Cinctive Capital Management LP increased its stake in shares of Bausch Health Companies Inc. (NYSE:BHC - Free Report) by 165.6% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 222,348 shares of the company's stock after acquiring an additional 138,638 shares during the quarter. Cinctive Capital Management LP owned approximately 0.06% of Bausch Health Companies worth $1,792,000 at the end of the most recent quarter.

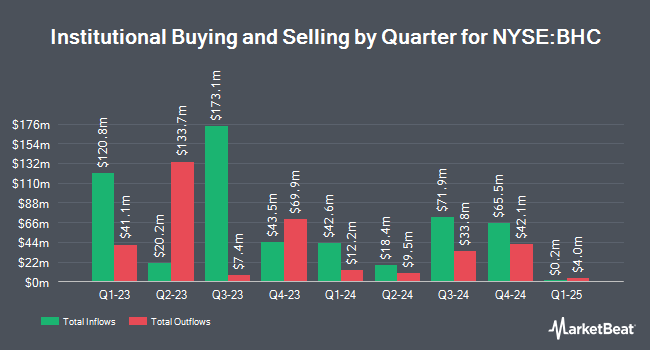

Several other large investors also recently made changes to their positions in the company. Charles Schwab Investment Management Inc. lifted its stake in Bausch Health Companies by 3.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,269,478 shares of the company's stock valued at $10,373,000 after acquiring an additional 42,539 shares in the last quarter. Cerity Partners LLC lifted its stake in shares of Bausch Health Companies by 14.4% during the 3rd quarter. Cerity Partners LLC now owns 79,290 shares of the company's stock valued at $647,000 after buying an additional 9,978 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its holdings in shares of Bausch Health Companies by 26.5% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 76,807 shares of the company's stock worth $628,000 after acquiring an additional 16,101 shares during the period. Verition Fund Management LLC purchased a new position in Bausch Health Companies during the 3rd quarter valued at about $808,000. Finally, Centiva Capital LP bought a new position in Bausch Health Companies in the 3rd quarter valued at $951,000. 78.65% of the stock is currently owned by institutional investors and hedge funds.

Bausch Health Companies Price Performance

BHC traded up $0.22 on Wednesday, hitting $5.03. The company had a trading volume of 6,878,452 shares, compared to its average volume of 2,739,058. Bausch Health Companies Inc. has a 52-week low of $3.96 and a 52-week high of $9.87. The firm has a market capitalization of $1.85 billion, a P/E ratio of -41.87, a P/E/G ratio of 0.37 and a beta of 0.43. The stock has a fifty day simple moving average of $6.65 and a 200-day simple moving average of $7.59.

Bausch Health Companies (NYSE:BHC - Get Free Report) last issued its quarterly earnings results on Wednesday, February 19th. The company reported $1.21 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.65 by ($0.44). Bausch Health Companies had a negative net margin of 0.48% and a negative return on equity of 577.82%. The business had revenue of $2.56 billion for the quarter, compared to analysts' expectations of $2.51 billion. Equities research analysts expect that Bausch Health Companies Inc. will post 4.41 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several brokerages have recently commented on BHC. Royal Bank of Canada cut their price objective on Bausch Health Companies from $9.00 to $8.50 and set a "sector perform" rating for the company in a report on Monday. Jefferies Financial Group reiterated a "hold" rating and issued a $8.00 price objective (down previously from $12.00) on shares of Bausch Health Companies in a research report on Thursday, February 6th. One research analyst has rated the stock with a sell rating, six have issued a hold rating and one has given a buy rating to the stock. According to data from MarketBeat.com, Bausch Health Companies presently has an average rating of "Hold" and a consensus target price of $7.17.

Read Our Latest Report on Bausch Health Companies

About Bausch Health Companies

(

Free Report)

Bausch Health Companies Inc operates as a diversified specialty pharmaceutical and medical device company in the United States and internationally. It develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, international pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health.

Featured Stories

Before you consider Bausch Health Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bausch Health Companies wasn't on the list.

While Bausch Health Companies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.