Citigroup initiated coverage on shares of Akero Therapeutics (NASDAQ:AKRO - Free Report) in a research report sent to investors on Monday, MarketBeat Ratings reports. The firm issued a buy rating and a $65.00 price objective on the stock.

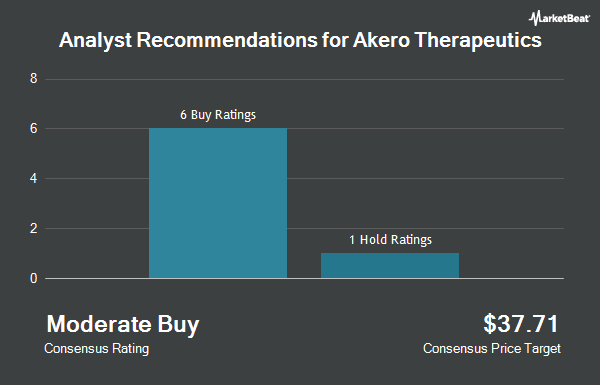

Separately, HC Wainwright restated a "buy" rating and issued a $50.00 target price on shares of Akero Therapeutics in a research note on Monday, November 11th. One analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $46.83.

View Our Latest Research Report on Akero Therapeutics

Akero Therapeutics Price Performance

NASDAQ:AKRO traded up $1.19 during mid-day trading on Monday, hitting $29.28. The company's stock had a trading volume of 912,804 shares, compared to its average volume of 867,354. The company has a market capitalization of $2.04 billion, a price-to-earnings ratio of -7.64 and a beta of -0.26. The company has a current ratio of 17.25, a quick ratio of 24.89 and a debt-to-equity ratio of 0.05. Akero Therapeutics has a fifty-two week low of $15.32 and a fifty-two week high of $37.00. The stock has a fifty day moving average of $29.46 and a 200-day moving average of $25.67.

Akero Therapeutics (NASDAQ:AKRO - Get Free Report) last issued its earnings results on Friday, November 8th. The company reported ($1.05) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.90) by ($0.15). As a group, equities analysts forecast that Akero Therapeutics will post -3.96 EPS for the current fiscal year.

Insiders Place Their Bets

In other Akero Therapeutics news, insider Catriona Yale sold 8,851 shares of the business's stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $27.53, for a total value of $243,668.03. Following the completion of the transaction, the insider now directly owns 75,931 shares of the company's stock, valued at approximately $2,090,380.43. The trade was a 10.44 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CEO Andrew Cheng sold 108,366 shares of the company's stock in a transaction that occurred on Friday, November 1st. The stock was sold at an average price of $31.73, for a total transaction of $3,438,453.18. Following the transaction, the chief executive officer now owns 605,417 shares in the company, valued at $19,209,881.41. The trade was a 15.18 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 428,397 shares of company stock valued at $12,997,971. 7.94% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Akero Therapeutics

Several hedge funds and other institutional investors have recently made changes to their positions in AKRO. Wellington Management Group LLP boosted its holdings in Akero Therapeutics by 54.4% in the third quarter. Wellington Management Group LLP now owns 7,896,632 shares of the company's stock valued at $226,554,000 after acquiring an additional 2,782,029 shares during the last quarter. Janus Henderson Group PLC boosted its stake in shares of Akero Therapeutics by 2.9% in the 3rd quarter. Janus Henderson Group PLC now owns 7,077,478 shares of the company's stock valued at $203,053,000 after purchasing an additional 201,225 shares during the last quarter. RTW Investments LP grew its position in shares of Akero Therapeutics by 9.0% during the 3rd quarter. RTW Investments LP now owns 5,919,435 shares of the company's stock worth $169,829,000 after buying an additional 487,450 shares during the period. Price T Rowe Associates Inc. MD raised its stake in shares of Akero Therapeutics by 10.5% during the first quarter. Price T Rowe Associates Inc. MD now owns 4,060,479 shares of the company's stock worth $102,569,000 after buying an additional 384,555 shares during the last quarter. Finally, Vanguard Group Inc. lifted its holdings in Akero Therapeutics by 19.0% in the first quarter. Vanguard Group Inc. now owns 3,669,923 shares of the company's stock valued at $92,702,000 after buying an additional 584,875 shares during the period.

About Akero Therapeutics

(

Get Free Report)

Akero Therapeutics, Inc, together with its subsidiary, engages in the development of treatments for patients with serious metabolic diseases in the United States. The company's lead product candidate is efruxifermin (EFX), which is in Phase 3 clinical trials that protects against cellular stress and regulates the metabolism of lipids, carbohydrates, and proteins throughout the body for the treatment of biopsy-confirmed metabolic dysfunction-associated steatohepatitis (MASH) patients.

Further Reading

Before you consider Akero Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akero Therapeutics wasn't on the list.

While Akero Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.