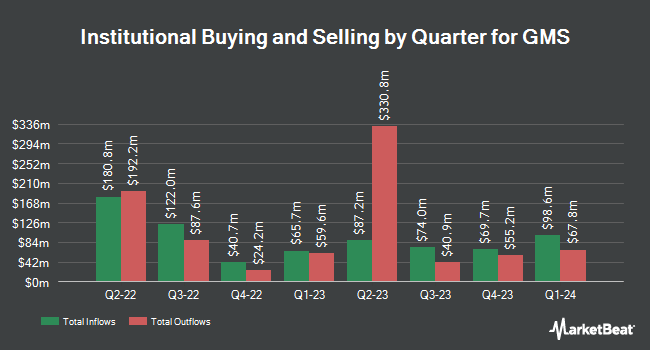

Citigroup Inc. increased its stake in GMS Inc. (NYSE:GMS - Free Report) by 61.8% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 49,733 shares of the company's stock after purchasing an additional 18,998 shares during the period. Citigroup Inc. owned approximately 0.13% of GMS worth $4,504,000 as of its most recent filing with the Securities and Exchange Commission.

Other large investors have also recently bought and sold shares of the company. Quarry LP raised its holdings in shares of GMS by 37.1% in the 2nd quarter. Quarry LP now owns 403 shares of the company's stock valued at $32,000 after purchasing an additional 109 shares during the period. State of New Jersey Common Pension Fund D lifted its stake in GMS by 0.5% in the 3rd quarter. State of New Jersey Common Pension Fund D now owns 20,805 shares of the company's stock valued at $1,884,000 after purchasing an additional 113 shares during the last quarter. QRG Capital Management Inc. grew its position in GMS by 2.0% during the 2nd quarter. QRG Capital Management Inc. now owns 8,231 shares of the company's stock worth $664,000 after acquiring an additional 161 shares during the last quarter. SummerHaven Investment Management LLC raised its position in GMS by 1.6% in the second quarter. SummerHaven Investment Management LLC now owns 10,509 shares of the company's stock valued at $847,000 after purchasing an additional 162 shares during the last quarter. Finally, Blue Trust Inc. boosted its stake in shares of GMS by 86.4% during the second quarter. Blue Trust Inc. now owns 369 shares of the company's stock valued at $30,000 after purchasing an additional 171 shares in the last quarter. Institutional investors and hedge funds own 95.28% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently issued reports on GMS shares. StockNews.com lowered shares of GMS from a "buy" rating to a "hold" rating in a report on Monday, September 2nd. Loop Capital lifted their price target on shares of GMS from $85.00 to $93.00 and gave the stock a "hold" rating in a report on Monday, November 25th. DA Davidson downgraded GMS from a "buy" rating to a "neutral" rating and set a $97.00 price objective for the company. in a report on Tuesday, November 26th. Barclays cut their target price on GMS from $81.00 to $80.00 and set an "equal weight" rating on the stock in a report on Monday, September 9th. Finally, Truist Financial reduced their price target on GMS from $95.00 to $90.00 and set a "hold" rating on the stock in a research report on Friday, August 30th. Six equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, GMS presently has an average rating of "Hold" and an average price target of $92.50.

View Our Latest Report on GMS

Insider Activity

In related news, COO George T. Hendren sold 5,000 shares of the business's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $102.13, for a total value of $510,650.00. Following the completion of the sale, the chief operating officer now directly owns 23,772 shares of the company's stock, valued at $2,427,834.36. The trade was a 17.38 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. 1.90% of the stock is currently owned by company insiders.

GMS Trading Up 2.5 %

Shares of GMS stock traded up $2.55 on Tuesday, hitting $102.68. 545,304 shares of the company's stock traded hands, compared to its average volume of 379,604. GMS Inc. has a one year low of $68.13 and a one year high of $105.54. The company has a debt-to-equity ratio of 0.90, a current ratio of 2.31 and a quick ratio of 1.45. The company has a fifty day moving average of $95.11 and a two-hundred day moving average of $90.88. The company has a market capitalization of $4.03 billion, a price-to-earnings ratio of 16.94 and a beta of 1.68.

GMS Company Profile

(

Free Report)

GMS Inc distributes wallboard, ceilings, steel framing and complementary construction products in the United States and Canada. The company offers ceilings products, including suspended mineral fibers, soft fibers, and metal ceiling systems primarily used in offices, hotels, hospitals, retail facilities, schools, and various other commercial and institutional buildings.

Recommended Stories

Before you consider GMS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GMS wasn't on the list.

While GMS currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.