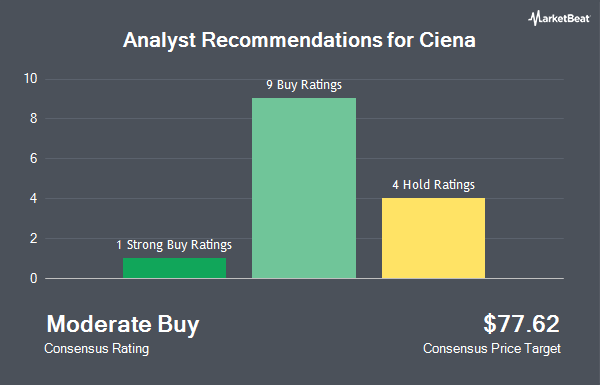

Shares of Ciena Co. (NYSE:CIEN - Get Free Report) have earned an average rating of "Hold" from the thirteen brokerages that are covering the stock, Marketbeat.com reports. Seven analysts have rated the stock with a hold recommendation and six have issued a buy recommendation on the company. The average 12-month price objective among brokerages that have updated their coverage on the stock in the last year is $63.08.

Several brokerages recently commented on CIEN. JPMorgan Chase & Co. downgraded Ciena from an "overweight" rating to a "neutral" rating and set a $65.00 target price on the stock. in a report on Monday, October 7th. Northland Securities reiterated a "market perform" rating and set a $46.00 price objective on shares of Ciena in a research note on Tuesday, September 3rd. Stifel Nicolaus upped their target price on shares of Ciena from $68.00 to $75.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. Barclays lifted their price target on shares of Ciena from $55.00 to $67.00 and gave the stock an "overweight" rating in a research note on Thursday, September 5th. Finally, Rosenblatt Securities boosted their price objective on shares of Ciena from $54.00 to $60.00 and gave the stock a "neutral" rating in a report on Thursday, September 5th.

Read Our Latest Research Report on Ciena

Insider Transactions at Ciena

In related news, SVP David M. Rothenstein sold 3,500 shares of the business's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $56.24, for a total transaction of $196,840.00. Following the completion of the sale, the senior vice president now owns 205,421 shares of the company's stock, valued at $11,552,877.04. This represents a 1.68 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Jason Phipps sold 2,200 shares of the firm's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $61.49, for a total transaction of $135,278.00. Following the completion of the transaction, the senior vice president now directly owns 91,149 shares in the company, valued at $5,604,752.01. This represents a 2.36 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 9,200 shares of company stock worth $568,123. 0.83% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the stock. Hoese & Co LLP acquired a new stake in shares of Ciena in the third quarter valued at approximately $25,000. UMB Bank n.a. increased its position in Ciena by 424.4% in the 3rd quarter. UMB Bank n.a. now owns 451 shares of the communications equipment provider's stock valued at $28,000 after acquiring an additional 365 shares during the period. Headlands Technologies LLC bought a new stake in Ciena during the 1st quarter valued at $40,000. Canton Hathaway LLC bought a new stake in Ciena during the 2nd quarter valued at $40,000. Finally, First Horizon Advisors Inc. boosted its position in Ciena by 152.8% during the 3rd quarter. First Horizon Advisors Inc. now owns 847 shares of the communications equipment provider's stock worth $52,000 after acquiring an additional 512 shares during the period. 91.99% of the stock is currently owned by institutional investors.

Ciena Trading Down 3.6 %

CIEN stock traded down $2.53 during midday trading on Friday, reaching $67.22. 1,611,781 shares of the company's stock traded hands, compared to its average volume of 1,806,615. The company has a debt-to-equity ratio of 0.53, a current ratio of 4.06 and a quick ratio of 2.99. Ciena has a fifty-two week low of $42.20 and a fifty-two week high of $73.47. The business has a 50-day moving average price of $63.80 and a two-hundred day moving average price of $54.63. The company has a market capitalization of $9.71 billion, a P/E ratio of 71.51, a PEG ratio of 5.80 and a beta of 0.94.

Ciena (NYSE:CIEN - Get Free Report) last announced its quarterly earnings results on Wednesday, September 4th. The communications equipment provider reported $0.35 earnings per share for the quarter, topping analysts' consensus estimates of $0.26 by $0.09. Ciena had a net margin of 3.44% and a return on equity of 5.98%. The firm had revenue of $942.30 million during the quarter, compared to analysts' expectations of $928.31 million. During the same period in the prior year, the company earned $0.36 EPS. The firm's revenue was down 11.8% on a year-over-year basis. Equities research analysts forecast that Ciena will post 1.13 EPS for the current fiscal year.

Ciena declared that its board has approved a share repurchase program on Wednesday, October 2nd that permits the company to buyback $1.00 billion in outstanding shares. This buyback authorization permits the communications equipment provider to buy up to 10.5% of its shares through open market purchases. Shares buyback programs are generally an indication that the company's leadership believes its stock is undervalued.

About Ciena

(

Get Free ReportCiena Corporation provides hardware and software services for delivery of video, data, and voice traffic metro, aggregation, and access communications network worldwide. The company's Networking Platforms segment offers convergence of coherent optical transport, open optical networking, optical transport network switching, IP routing, and switching services.

Featured Stories

Before you consider Ciena, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ciena wasn't on the list.

While Ciena currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.