Teachers Retirement System of The State of Kentucky trimmed its stake in Clean Harbors, Inc. (NYSE:CLH - Free Report) by 23.3% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 15,942 shares of the business services provider's stock after selling 4,837 shares during the quarter. Teachers Retirement System of The State of Kentucky's holdings in Clean Harbors were worth $3,853,000 as of its most recent filing with the SEC.

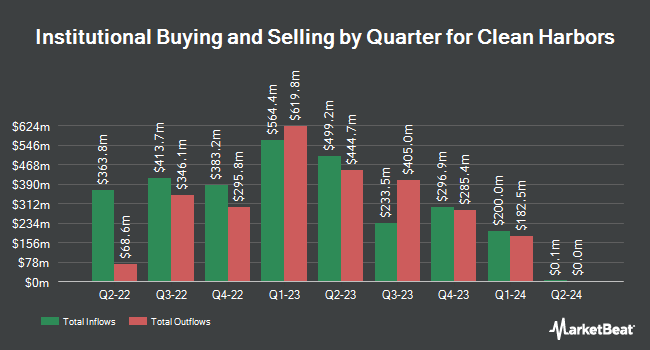

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Innealta Capital LLC acquired a new position in shares of Clean Harbors in the 2nd quarter valued at about $25,000. UMB Bank n.a. lifted its position in Clean Harbors by 63.4% during the third quarter. UMB Bank n.a. now owns 214 shares of the business services provider's stock valued at $52,000 after buying an additional 83 shares in the last quarter. Prospera Private Wealth LLC purchased a new stake in Clean Harbors during the third quarter worth approximately $56,000. Brown Brothers Harriman & Co. acquired a new stake in shares of Clean Harbors in the second quarter worth $56,000. Finally, CENTRAL TRUST Co raised its stake in shares of Clean Harbors by 161.6% in the 3rd quarter. CENTRAL TRUST Co now owns 259 shares of the business services provider's stock valued at $63,000 after acquiring an additional 160 shares during the period. Institutional investors and hedge funds own 90.43% of the company's stock.

Clean Harbors Stock Down 1.3 %

Shares of CLH traded down $3.20 during midday trading on Friday, hitting $244.28. The company had a trading volume of 160,504 shares, compared to its average volume of 295,524. The stock has a market cap of $13.17 billion, a price-to-earnings ratio of 31.82 and a beta of 1.22. The company's 50 day moving average price is $252.32 and its 200 day moving average price is $238.96. The company has a quick ratio of 1.76, a current ratio of 2.10 and a debt-to-equity ratio of 1.10. Clean Harbors, Inc. has a 52 week low of $161.39 and a 52 week high of $267.11.

Clean Harbors (NYSE:CLH - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The business services provider reported $2.12 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.15 by ($0.03). The firm had revenue of $1.53 billion for the quarter, compared to analyst estimates of $1.51 billion. Clean Harbors had a net margin of 7.19% and a return on equity of 17.51%. The business's revenue was up 12.0% compared to the same quarter last year. During the same period last year, the firm posted $1.68 EPS. On average, equities research analysts predict that Clean Harbors, Inc. will post 7.21 EPS for the current year.

Insider Buying and Selling at Clean Harbors

In related news, CEO Michael Louis Battles sold 10,000 shares of the business's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $245.74, for a total value of $2,457,400.00. Following the sale, the chief executive officer now directly owns 77,136 shares in the company, valued at $18,955,400.64. The trade was a 11.48 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, EVP Brian P. Weber sold 861 shares of the firm's stock in a transaction that occurred on Wednesday, November 27th. The stock was sold at an average price of $261.31, for a total transaction of $224,987.91. Following the sale, the executive vice president now owns 59,346 shares of the company's stock, valued at $15,507,703.26. The trade was a 1.43 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 18,447 shares of company stock valued at $4,576,829. 5.90% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on CLH shares. Oppenheimer increased their price target on Clean Harbors from $252.00 to $270.00 and gave the company an "outperform" rating in a report on Monday, October 21st. Robert W. Baird dropped their target price on Clean Harbors from $300.00 to $285.00 and set an "outperform" rating on the stock in a report on Thursday, October 31st. Stifel Nicolaus upped their price target on Clean Harbors from $270.00 to $290.00 and gave the stock a "buy" rating in a report on Wednesday. Needham & Company LLC dropped their price objective on shares of Clean Harbors from $274.00 to $268.00 and set a "buy" rating on the stock in a research note on Thursday, October 31st. Finally, Truist Financial upped their target price on shares of Clean Harbors from $260.00 to $280.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. One equities research analyst has rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average target price of $271.00.

Get Our Latest Stock Analysis on Clean Harbors

About Clean Harbors

(

Free Report)

Clean Harbors, Inc provides environmental and industrial services in the United States and internationally. The company operates through two segments, Environmental Services and Safety-Kleen Sustainability Solutions. The Environmental Services segment collects, transports, treats, and disposes hazardous and non-hazardous waste, such as resource recovery, physical treatment, fuel blending, incineration, landfill disposal, wastewater treatment, lab chemicals disposal, and explosives management services; and offers CleanPack services, including collection, identification, categorization, specialized packaging, transportation, and disposal of laboratory chemicals and household hazardous waste.

Featured Articles

Before you consider Clean Harbors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clean Harbors wasn't on the list.

While Clean Harbors currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.