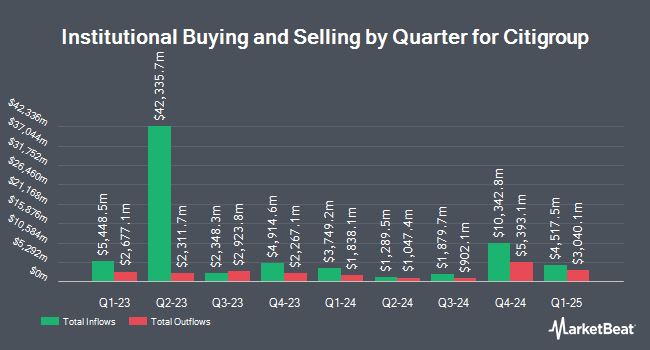

MAI Capital Management lowered its holdings in shares of Citigroup Inc. (NYSE:C - Free Report) by 53.2% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 46,648 shares of the company's stock after selling 52,943 shares during the quarter. MAI Capital Management's holdings in Citigroup were worth $2,920,000 at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in C. Clearbridge Investments LLC purchased a new position in Citigroup during the 1st quarter worth $1,447,000. Bessemer Group Inc. increased its holdings in Citigroup by 28.7% during the 1st quarter. Bessemer Group Inc. now owns 97,307 shares of the company's stock worth $6,154,000 after purchasing an additional 21,684 shares during the period. Lake Street Advisors Group LLC increased its holdings in Citigroup by 63.2% during the 1st quarter. Lake Street Advisors Group LLC now owns 15,079 shares of the company's stock worth $954,000 after purchasing an additional 5,840 shares during the period. InterOcean Capital Group LLC purchased a new position in Citigroup during the 1st quarter worth $273,000. Finally, Crewe Advisors LLC purchased a new position in shares of Citigroup in the 1st quarter valued at $192,000. Hedge funds and other institutional investors own 71.72% of the company's stock.

Citigroup Trading Down 0.5 %

Shares of C stock traded down $0.32 on Wednesday, reaching $68.28. 10,494,038 shares of the stock were exchanged, compared to its average volume of 14,429,116. The stock has a market cap of $129.14 billion, a P/E ratio of 19.85, a price-to-earnings-growth ratio of 0.77 and a beta of 1.44. The company has a quick ratio of 0.96, a current ratio of 0.96 and a debt-to-equity ratio of 1.55. The firm has a 50 day moving average of $63.62 and a two-hundred day moving average of $62.71. Citigroup Inc. has a 1-year low of $44.56 and a 1-year high of $70.20.

Citigroup (NYSE:C - Get Free Report) last announced its quarterly earnings results on Tuesday, October 15th. The company reported $1.51 earnings per share for the quarter, topping analysts' consensus estimates of $1.31 by $0.20. Citigroup had a net margin of 4.70% and a return on equity of 6.19%. The firm had revenue of $20.32 billion during the quarter, compared to analysts' expectations of $19.86 billion. During the same period in the prior year, the company earned $1.52 EPS. The firm's revenue was up .9% on a year-over-year basis. On average, research analysts anticipate that Citigroup Inc. will post 5.85 EPS for the current year.

Citigroup Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Tuesday, November 5th were given a dividend of $0.56 per share. The ex-dividend date was Monday, November 4th. This represents a $2.24 annualized dividend and a dividend yield of 3.28%. Citigroup's payout ratio is 64.93%.

Wall Street Analyst Weigh In

A number of analysts have commented on the company. Evercore ISI lifted their price target on Citigroup from $63.00 to $64.00 and gave the stock an "in-line" rating in a research report on Wednesday, October 16th. Bank of America lifted their price target on Citigroup from $77.00 to $78.00 and gave the company a "buy" rating in a research note on Wednesday, October 16th. Morgan Stanley cut their price target on Citigroup from $86.00 to $82.00 and set an "overweight" rating for the company in a research note on Wednesday, October 16th. The Goldman Sachs Group cut their price objective on Citigroup from $75.00 to $71.00 and set a "buy" rating for the company in a research note on Wednesday, September 11th. Finally, Barclays boosted their price objective on Citigroup from $63.00 to $70.00 and gave the stock an "equal weight" rating in a research note on Wednesday, October 16th. One analyst has rated the stock with a sell rating, six have issued a hold rating and eleven have assigned a buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $73.00.

Read Our Latest Report on C

Citigroup Profile

(

Free Report)

Citigroup Inc, a diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions worldwide. It operates through five segments: Services, Markets, Banking, U.S. Personal Banking, and Wealth. The Services segment includes Treasury and Trade Solutions, which provides cash management, trade, and working capital solutions to multinational corporations, financial institutions, and public sector organizations; and Securities Services, such as cross-border support for clients, local market expertise, post-trade technologies, data solutions, and various securities services solutions.

Read More

Before you consider Citigroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Citigroup wasn't on the list.

While Citigroup currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.