Citigroup Inc. raised its position in The Hartford Financial Services Group, Inc. (NYSE:HIG - Free Report) by 3.5% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 314,849 shares of the insurance provider's stock after buying an additional 10,566 shares during the quarter. Citigroup Inc. owned about 0.11% of The Hartford Financial Services Group worth $37,029,000 at the end of the most recent quarter.

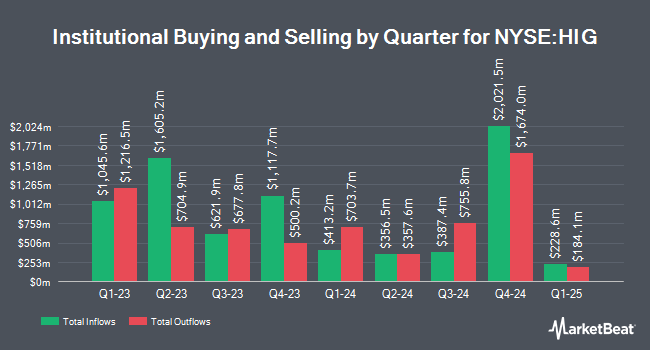

Several other hedge funds and other institutional investors also recently made changes to their positions in the company. CreativeOne Wealth LLC acquired a new position in The Hartford Financial Services Group during the first quarter valued at approximately $278,000. Canada Pension Plan Investment Board raised its holdings in shares of The Hartford Financial Services Group by 94.4% during the 1st quarter. Canada Pension Plan Investment Board now owns 195,017 shares of the insurance provider's stock worth $20,097,000 after buying an additional 94,717 shares in the last quarter. LRI Investments LLC bought a new stake in shares of The Hartford Financial Services Group during the 1st quarter worth $56,000. SVB Wealth LLC boosted its stake in The Hartford Financial Services Group by 4.1% in the first quarter. SVB Wealth LLC now owns 9,774 shares of the insurance provider's stock valued at $1,007,000 after buying an additional 386 shares in the last quarter. Finally, Dynasty Wealth Management LLC bought a new position in The Hartford Financial Services Group in the first quarter valued at about $643,000. 93.42% of the stock is currently owned by institutional investors and hedge funds.

The Hartford Financial Services Group Stock Up 0.7 %

HIG traded up $0.80 during trading on Monday, hitting $121.52. 3,323,435 shares of the company's stock were exchanged, compared to its average volume of 1,598,081. The Hartford Financial Services Group, Inc. has a fifty-two week low of $76.65 and a fifty-two week high of $123.23. The stock has a market cap of $35.23 billion, a P/E ratio of 12.10, a PEG ratio of 0.99 and a beta of 0.94. The business's 50 day moving average is $116.81 and its two-hundred day moving average is $109.46. The company has a quick ratio of 0.32, a current ratio of 0.32 and a debt-to-equity ratio of 0.26.

The Hartford Financial Services Group Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Stockholders of record on Monday, December 2nd will be issued a $0.52 dividend. This represents a $2.08 dividend on an annualized basis and a dividend yield of 1.71%. The ex-dividend date of this dividend is Monday, December 2nd. This is a positive change from The Hartford Financial Services Group's previous quarterly dividend of $0.47. The Hartford Financial Services Group's dividend payout ratio (DPR) is currently 18.84%.

Insider Activity at The Hartford Financial Services Group

In other news, EVP Adin M. Tooker sold 6,865 shares of the business's stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $117.04, for a total value of $803,479.60. Following the transaction, the executive vice president now owns 25,820 shares in the company, valued at $3,021,972.80. The trade was a 21.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 1.60% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on HIG shares. Royal Bank of Canada boosted their price objective on The Hartford Financial Services Group from $105.00 to $115.00 and gave the stock a "sector perform" rating in a research report on Monday, July 29th. UBS Group lifted their target price on shares of The Hartford Financial Services Group from $134.00 to $135.00 and gave the stock a "buy" rating in a research report on Tuesday, October 15th. Argus upgraded shares of The Hartford Financial Services Group to a "strong-buy" rating in a research report on Friday, August 2nd. StockNews.com raised shares of The Hartford Financial Services Group from a "hold" rating to a "buy" rating in a research note on Friday, November 15th. Finally, Barclays started coverage on The Hartford Financial Services Group in a report on Wednesday, September 4th. They set an "equal weight" rating and a $130.00 target price on the stock. Nine analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, The Hartford Financial Services Group presently has a consensus rating of "Moderate Buy" and a consensus target price of $120.88.

Get Our Latest Stock Report on The Hartford Financial Services Group

The Hartford Financial Services Group Profile

(

Free Report)

The Hartford Financial Services Group, Inc, together with its subsidiaries, provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers insurance coverages, including workers' compensation, property, automobile, general and professional liability, package business, umbrella, fidelity and surety, marine, livestock, accident, health, and reinsurance through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers.

Featured Articles

Before you consider The Hartford Financial Services Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hartford Financial Services Group wasn't on the list.

While The Hartford Financial Services Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.