Clarkston Capital Partners LLC boosted its holdings in shares of Clarivate Plc (NYSE:CLVT - Free Report) by 8.1% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 70,733,831 shares of the company's stock after buying an additional 5,319,535 shares during the quarter. Clarivate accounts for 6.9% of Clarkston Capital Partners LLC's investment portfolio, making the stock its 2nd largest position. Clarkston Capital Partners LLC owned approximately 9.96% of Clarivate worth $359,328,000 as of its most recent SEC filing.

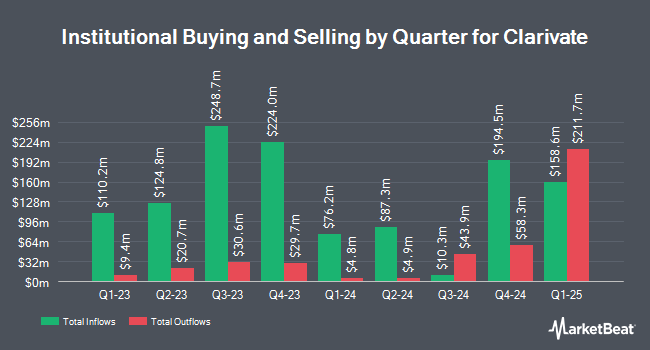

A number of other hedge funds also recently added to or reduced their stakes in the business. Norges Bank acquired a new stake in shares of Clarivate in the fourth quarter valued at $27,764,000. Raymond James Financial Inc. purchased a new stake in shares of Clarivate during the fourth quarter worth approximately $19,172,000. American Century Companies Inc. raised its holdings in Clarivate by 175.5% in the fourth quarter. American Century Companies Inc. now owns 5,061,276 shares of the company's stock valued at $25,711,000 after acquiring an additional 3,224,278 shares in the last quarter. Perpetual Ltd increased its position in shares of Clarivate by 24.6% in the 4th quarter. Perpetual Ltd now owns 9,192,680 shares of the company's stock valued at $46,699,000 after purchasing an additional 1,816,936 shares during the last quarter. Finally, Edmond DE Rothschild Holding S.A. raised its holdings in shares of Clarivate by 33.6% in the 4th quarter. Edmond DE Rothschild Holding S.A. now owns 6,492,760 shares of the company's stock valued at $32,983,000 after purchasing an additional 1,632,930 shares in the last quarter. 85.72% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Separately, Royal Bank of Canada reissued a "sector perform" rating and issued a $6.00 target price on shares of Clarivate in a report on Thursday, February 20th.

Get Our Latest Stock Analysis on CLVT

Clarivate Stock Down 0.2 %

Shares of NYSE CLVT traded down $0.01 during mid-day trading on Friday, reaching $3.20. The company had a trading volume of 1,841,319 shares, compared to its average volume of 5,105,496. The firm has a 50 day simple moving average of $4.27 and a two-hundred day simple moving average of $5.18. The stock has a market cap of $2.20 billion, a P/E ratio of -3.33 and a beta of 1.48. Clarivate Plc has a 52-week low of $3.04 and a 52-week high of $7.57. The company has a current ratio of 0.87, a quick ratio of 0.88 and a debt-to-equity ratio of 0.88.

Clarivate announced that its Board of Directors has initiated a share repurchase plan on Monday, December 16th that permits the company to repurchase $500.00 million in shares. This repurchase authorization permits the company to repurchase up to 12.8% of its shares through open market purchases. Shares repurchase plans are generally an indication that the company's leadership believes its shares are undervalued.

Clarivate Profile

(

Free Report)

Clarivate Plc operates as an information services provider in the Americas, the Middle East, Africa, Europe, and the Asia Pacific. It operates through three segments: Academia & Government, Life Sciences & Healthcare, and Intellectual Property. The company offers Web of Science and InCites, that analyzes and explores the academic research landscape and manages research information; ProQuest One and Ebook Central that provides comprehensive content collections to institutions in a cost-effective manner; and Alma and Polaris, that manages academic resources and services, connect users, and support research publications.

Further Reading

Before you consider Clarivate, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clarivate wasn't on the list.

While Clarivate currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.