Citigroup Inc. raised its stake in shares of Altair Engineering Inc. (NASDAQ:ALTR - Free Report) by 141.0% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 50,518 shares of the software's stock after buying an additional 29,556 shares during the period. Citigroup Inc. owned 0.06% of Altair Engineering worth $4,825,000 at the end of the most recent quarter.

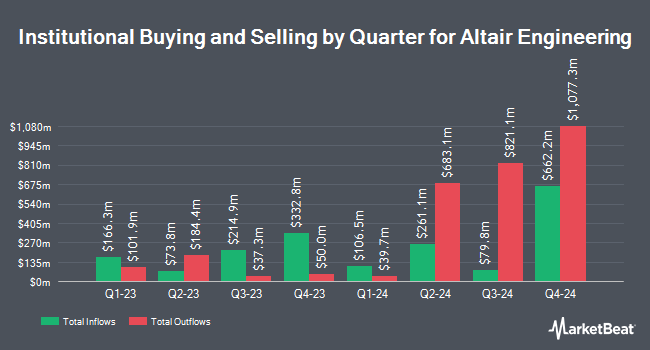

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the stock. Charles Schwab Investment Management Inc. increased its holdings in shares of Altair Engineering by 9.2% during the third quarter. Charles Schwab Investment Management Inc. now owns 505,470 shares of the software's stock worth $48,277,000 after buying an additional 42,592 shares in the last quarter. Massachusetts Financial Services Co. MA boosted its position in shares of Altair Engineering by 31.6% during the third quarter. Massachusetts Financial Services Co. MA now owns 392,343 shares of the software's stock worth $37,473,000 after buying an additional 94,219 shares during the period. Intech Investment Management LLC bought a new position in Altair Engineering in the third quarter valued at $1,084,000. King Luther Capital Management Corp increased its position in shares of Altair Engineering by 5.6% during the 3rd quarter. King Luther Capital Management Corp now owns 174,733 shares of the software's stock worth $16,689,000 after purchasing an additional 9,310 shares during the last quarter. Finally, Quest Partners LLC bought a new stake in shares of Altair Engineering in the 3rd quarter valued at about $617,000. 63.38% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In other Altair Engineering news, major shareholder Jrs Investments Llc sold 6,500 shares of the company's stock in a transaction that occurred on Friday, November 29th. The stock was sold at an average price of $105.69, for a total value of $686,985.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Teresa A. Harris sold 620 shares of the business's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $95.12, for a total value of $58,974.40. Following the completion of the sale, the director now owns 21,242 shares in the company, valued at $2,020,539.04. This represents a 2.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 361,924 shares of company stock worth $35,986,262 over the last 90 days. 21.75% of the stock is currently owned by insiders.

Altair Engineering Trading Down 0.5 %

Shares of ALTR traded down $0.53 during trading hours on Tuesday, hitting $105.30. The company had a trading volume of 713,694 shares, compared to its average volume of 1,249,391. The company has a quick ratio of 3.27, a current ratio of 3.27 and a debt-to-equity ratio of 0.27. Altair Engineering Inc. has a 52-week low of $70.07 and a 52-week high of $113.12. The stock's 50 day moving average price is $100.72 and its 200 day moving average price is $94.70. The firm has a market cap of $8.96 billion, a P/E ratio of 277.11, a P/E/G ratio of 12.16 and a beta of 1.44.

Analyst Upgrades and Downgrades

Several research analysts have weighed in on the company. Wolfe Research cut Altair Engineering from a "strong-buy" rating to a "hold" rating in a research report on Sunday, November 3rd. William Blair reissued a "market perform" rating on shares of Altair Engineering in a research note on Thursday, October 31st. Loop Capital restated a "hold" rating and set a $113.00 price objective on shares of Altair Engineering in a research report on Thursday, October 31st. Needham & Company LLC reiterated a "hold" rating and set a $100.00 price target on shares of Altair Engineering in a report on Thursday, October 31st. Finally, Royal Bank of Canada raised their price target on shares of Altair Engineering from $90.00 to $113.00 and gave the stock a "sector perform" rating in a report on Thursday, October 31st. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating and one has assigned a buy rating to the company. Based on data from MarketBeat, Altair Engineering has an average rating of "Hold" and a consensus price target of $100.71.

Get Our Latest Analysis on ALTR

Altair Engineering Profile

(

Free Report)

Altair Engineering Inc, together with its subsidiaries, provides software and cloud solutions in the areas of simulation and design, high-performance computing, data analytics, and artificial intelligence in the United States and internationally. It operates in two segments, Software and Client Engineering Services.

Featured Articles

Before you consider Altair Engineering, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altair Engineering wasn't on the list.

While Altair Engineering currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.