Citigroup Inc. boosted its holdings in Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS - Free Report) by 55.9% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 299,806 shares of the aerospace company's stock after buying an additional 107,530 shares during the period. Citigroup Inc. owned approximately 0.20% of Kratos Defense & Security Solutions worth $6,985,000 as of its most recent SEC filing.

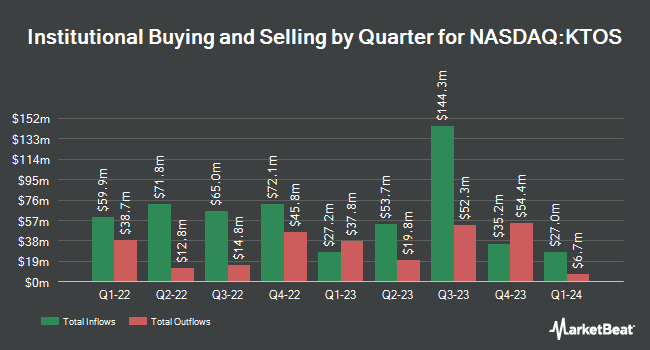

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Dimensional Fund Advisors LP grew its position in shares of Kratos Defense & Security Solutions by 3.4% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,190,639 shares of the aerospace company's stock worth $83,855,000 after buying an additional 136,696 shares during the period. Hood River Capital Management LLC boosted its stake in Kratos Defense & Security Solutions by 5.5% during the 2nd quarter. Hood River Capital Management LLC now owns 2,696,640 shares of the aerospace company's stock worth $53,960,000 after acquiring an additional 139,853 shares during the last quarter. Westwood Holdings Group Inc. grew its holdings in Kratos Defense & Security Solutions by 0.8% during the second quarter. Westwood Holdings Group Inc. now owns 2,531,476 shares of the aerospace company's stock valued at $50,655,000 after purchasing an additional 19,104 shares during the period. Charles Schwab Investment Management Inc. increased its stake in Kratos Defense & Security Solutions by 2.4% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,498,849 shares of the aerospace company's stock valued at $34,923,000 after purchasing an additional 35,421 shares in the last quarter. Finally, Van ECK Associates Corp raised its holdings in Kratos Defense & Security Solutions by 19.5% in the third quarter. Van ECK Associates Corp now owns 889,562 shares of the aerospace company's stock worth $21,358,000 after purchasing an additional 145,462 shares during the period. 75.92% of the stock is owned by institutional investors.

Insider Activity at Kratos Defense & Security Solutions

In other Kratos Defense & Security Solutions news, insider Steven S. Fendley sold 7,000 shares of the firm's stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $26.51, for a total value of $185,570.00. Following the completion of the transaction, the insider now directly owns 349,406 shares in the company, valued at $9,262,753.06. This trade represents a 1.96 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, insider Thomas E. Iv Mills sold 6,603 shares of the company's stock in a transaction that occurred on Tuesday, October 15th. The stock was sold at an average price of $24.88, for a total value of $164,282.64. Following the sale, the insider now owns 23,848 shares in the company, valued at approximately $593,338.24. This represents a 21.68 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 71,620 shares of company stock valued at $1,727,730. 2.27% of the stock is owned by insiders.

Wall Street Analyst Weigh In

A number of analysts recently commented on KTOS shares. Truist Financial restated a "buy" rating and issued a $27.00 price objective (up previously from $25.00) on shares of Kratos Defense & Security Solutions in a research report on Thursday, September 26th. B. Riley downgraded Kratos Defense & Security Solutions from a "buy" rating to a "neutral" rating and increased their price target for the stock from $24.00 to $26.00 in a report on Wednesday, October 30th. Benchmark reiterated a "buy" rating and set a $25.00 price objective on shares of Kratos Defense & Security Solutions in a report on Friday, September 13th. StockNews.com raised Kratos Defense & Security Solutions from a "sell" rating to a "hold" rating in a research note on Wednesday. Finally, Robert W. Baird raised their target price on shares of Kratos Defense & Security Solutions from $22.00 to $35.00 and gave the stock an "outperform" rating in a report on Monday, September 23rd. Six analysts have rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $25.40.

View Our Latest Report on Kratos Defense & Security Solutions

Kratos Defense & Security Solutions Stock Up 0.5 %

NASDAQ:KTOS traded up $0.14 on Friday, hitting $27.09. 593,090 shares of the company's stock were exchanged, compared to its average volume of 1,215,789. The firm has a 50-day moving average price of $24.86 and a 200-day moving average price of $22.49. Kratos Defense & Security Solutions, Inc. has a 52 week low of $16.71 and a 52 week high of $28.62. The company has a debt-to-equity ratio of 0.13, a current ratio of 3.22 and a quick ratio of 2.61. The company has a market cap of $4.09 billion, a P/E ratio of 270.93 and a beta of 1.02.

About Kratos Defense & Security Solutions

(

Free Report)

Kratos Defense & Security Solutions, Inc operates as a technology company that addresses the defense, national security, and commercial markets. It operates through two segments, Kratos Government Solutions and Unmanned Systems. The company offers ground systems for satellites and space vehicles, including software for command and control, telemetry, and tracking and control; jet-powered unmanned aerial drone systems, hypersonic vehicles, and rocket systems; propulsion systems for drones, missiles, loitering munitions, supersonic systems, spacecraft, and launch systems; command, control, communication, computing, combat, intelligence surveillance and reconnaissance; and microwave electronic products for missile, radar, missile defense, space, and satellite; counter unmanned aircraft systems, directed energy, communication and other systems, and virtual and augmented reality training systems for the warfighter.

Read More

Before you consider Kratos Defense & Security Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kratos Defense & Security Solutions wasn't on the list.

While Kratos Defense & Security Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.