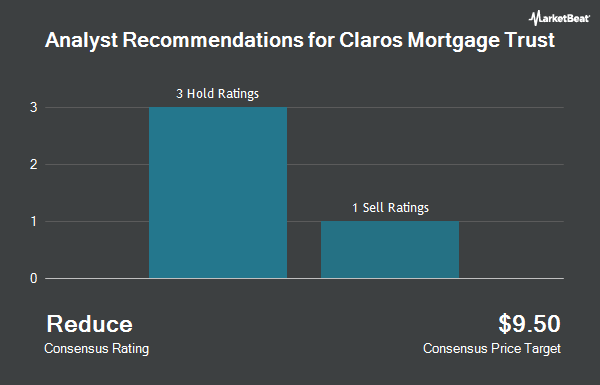

Claros Mortgage Trust, Inc. (NYSE:CMTG - Get Free Report) has been given an average rating of "Reduce" by the six research firms that are covering the stock, MarketBeat reports. Two equities research analysts have rated the stock with a sell rating and four have issued a hold rating on the company. The average 1 year price objective among analysts that have issued ratings on the stock in the last year is $7.44.

CMTG has been the subject of several analyst reports. Wells Fargo & Company downgraded shares of Claros Mortgage Trust from an "equal weight" rating to an "underweight" rating and set a $8.00 price objective for the company. in a report on Friday, September 20th. Keefe, Bruyette & Woods lifted their price target on Claros Mortgage Trust from $6.75 to $7.25 and gave the company an "underperform" rating in a research report on Tuesday, November 12th. JPMorgan Chase & Co. dropped their price objective on Claros Mortgage Trust from $9.00 to $6.50 and set a "neutral" rating on the stock in a report on Thursday, October 17th. Finally, UBS Group reduced their target price on Claros Mortgage Trust from $8.50 to $8.00 and set a "neutral" rating for the company in a report on Friday, November 15th.

View Our Latest Analysis on Claros Mortgage Trust

Claros Mortgage Trust Stock Performance

Claros Mortgage Trust stock traded up $0.08 during midday trading on Thursday, reaching $6.52. The stock had a trading volume of 170,259 shares, compared to its average volume of 340,331. The company has a quick ratio of 20.68, a current ratio of 20.68 and a debt-to-equity ratio of 2.11. The firm has a market capitalization of $908.63 million, a PE ratio of -10.24 and a beta of 1.51. Claros Mortgage Trust has a 12 month low of $6.08 and a 12 month high of $15.25. The firm's 50-day moving average price is $6.97 and its 200 day moving average price is $7.83.

Institutional Trading of Claros Mortgage Trust

Large investors have recently modified their holdings of the business. Barclays PLC lifted its holdings in shares of Claros Mortgage Trust by 332.1% during the 3rd quarter. Barclays PLC now owns 138,291 shares of the company's stock worth $1,037,000 after acquiring an additional 106,289 shares during the last quarter. Zacks Investment Management lifted its stake in Claros Mortgage Trust by 26.1% during the third quarter. Zacks Investment Management now owns 331,865 shares of the company's stock worth $2,486,000 after purchasing an additional 68,749 shares during the last quarter. State Street Corp boosted its holdings in shares of Claros Mortgage Trust by 0.3% in the 3rd quarter. State Street Corp now owns 2,165,863 shares of the company's stock worth $16,436,000 after purchasing an additional 6,882 shares in the last quarter. Hotchkis & Wiley Capital Management LLC bought a new position in shares of Claros Mortgage Trust during the 3rd quarter valued at about $2,552,000. Finally, PDT Partners LLC bought a new position in shares of Claros Mortgage Trust during the 3rd quarter valued at about $208,000. Institutional investors own 89.53% of the company's stock.

Claros Mortgage Trust Company Profile

(

Get Free ReportClaros Mortgage Trust, Inc operates as a real estate investment trust. It focuses on originating senior and subordinate loans on transitional commercial real estate assets in the United States. The company has elected to be taxed as a real estate investment trust. As a result, it would not be subject to corporate income tax on that portion of its net income that is distributed to shareholders.

Further Reading

Before you consider Claros Mortgage Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Claros Mortgage Trust wasn't on the list.

While Claros Mortgage Trust currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.