Warner Music Group (NASDAQ:WMG - Free Report) had its target price upped by Citigroup from $31.00 to $34.00 in a research note published on Friday,Benzinga reports. They currently have a neutral rating on the stock.

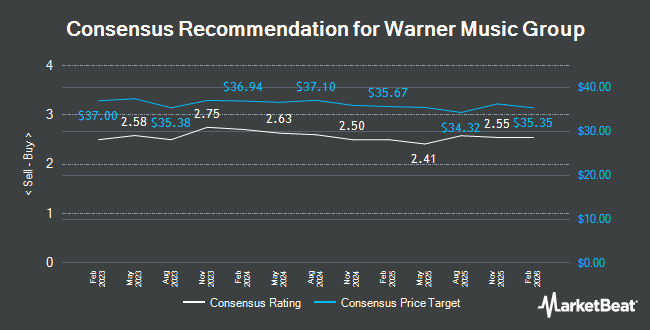

Several other research analysts have also commented on the company. Wells Fargo & Company reduced their price target on Warner Music Group from $37.00 to $34.00 and set an "equal weight" rating on the stock in a report on Thursday, August 8th. Bank of America reaffirmed an "underperform" rating and set a $30.00 target price (down from $33.00) on shares of Warner Music Group in a research note on Friday, October 4th. Loop Capital dropped their price target on shares of Warner Music Group from $38.00 to $35.00 and set a "hold" rating for the company in a research note on Monday, November 25th. JPMorgan Chase & Co. reduced their price target on shares of Warner Music Group from $41.00 to $40.00 and set an "overweight" rating on the stock in a research report on Friday, November 22nd. Finally, Guggenheim reiterated a "buy" rating and issued a $44.00 price objective on shares of Warner Music Group in a research report on Friday, November 22nd. Two investment analysts have rated the stock with a sell rating, five have given a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $35.67.

Check Out Our Latest Research Report on Warner Music Group

Warner Music Group Stock Up 1.3 %

Shares of WMG stock traded up $0.42 during trading hours on Friday, reaching $32.52. 729,242 shares of the company's stock were exchanged, compared to its average volume of 1,576,985. Warner Music Group has a fifty-two week low of $27.06 and a fifty-two week high of $38.05. The company has a market cap of $16.85 billion, a price-to-earnings ratio of 39.18, a P/E/G ratio of 0.70 and a beta of 1.37. The company has a current ratio of 0.68, a quick ratio of 0.65 and a debt-to-equity ratio of 5.95. The stock's 50 day moving average is $31.97 and its 200-day moving average is $30.63.

Warner Music Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 3rd. Shareholders of record on Tuesday, November 19th will be given a $0.18 dividend. This represents a $0.72 annualized dividend and a yield of 2.21%. The ex-dividend date is Tuesday, November 19th. Warner Music Group's dividend payout ratio is currently 86.75%.

Insider Transactions at Warner Music Group

In related news, CEO Max Lousada sold 135,324 shares of the business's stock in a transaction on Thursday, September 5th. The stock was sold at an average price of $28.17, for a total transaction of $3,812,077.08. Following the completion of the transaction, the chief executive officer now directly owns 2,725,964 shares of the company's stock, valued at $76,790,405.88. The trade was a 4.73 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Over the last quarter, insiders have sold 628,205 shares of company stock valued at $17,628,757. 73.35% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in the company. Mawer Investment Management Ltd. boosted its holdings in shares of Warner Music Group by 2,699.4% in the 3rd quarter. Mawer Investment Management Ltd. now owns 8,217,467 shares of the company's stock valued at $257,207,000 after buying an additional 7,923,926 shares in the last quarter. Independent Franchise Partners LLP acquired a new stake in shares of Warner Music Group in the 2nd quarter valued at about $160,156,000. D1 Capital Partners L.P. purchased a new position in Warner Music Group during the 2nd quarter worth approximately $84,281,000. Darlington Partners Capital Management LP increased its position in Warner Music Group by 47.4% during the second quarter. Darlington Partners Capital Management LP now owns 8,072,372 shares of the company's stock worth $247,418,000 after buying an additional 2,594,994 shares during the period. Finally, Cooke & Bieler LP boosted its holdings in shares of Warner Music Group by 19.6% in the second quarter. Cooke & Bieler LP now owns 5,061,093 shares of the company's stock valued at $155,122,000 after acquiring an additional 831,114 shares during the period. Institutional investors and hedge funds own 96.88% of the company's stock.

About Warner Music Group

(

Get Free Report)

Warner Music Group Corp. operates as a music entertainment company in the United States, the United Kingdom, Germany, and internationally. It operates through Recorded Music and Music Publishing segments. The Recorded Music segment is involved in the discovery and development of recording artists, as well as related marketing, promotion, distribution, sale, and licensing of music created by such recording artists; markets its music catalog through compilations and reissuances of previously released music and video titles, as well as previously unreleased materials; and conducts its operation primarily through a collection of record labels, such as Warner Records and Atlantic Records, as well as Asylum, Big Beat, Canvasback, East West, Erato, FFRR, Fueled by Ramen, Nonesuch, Parlophone, Reprise, Roadrunner, Sire, Spinnin' Records, Warner Classics, and Warner Music Nashville.

See Also

Before you consider Warner Music Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warner Music Group wasn't on the list.

While Warner Music Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.