Cimpress (NASDAQ:CMPR - Get Free Report) is expected to post its Q3 2025 quarterly earnings results after the market closes on Wednesday, April 30th. Analysts expect Cimpress to post earnings of $0.61 per share and revenue of $798.02 million for the quarter. Cimpress has set its FY 2025 guidance at EPS.

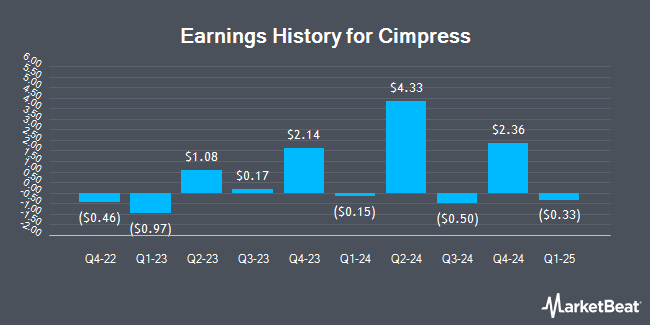

Cimpress (NASDAQ:CMPR - Get Free Report) last issued its quarterly earnings data on Wednesday, January 29th. The business services provider reported $2.36 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.52 by ($0.16). Cimpress had a negative return on equity of 27.64% and a net margin of 4.75%. On average, analysts expect Cimpress to post $4 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Cimpress Price Performance

Shares of CMPR stock opened at $41.63 on Wednesday. The stock has a market capitalization of $1.05 billion, a PE ratio of 6.89, a PEG ratio of 0.50 and a beta of 1.94. Cimpress has a one year low of $39.11 and a one year high of $104.92. The business's 50 day simple moving average is $45.08 and its 200 day simple moving average is $64.37.

Insider Buying and Selling

In other news, CFO Sean Edward Quinn bought 5,000 shares of the stock in a transaction dated Friday, March 14th. The shares were bought at an average cost of $41.50 per share, with a total value of $207,500.00. Following the completion of the transaction, the chief financial officer now directly owns 20,224 shares of the company's stock, valued at $839,296. This trade represents a 32.84 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which can be accessed through the SEC website. 17.80% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on the company. Truist Financial dropped their price objective on Cimpress from $110.00 to $87.00 and set a "buy" rating on the stock in a research note on Friday, January 31st. Barrington Research reaffirmed an "outperform" rating and set a $119.00 price objective on shares of Cimpress in a research report on Wednesday, January 29th. Finally, StockNews.com upgraded shares of Cimpress from a "buy" rating to a "strong-buy" rating in a research report on Saturday, February 8th.

Get Our Latest Stock Report on Cimpress

Cimpress Company Profile

(

Get Free Report)

Cimpress plc provides various mass customization of printing and related products in North America, Europe, and internationally. The company operates through five segments: Vista, PrintBrothers, The Print Group, National Pen, and All Other Businesses. It offers printed and digital marketing products; internet-based canvas-print wall décor, business signage, and other printed products; business cards; and marketing materials, such as flyers and postcards, digital and marketing services, writing instruments, decorated apparel, promotional products and gifts, packaging, design services, textiles, and magazines and catalogs.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cimpress, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cimpress wasn't on the list.

While Cimpress currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.