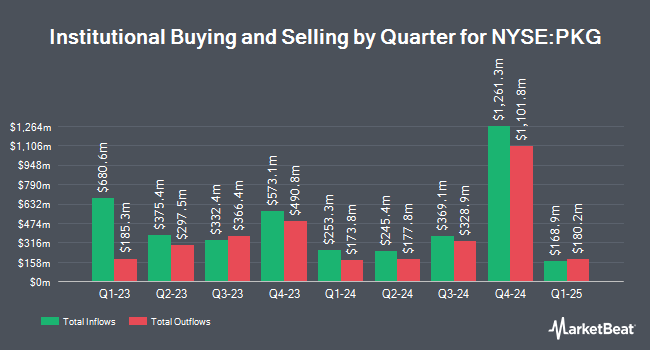

Citigroup Inc. boosted its position in Packaging Co. of America (NYSE:PKG - Free Report) by 30.7% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 115,005 shares of the industrial products company's stock after purchasing an additional 27,018 shares during the quarter. Citigroup Inc. owned approximately 0.13% of Packaging Co. of America worth $24,772,000 at the end of the most recent quarter.

A number of other hedge funds have also recently modified their holdings of PKG. Charles Schwab Investment Management Inc. grew its stake in shares of Packaging Co. of America by 3.5% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,937,113 shares of the industrial products company's stock worth $632,654,000 after buying an additional 98,223 shares during the last quarter. Trustmark National Bank Trust Department purchased a new stake in shares of Packaging Co. of America in the third quarter worth $277,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its holdings in shares of Packaging Co. of America by 227.5% during the third quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 32,243 shares of the industrial products company's stock valued at $6,945,000 after acquiring an additional 22,397 shares in the last quarter. Strategy Asset Managers LLC purchased a new position in shares of Packaging Co. of America in the 3rd quarter worth about $761,000. Finally, PNC Financial Services Group Inc. boosted its stake in Packaging Co. of America by 1.2% in the 3rd quarter. PNC Financial Services Group Inc. now owns 60,254 shares of the industrial products company's stock worth $12,979,000 after purchasing an additional 735 shares in the last quarter. Institutional investors own 89.78% of the company's stock.

Packaging Co. of America Stock Performance

PKG stock traded down $0.98 during midday trading on Wednesday, reaching $247.05. 33,234 shares of the company's stock traded hands, compared to its average volume of 600,652. The company has a current ratio of 2.95, a quick ratio of 1.98 and a debt-to-equity ratio of 0.58. Packaging Co. of America has a 52-week low of $156.87 and a 52-week high of $250.82. The stock has a market cap of $22.19 billion, a P/E ratio of 28.92, a PEG ratio of 3.47 and a beta of 0.76. The stock's 50-day moving average is $225.48 and its 200 day moving average is $203.08.

Packaging Co. of America (NYSE:PKG - Get Free Report) last announced its earnings results on Tuesday, October 22nd. The industrial products company reported $2.65 EPS for the quarter, topping analysts' consensus estimates of $2.50 by $0.15. The company had revenue of $2.18 billion for the quarter, compared to analysts' expectations of $2.09 billion. Packaging Co. of America had a return on equity of 19.10% and a net margin of 9.46%. Packaging Co. of America's revenue for the quarter was up 14.9% compared to the same quarter last year. During the same period last year, the firm earned $2.05 EPS. As a group, analysts anticipate that Packaging Co. of America will post 9.07 EPS for the current year.

Analyst Ratings Changes

PKG has been the subject of several analyst reports. Truist Financial reissued a "buy" rating and set a $252.00 price target (up previously from $242.00) on shares of Packaging Co. of America in a research report on Thursday, October 24th. Citigroup upped their price target on Packaging Co. of America from $199.00 to $221.00 and gave the company a "neutral" rating in a report on Wednesday, October 2nd. Wells Fargo & Company lifted their price objective on Packaging Co. of America from $235.00 to $253.00 and gave the stock an "overweight" rating in a report on Thursday, October 24th. Finally, StockNews.com cut shares of Packaging Co. of America from a "buy" rating to a "hold" rating in a research note on Wednesday, November 20th. Four research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $221.60.

Read Our Latest Research Report on Packaging Co. of America

Insider Activity at Packaging Co. of America

In other news, Director Paul T. Stecko sold 10,500 shares of the business's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $244.91, for a total value of $2,571,555.00. Following the transaction, the director now owns 8,881 shares of the company's stock, valued at approximately $2,175,045.71. The trade was a 54.18 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Robert P. Mundy sold 12,500 shares of Packaging Co. of America stock in a transaction on Friday, November 8th. The shares were sold at an average price of $240.62, for a total transaction of $3,007,750.00. Following the completion of the sale, the chief financial officer now owns 43,954 shares in the company, valued at approximately $10,576,211.48. This represents a 22.14 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 31,000 shares of company stock worth $7,500,905. 1.70% of the stock is owned by company insiders.

Packaging Co. of America Profile

(

Free Report)

Packaging Corporation of America manufactures and sells containerboard and corrugated packaging products in the United States. The company operates through three segments: Packaging, Paper, and Corporate and Other. The Packaging segment offers various containerboard and corrugated packaging products, such as conventional shipping containers used to protect and transport manufactured goods; multi-color boxes and displays that help to merchandise the packaged product in retail locations; and honeycomb protective packaging products, as well as packaging for meat, fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products.

Read More

Before you consider Packaging Co. of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Packaging Co. of America wasn't on the list.

While Packaging Co. of America currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.