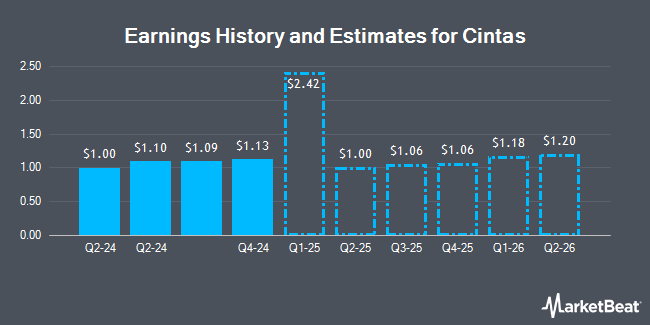

Cintas (NASDAQ:CTAS - Get Free Report) issued an update on its FY 2025 earnings guidance on Thursday morning. The company provided earnings per share (EPS) guidance of 4.280-4.340 for the period, compared to the consensus estimate of 4.240. The company issued revenue guidance of $10.3 billion-$10.3 billion, compared to the consensus revenue estimate of $10.3 billion. Cintas also updated its FY25 guidance to $4.28-4.34 EPS.

Cintas Stock Down 10.6 %

Shares of NASDAQ:CTAS traded down $21.60 during midday trading on Thursday, reaching $182.79. The company had a trading volume of 6,208,660 shares, compared to its average volume of 1,503,445. The stock has a market capitalization of $73.72 billion, a P/E ratio of 46.16, a PEG ratio of 4.15 and a beta of 1.33. The stock's fifty day moving average price is $214.74 and its 200-day moving average price is $202.86. The company has a debt-to-equity ratio of 0.50, a current ratio of 1.53 and a quick ratio of 1.33. Cintas has a one year low of $138.39 and a one year high of $228.12.

Cintas (NASDAQ:CTAS - Get Free Report) last released its earnings results on Thursday, December 19th. The business services provider reported $1.09 earnings per share for the quarter, topping the consensus estimate of $1.01 by $0.08. Cintas had a net margin of 16.80% and a return on equity of 39.56%. The company had revenue of $2.56 billion during the quarter, compared to the consensus estimate of $2.56 billion. During the same quarter in the previous year, the firm earned $3.61 EPS. The company's revenue was up 7.8% on a year-over-year basis. Equities research analysts expect that Cintas will post 4.23 earnings per share for the current fiscal year.

Cintas Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, December 13th. Stockholders of record on Friday, November 15th were given a $0.39 dividend. The ex-dividend date of this dividend was Friday, November 15th. This represents a $1.56 annualized dividend and a dividend yield of 0.85%. Cintas's payout ratio is 39.39%.

Analyst Upgrades and Downgrades

Several equities analysts recently issued reports on CTAS shares. Morgan Stanley raised their price objective on Cintas from $185.00 to $202.00 and gave the stock an "equal weight" rating in a research note on Thursday, December 12th. Wells Fargo & Company raised their price target on shares of Cintas from $184.00 to $191.00 and gave the stock an "underweight" rating in a research report on Thursday, September 26th. Royal Bank of Canada boosted their price objective on shares of Cintas from $181.00 to $215.00 and gave the company a "sector perform" rating in a research report on Thursday, September 26th. Robert W. Baird raised their target price on shares of Cintas from $194.00 to $209.00 and gave the stock a "neutral" rating in a report on Thursday, September 26th. Finally, Jefferies Financial Group lowered their target price on Cintas from $730.00 to $200.00 and set a "hold" rating for the company in a report on Thursday, September 26th. Two equities research analysts have rated the stock with a sell rating, nine have assigned a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, Cintas currently has a consensus rating of "Hold" and an average target price of $200.77.

Read Our Latest Research Report on CTAS

About Cintas

(

Get Free Report)

Cintas Corporation engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America. It operates through Uniform Rental and Facility Services, First Aid and Safety Services, and All Other segments. The company rents and services uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items; and provides restroom cleaning services and supplies, as well as sells uniforms.

See Also

Before you consider Cintas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cintas wasn't on the list.

While Cintas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.