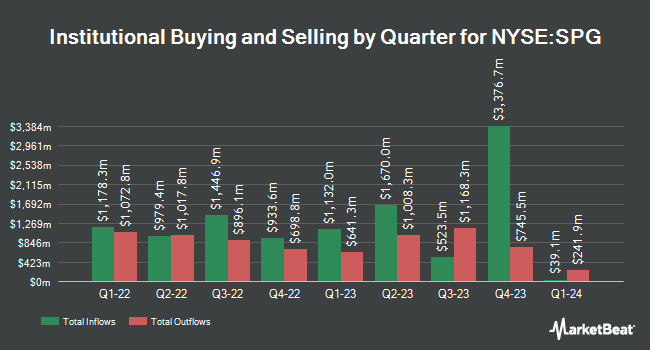

Cibc World Markets Corp increased its position in shares of Simon Property Group, Inc. (NYSE:SPG - Free Report) by 11.9% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 138,486 shares of the real estate investment trust's stock after buying an additional 14,728 shares during the quarter. Cibc World Markets Corp's holdings in Simon Property Group were worth $23,849,000 at the end of the most recent reporting period.

A number of other large investors have also recently added to or reduced their stakes in the business. Creative Financial Designs Inc. ADV raised its stake in shares of Simon Property Group by 284.1% in the 4th quarter. Creative Financial Designs Inc. ADV now owns 1,621 shares of the real estate investment trust's stock valued at $279,000 after acquiring an additional 1,199 shares during the period. SlateStone Wealth LLC increased its holdings in Simon Property Group by 16.3% in the 4th quarter. SlateStone Wealth LLC now owns 1,593 shares of the real estate investment trust's stock valued at $274,000 after purchasing an additional 223 shares during the last quarter. one8zero8 LLC purchased a new stake in Simon Property Group in the fourth quarter valued at approximately $1,527,000. Natixis Advisors LLC lifted its stake in Simon Property Group by 6.1% during the fourth quarter. Natixis Advisors LLC now owns 197,248 shares of the real estate investment trust's stock worth $33,968,000 after purchasing an additional 11,293 shares in the last quarter. Finally, Frank Rimerman Advisors LLC boosted its position in shares of Simon Property Group by 2.6% during the fourth quarter. Frank Rimerman Advisors LLC now owns 8,031 shares of the real estate investment trust's stock worth $1,383,000 after buying an additional 207 shares during the period. 93.01% of the stock is currently owned by institutional investors and hedge funds.

Insiders Place Their Bets

In related news, Director Reuben S. Leibowitz purchased 465 shares of the business's stock in a transaction dated Monday, December 30th. The stock was acquired at an average price of $168.59 per share, for a total transaction of $78,394.35. Following the acquisition, the director now directly owns 55,919 shares of the company's stock, valued at $9,427,384.21. This trade represents a 0.84 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 8.60% of the stock is currently owned by company insiders.

Simon Property Group Stock Down 1.4 %

SPG traded down $2.33 on Friday, reaching $162.12. The company's stock had a trading volume of 3,094,006 shares, compared to its average volume of 1,527,094. The company has a market capitalization of $52.90 billion, a price-to-earnings ratio of 22.33, a P/E/G ratio of 10.10 and a beta of 1.78. Simon Property Group, Inc. has a fifty-two week low of $139.25 and a fifty-two week high of $190.13. The company has a quick ratio of 2.00, a current ratio of 1.28 and a debt-to-equity ratio of 7.19. The stock has a 50 day moving average of $176.29 and a two-hundred day moving average of $174.33.

Simon Property Group (NYSE:SPG - Get Free Report) last issued its quarterly earnings results on Tuesday, February 4th. The real estate investment trust reported $3.68 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.98 by $1.70. Simon Property Group had a return on equity of 74.02% and a net margin of 41.49%. As a group, analysts forecast that Simon Property Group, Inc. will post 12.54 EPS for the current fiscal year.

Simon Property Group Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Investors of record on Monday, March 10th will be issued a dividend of $2.10 per share. This represents a $8.40 dividend on an annualized basis and a yield of 5.18%. The ex-dividend date of this dividend is Monday, March 10th. Simon Property Group's dividend payout ratio is presently 115.70%.

Analyst Ratings Changes

Several equities analysts recently issued reports on the company. Piper Sandler raised Simon Property Group from a "neutral" rating to an "overweight" rating and increased their target price for the stock from $175.00 to $205.00 in a research note on Wednesday, February 5th. Deutsche Bank Aktiengesellschaft began coverage on shares of Simon Property Group in a research report on Tuesday, December 17th. They set a "hold" rating and a $195.00 price target on the stock. Mizuho lifted their price objective on shares of Simon Property Group from $158.00 to $182.00 and gave the company a "neutral" rating in a report on Wednesday, December 4th. StockNews.com lowered shares of Simon Property Group from a "buy" rating to a "hold" rating in a report on Saturday, March 8th. Finally, Jefferies Financial Group upgraded shares of Simon Property Group from a "hold" rating to a "buy" rating and boosted their price target for the stock from $179.00 to $198.00 in a research note on Thursday, January 2nd. Six equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $180.33.

Check Out Our Latest Report on Simon Property Group

About Simon Property Group

(

Free Report)

Simon Property Group, Inc NYSE: SPG is a self-administered and self-managed real estate investment trust (REIT). Simon Property Group, L.P., or the Operating Partnership, is our majority-owned partnership subsidiary that owns all of our real estate properties and other assets. In this package, the terms Simon, we, our, or the Company refer to Simon Property Group, Inc, the Operating Partnership, and its subsidiaries.

See Also

Before you consider Simon Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simon Property Group wasn't on the list.

While Simon Property Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.