Inc. will post 9.22 earnings per share for the current year.

Analyst Ratings Changes

Several research analysts have recently issued reports on OSIS shares. Oppenheimer raised their price target on OSI Systems from $205.00 to $225.00 and gave the stock an "outperform" rating in a research report on Friday, January 24th. B. Riley boosted their price objective on shares of OSI Systems from $180.00 to $221.00 and gave the company a "buy" rating in a report on Friday, January 24th. Roth Mkm increased their target price on shares of OSI Systems from $178.00 to $224.00 and gave the stock a "buy" rating in a report on Friday, January 24th. JPMorgan Chase & Co. initiated coverage on shares of OSI Systems in a research report on Friday, February 21st. They issued a "neutral" rating and a $225.00 price objective for the company. Finally, StockNews.com downgraded OSI Systems from a "hold" rating to a "sell" rating in a research note on Thursday. One analyst has rated the stock with a sell rating, one has given a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $212.00.

Read Our Latest Research Report on OSIS

About OSI Systems

(

Free Report)

OSI Systems, Inc designs and manufactures electronic systems and components. It operates in three segments: Security, Healthcare, and Optoelectronics and Manufacturing. The Security segment offers baggage and parcel inspection, cargo and vehicle inspection, hold baggage and people screening, radiation monitoring, explosive and narcotics trace detection systems, and optical inspection systems under the Rapiscan name.

Featured Articles

Before you consider OSI Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OSI Systems wasn't on the list.

While OSI Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.