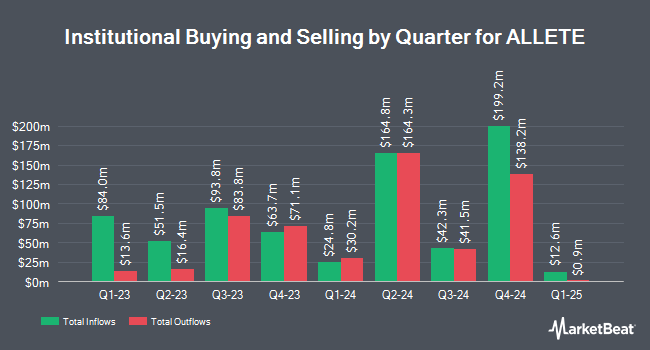

Cibc World Markets Corp acquired a new stake in ALLETE, Inc. (NYSE:ALE - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor acquired 5,435 shares of the utilities provider's stock, valued at approximately $352,000.

Several other hedge funds have also added to or reduced their stakes in ALE. Glazer Capital LLC acquired a new position in ALLETE in the 3rd quarter valued at $5,766,000. Tokio Marine Asset Management Co. Ltd. acquired a new position in shares of ALLETE in the fourth quarter valued at about $5,378,000. Barclays PLC increased its position in ALLETE by 187.1% during the third quarter. Barclays PLC now owns 100,079 shares of the utilities provider's stock worth $6,425,000 after acquiring an additional 65,222 shares during the period. Jane Street Group LLC raised its stake in ALLETE by 107.8% in the 3rd quarter. Jane Street Group LLC now owns 121,631 shares of the utilities provider's stock worth $7,807,000 after purchasing an additional 63,091 shares in the last quarter. Finally, Raymond James Financial Inc. bought a new stake in ALLETE in the 4th quarter valued at about $3,522,000. Institutional investors and hedge funds own 76.55% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com began coverage on ALLETE in a research report on Friday, January 10th. They issued a "hold" rating on the stock.

Get Our Latest Stock Report on ALLETE

ALLETE Price Performance

ALE traded up $0.02 during trading on Friday, hitting $65.68. 170,335 shares of the stock traded hands, compared to its average volume of 362,941. The business has a 50 day moving average price of $65.55 and a 200 day moving average price of $64.87. The company has a market cap of $3.81 billion, a price-to-earnings ratio of 21.19 and a beta of 0.74. ALLETE, Inc. has a twelve month low of $56.66 and a twelve month high of $65.99. The company has a debt-to-equity ratio of 0.50, a current ratio of 1.08 and a quick ratio of 0.69.

ALLETE (NYSE:ALE - Get Free Report) last posted its quarterly earnings results on Tuesday, February 18th. The utilities provider reported $0.87 EPS for the quarter, missing analysts' consensus estimates of $1.02 by ($0.15). ALLETE had a return on equity of 5.97% and a net margin of 11.72%.

ALLETE Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Saturday, March 1st. Investors of record on Friday, February 14th were issued a dividend of $0.73 per share. The ex-dividend date was Friday, February 14th. This is a positive change from ALLETE's previous quarterly dividend of $0.71. This represents a $2.92 annualized dividend and a dividend yield of 4.45%. ALLETE's payout ratio is 94.19%.

ALLETE Company Profile

(

Free Report)

ALLETE, Inc operates as an energy company. The company operates through Regulated Operations, ALLETE Clean Energy, and Corporate and Other segments. It generates electricity from coal-fired, biomass co-fired / natural gas, hydroelectric, wind, and solar. In addition, the company provides regulated utility electric services in northwestern Wisconsin to approximately 15,000 electric customers, 13,000 natural gas customers, and 10,000 water customers, as well as regulated utility electric services in northeastern Minnesota to approximately 150,000 retail customers and 14 non-affiliated municipal customers.

Featured Stories

Before you consider ALLETE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ALLETE wasn't on the list.

While ALLETE currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.