Cibc World Markets Corp purchased a new stake in shares of Essent Group Ltd. (NYSE:ESNT - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm purchased 9,766 shares of the financial services provider's stock, valued at approximately $532,000.

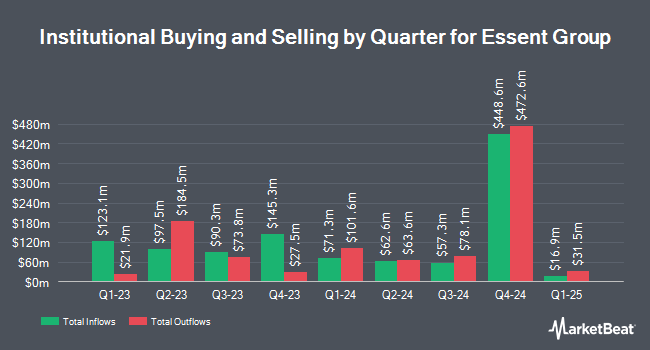

Other hedge funds have also recently made changes to their positions in the company. Mainstream Capital Management LLC bought a new position in Essent Group in the 4th quarter worth about $25,000. Picton Mahoney Asset Management increased its position in shares of Essent Group by 68.8% in the fourth quarter. Picton Mahoney Asset Management now owns 584 shares of the financial services provider's stock valued at $32,000 after buying an additional 238 shares in the last quarter. US Bancorp DE lifted its stake in Essent Group by 53.3% in the 4th quarter. US Bancorp DE now owns 1,125 shares of the financial services provider's stock valued at $61,000 after buying an additional 391 shares in the last quarter. R Squared Ltd acquired a new stake in shares of Essent Group in the fourth quarter valued at about $63,000. Finally, Advisors Asset Management Inc. lifted its position in Essent Group by 53.9% during the third quarter. Advisors Asset Management Inc. now owns 1,362 shares of the financial services provider's stock worth $88,000 after buying an additional 477 shares in the last quarter. Institutional investors own 93.00% of the company's stock.

Essent Group Stock Up 1.3 %

ESNT stock traded up $0.76 during trading on Wednesday, reaching $58.03. 463,621 shares of the company's stock were exchanged, compared to its average volume of 576,431. The company's fifty day moving average price is $56.92 and its 200-day moving average price is $58.00. The firm has a market cap of $6.03 billion, a PE ratio of 8.48, a P/E/G ratio of 2.70 and a beta of 1.09. Essent Group Ltd. has a 1-year low of $52.22 and a 1-year high of $65.34.

Essent Group (NYSE:ESNT - Get Free Report) last posted its earnings results on Friday, February 14th. The financial services provider reported $1.58 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.67 by ($0.09). The business had revenue of $315.00 million during the quarter, compared to analyst estimates of $313.88 million. Essent Group had a net margin of 58.69% and a return on equity of 13.35%. Essent Group's revenue was up 6.0% compared to the same quarter last year. During the same quarter last year, the firm earned $1.64 earnings per share. As a group, sell-side analysts expect that Essent Group Ltd. will post 6.88 earnings per share for the current fiscal year.

Essent Group Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, March 24th. Shareholders of record on Friday, March 14th were issued a dividend of $0.31 per share. This is an increase from Essent Group's previous quarterly dividend of $0.28. The ex-dividend date was Friday, March 14th. This represents a $1.24 annualized dividend and a yield of 2.14%. Essent Group's dividend payout ratio is currently 18.13%.

Wall Street Analyst Weigh In

ESNT has been the topic of several research analyst reports. Barclays lowered shares of Essent Group from an "overweight" rating to an "equal weight" rating and reduced their price objective for the company from $69.00 to $58.00 in a report on Monday, January 6th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $67.00 target price on shares of Essent Group in a report on Tuesday, February 18th. JPMorgan Chase & Co. cut their price target on shares of Essent Group from $67.00 to $60.00 and set a "neutral" rating for the company in a report on Monday, December 9th. Finally, Keefe, Bruyette & Woods reduced their price objective on Essent Group from $72.00 to $71.00 and set an "outperform" rating for the company in a report on Tuesday, February 18th. Four investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $62.57.

Get Our Latest Stock Report on Essent Group

Essent Group Profile

(

Free Report)

Essent Group Ltd., through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States. Its mortgage insurance products include primary, pool, and master policy. The company also provides information technology maintenance and development services; customer support-related services; underwriting consulting; and contract underwriting services, as well as risk management products and title insurance and settlement services.

See Also

Before you consider Essent Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Essent Group wasn't on the list.

While Essent Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.