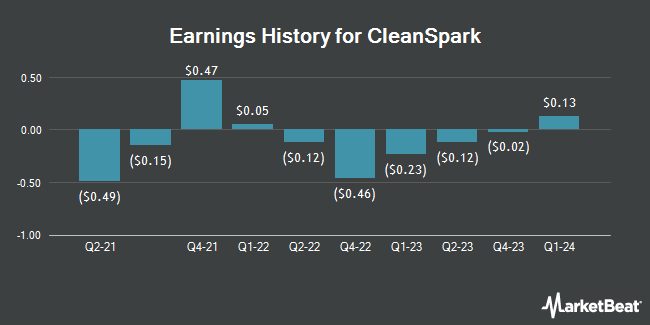

CleanSpark (NASDAQ:CLSK - Get Free Report) announced its earnings results on Thursday. The company reported ($0.07) earnings per share for the quarter, beating the consensus estimate of ($0.11) by $0.04, Zacks reports. CleanSpark had a net margin of 16.07% and a negative return on equity of 2.81%.

CleanSpark Trading Down 1.3 %

Shares of CleanSpark stock traded down $0.15 during trading hours on Monday, reaching $11.18. The stock had a trading volume of 22,481,093 shares, compared to its average volume of 24,447,730. CleanSpark has a twelve month low of $8.04 and a twelve month high of $24.72. The firm has a market capitalization of $3.14 billion, a PE ratio of 101.65 and a beta of 4.24. The stock's 50 day moving average is $11.27 and its 200 day moving average is $11.51.

Wall Street Analyst Weigh In

Several analysts have recently commented on the company. JPMorgan Chase & Co. upgraded CleanSpark from a "neutral" rating to an "overweight" rating and increased their price objective for the company from $10.50 to $17.00 in a report on Tuesday, December 10th. Macquarie increased their price target on CleanSpark from $20.00 to $24.00 and gave the company an "outperform" rating in a research note on Wednesday, December 4th. HC Wainwright restated a "buy" rating and set a $27.00 price target on shares of CleanSpark in a research note on Friday. Finally, Keefe, Bruyette & Woods initiated coverage on shares of CleanSpark in a report on Monday, January 27th. They set an "outperform" rating and a $19.00 price objective on the stock. Seven analysts have rated the stock with a buy rating, According to data from MarketBeat.com, CleanSpark has an average rating of "Buy" and an average price target of $22.57.

Read Our Latest Research Report on CleanSpark

CleanSpark Company Profile

(

Get Free Report)

CleanSpark, Inc operates as a bitcoin miner in the Americas. It owns and operates data centers that primarily run on low-carbon power. Its infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion. The company was formerly known as Stratean Inc and changed its name to CleanSpark, Inc in November 2016.

See Also

Before you consider CleanSpark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CleanSpark wasn't on the list.

While CleanSpark currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.