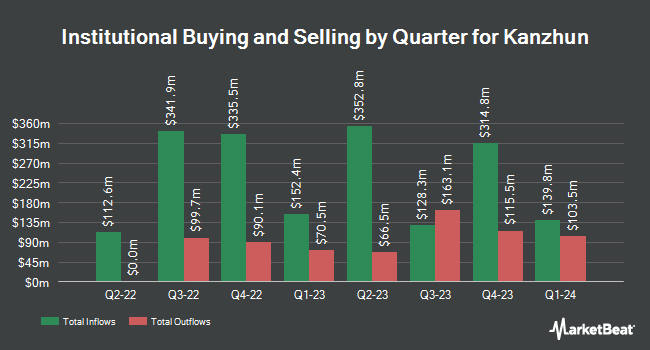

Citigroup Inc. raised its stake in Kanzhun Limited (NASDAQ:BZ - Free Report) by 149.2% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,343,278 shares of the company's stock after buying an additional 1,402,885 shares during the period. Citigroup Inc. owned about 0.62% of Kanzhun worth $40,679,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Jennison Associates LLC lifted its position in shares of Kanzhun by 58.8% in the third quarter. Jennison Associates LLC now owns 1,853,160 shares of the company's stock valued at $32,171,000 after acquiring an additional 686,245 shares in the last quarter. Premier Fund Managers Ltd grew its stake in shares of Kanzhun by 38.0% in the third quarter. Premier Fund Managers Ltd now owns 10,470 shares of the company's stock valued at $180,000 after buying an additional 2,884 shares in the last quarter. B. Metzler seel. Sohn & Co. Holding AG acquired a new position in shares of Kanzhun in the third quarter valued at approximately $2,308,000. GGV Capital LLC increased its holdings in Kanzhun by 57.1% during the 3rd quarter. GGV Capital LLC now owns 825,000 shares of the company's stock worth $14,322,000 after purchasing an additional 300,000 shares during the period. Finally, Swiss National Bank lifted its stake in Kanzhun by 4.9% in the third quarter. Swiss National Bank now owns 599,066 shares of the company's stock worth $10,400,000 after acquiring an additional 28,239 shares during the last quarter. Institutional investors own 60.67% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts recently weighed in on BZ shares. Barclays dropped their price objective on Kanzhun from $27.00 to $14.00 and set an "overweight" rating for the company in a research note on Friday, August 30th. CLSA started coverage on Kanzhun in a research note on Monday, November 18th. They set an "outperform" rating and a $18.00 price target for the company. Three analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $22.50.

Get Our Latest Research Report on BZ

Kanzhun Trading Down 0.9 %

Shares of NASDAQ:BZ traded down $0.12 during midday trading on Monday, hitting $12.64. The company had a trading volume of 5,124,179 shares, compared to its average volume of 4,099,479. Kanzhun Limited has a 12 month low of $10.57 and a 12 month high of $22.74. The stock has a market cap of $4.79 billion, a price-to-earnings ratio of 29.68 and a beta of 0.55. The firm has a fifty day simple moving average of $15.04 and a 200 day simple moving average of $16.42.

Kanzhun (NASDAQ:BZ - Get Free Report) last issued its earnings results on Wednesday, August 28th. The company reported $0.13 earnings per share for the quarter, topping analysts' consensus estimates of $0.12 by $0.01. Kanzhun had a net margin of 20.90% and a return on equity of 10.19%. The business had revenue of $263.75 million for the quarter, compared to the consensus estimate of $264.38 million. Equities analysts forecast that Kanzhun Limited will post 0.47 EPS for the current fiscal year.

About Kanzhun

(

Free Report)

Kanzhun Limited, together with its subsidiaries, provides online recruitment services in the People's Republic of China. The company offers its recruitment services through a mobile app under the BOSS Zhipin brand name. Its services allow enterprise customers to access and interact with job seekers and manage their recruitment process.

Recommended Stories

Before you consider Kanzhun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kanzhun wasn't on the list.

While Kanzhun currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.