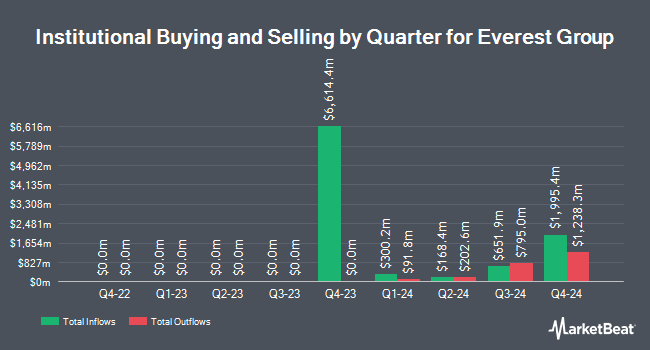

Citigroup Inc. increased its position in Everest Group, Ltd. (NYSE:EG - Free Report) by 5.9% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 51,962 shares of the company's stock after acquiring an additional 2,877 shares during the period. Citigroup Inc. owned about 0.12% of Everest Group worth $20,360,000 at the end of the most recent reporting period.

Several other large investors also recently modified their holdings of the company. Raymond James Trust N.A. grew its holdings in shares of Everest Group by 59.7% in the third quarter. Raymond James Trust N.A. now owns 1,434 shares of the company's stock worth $562,000 after acquiring an additional 536 shares during the period. Blackhawk Capital Partners LLC. bought a new stake in Everest Group during the third quarter valued at about $214,000. Massachusetts Financial Services Co. MA grew its holdings in Everest Group by 6.6% during the third quarter. Massachusetts Financial Services Co. MA now owns 490,691 shares of the company's stock valued at $192,267,000 after purchasing an additional 30,458 shares during the period. Intech Investment Management LLC grew its holdings in Everest Group by 13.1% during the third quarter. Intech Investment Management LLC now owns 27,324 shares of the company's stock valued at $10,706,000 after purchasing an additional 3,166 shares during the period. Finally, BNP PARIBAS ASSET MANAGEMENT Holding S.A. grew its holdings in Everest Group by 2.7% during the third quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 149,362 shares of the company's stock valued at $58,525,000 after purchasing an additional 3,866 shares during the period. Institutional investors own 92.64% of the company's stock.

Everest Group Trading Down 0.6 %

Shares of EG stock opened at $387.59 on Wednesday. Everest Group, Ltd. has a 1 year low of $343.76 and a 1 year high of $417.04. The company has a debt-to-equity ratio of 0.22, a current ratio of 0.40 and a quick ratio of 0.40. The stock's 50 day simple moving average is $380.79 and its two-hundred day simple moving average is $380.87. The company has a market cap of $16.66 billion, a PE ratio of 6.07, a price-to-earnings-growth ratio of 2.89 and a beta of 0.63.

Everest Group Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Wednesday, November 27th will be paid a dividend of $2.00 per share. The ex-dividend date of this dividend is Wednesday, November 27th. This represents a $8.00 dividend on an annualized basis and a dividend yield of 2.06%. Everest Group's dividend payout ratio is 12.52%.

Wall Street Analyst Weigh In

EG has been the topic of several research analyst reports. BMO Capital Markets lowered their price objective on Everest Group from $383.00 to $372.00 and set a "market perform" rating on the stock in a research report on Thursday, November 14th. TD Cowen decreased their target price on Everest Group from $444.00 to $419.00 and set a "hold" rating on the stock in a research report on Monday, November 18th. Barclays decreased their target price on Everest Group from $527.00 to $517.00 and set an "overweight" rating on the stock in a research report on Thursday, October 31st. Bank of America decreased their target price on Everest Group from $496.00 to $485.00 and set a "buy" rating on the stock in a research report on Thursday, October 10th. Finally, Keefe, Bruyette & Woods decreased their target price on Everest Group from $454.00 to $438.00 and set an "outperform" rating on the stock in a research report on Thursday, August 8th. Six equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $431.30.

View Our Latest Research Report on Everest Group

Insider Activity

In related news, COO James Allan Williamson sold 200 shares of the stock in a transaction that occurred on Thursday, November 14th. The stock was sold at an average price of $370.00, for a total value of $74,000.00. Following the transaction, the chief operating officer now owns 15,009 shares of the company's stock, valued at $5,553,330. This represents a 1.32 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director William F. Galtney, Jr. acquired 2,870 shares of the company's stock in a transaction that occurred on Monday, November 4th. The stock was purchased at an average cost of $348.64 per share, for a total transaction of $1,000,596.80. Following the purchase, the director now owns 32,822 shares of the company's stock, valued at $11,443,062.08. This represents a 9.58 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders own 1.20% of the company's stock.

About Everest Group

(

Free Report)

Everest Group, Ltd., through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally. The company operates through two segment, Insurance and Reinsurance. The Reinsurance segment writes property and casualty reinsurance; and specialty lines of business through reinsurance brokers, as well as directly with ceding companies in the United States, Bermuda, Ireland, Canada, Singapore, Switzerland, and the United Kingdom.

Read More

Before you consider Everest Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Everest Group wasn't on the list.

While Everest Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.