Cipher Mining (NASDAQ:CIFR - Get Free Report) was upgraded by JPMorgan Chase & Co. from a "neutral" rating to an "overweight" rating in a research note issued on Tuesday, MarketBeat reports. The brokerage currently has a $8.00 target price on the stock. JPMorgan Chase & Co.'s price objective indicates a potential upside of 30.51% from the company's previous close.

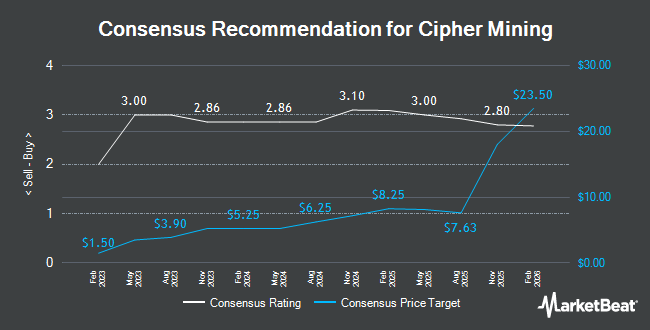

Several other research firms have also recently weighed in on CIFR. BTIG Research upped their price objective on shares of Cipher Mining from $6.00 to $9.00 and gave the stock a "buy" rating in a research report on Friday, November 15th. Northland Capmk raised shares of Cipher Mining to a "strong-buy" rating in a report on Wednesday, September 25th. Northland Securities lifted their price objective on shares of Cipher Mining from $6.00 to $8.50 and gave the company an "outperform" rating in a research note on Wednesday, December 4th. Macquarie upped their target price on Cipher Mining from $6.00 to $7.25 and gave the stock an "outperform" rating in a research note on Thursday, November 7th. Finally, Cantor Fitzgerald reiterated an "overweight" rating and issued a $9.00 price target on shares of Cipher Mining in a research note on Thursday, October 3rd. Nine investment analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, Cipher Mining has an average rating of "Buy" and a consensus target price of $8.03.

View Our Latest Research Report on Cipher Mining

Cipher Mining Stock Performance

Shares of CIFR traded down $0.25 during mid-day trading on Tuesday, hitting $6.13. 6,920,621 shares of the company's stock were exchanged, compared to its average volume of 9,356,080. The company has a quick ratio of 2.57, a current ratio of 2.57 and a debt-to-equity ratio of 0.01. Cipher Mining has a 52 week low of $2.15 and a 52 week high of $7.99. The stock's 50-day simple moving average is $5.64 and its 200-day simple moving average is $4.73. The firm has a market cap of $2.13 billion, a price-to-earnings ratio of -47.31 and a beta of 2.29.

Cipher Mining (NASDAQ:CIFR - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported ($0.26) EPS for the quarter, missing analysts' consensus estimates of ($0.08) by ($0.18). The company had revenue of $24.10 million for the quarter, compared to the consensus estimate of $25.84 million. Cipher Mining had a negative return on equity of 8.29% and a negative net margin of 33.39%. During the same quarter last year, the business earned ($0.07) EPS. On average, equities research analysts expect that Cipher Mining will post -0.18 EPS for the current year.

Insiders Place Their Bets

In related news, COO Patrick Arthur Kelly sold 53,161 shares of the business's stock in a transaction on Friday, November 8th. The shares were sold at an average price of $7.16, for a total value of $380,632.76. Following the sale, the chief operating officer now owns 664,270 shares of the company's stock, valued at $4,756,173.20. The trade was a 7.41 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider William Iwaschuk sold 150,000 shares of the stock in a transaction on Wednesday, September 25th. The shares were sold at an average price of $3.94, for a total value of $591,000.00. Following the completion of the sale, the insider now owns 619,148 shares of the company's stock, valued at $2,439,443.12. The trade was a 19.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 1,593,503 shares of company stock valued at $9,568,005 in the last 90 days. Corporate insiders own 2.25% of the company's stock.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the stock. Price T Rowe Associates Inc. MD acquired a new position in shares of Cipher Mining in the first quarter worth approximately $59,000. California State Teachers Retirement System lifted its position in shares of Cipher Mining by 19.4% in the 1st quarter. California State Teachers Retirement System now owns 61,546 shares of the company's stock worth $317,000 after purchasing an additional 10,019 shares during the period. Wealth Enhancement Advisory Services LLC lifted its position in shares of Cipher Mining by 16.4% in the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 122,481 shares of the company's stock worth $508,000 after purchasing an additional 17,254 shares during the period. Hennion & Walsh Asset Management Inc. boosted its stake in shares of Cipher Mining by 13.1% in the 2nd quarter. Hennion & Walsh Asset Management Inc. now owns 149,659 shares of the company's stock valued at $621,000 after purchasing an additional 17,355 shares during the last quarter. Finally, Bank of New York Mellon Corp increased its position in shares of Cipher Mining by 243.2% during the second quarter. Bank of New York Mellon Corp now owns 549,070 shares of the company's stock worth $2,279,000 after buying an additional 389,079 shares during the period. 12.26% of the stock is owned by institutional investors and hedge funds.

Cipher Mining Company Profile

(

Get Free Report)

Cipher Mining Inc, together with its subsidiaries, engages in the development and operation of industrial scale bitcoin mining data centers in the United States. The company was incorporated in 2020 and is based in New York, New York. Cipher Mining Inc operates as a subsidiary of Bitfury Holding B.V.

Featured Stories

Before you consider Cipher Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cipher Mining wasn't on the list.

While Cipher Mining currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.