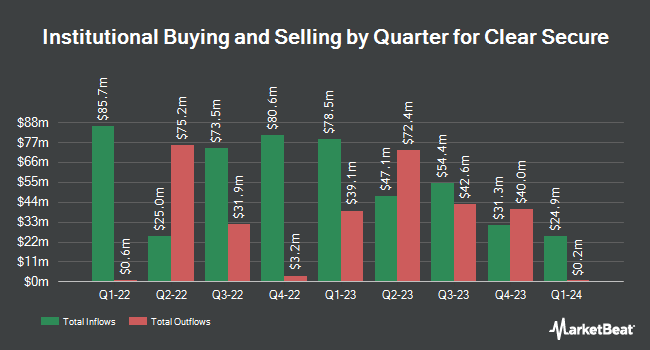

Citigroup Inc. boosted its position in Clear Secure, Inc. (NYSE:YOU - Free Report) by 257.9% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 107,858 shares of the company's stock after acquiring an additional 77,718 shares during the quarter. Citigroup Inc. owned 0.08% of Clear Secure worth $3,574,000 at the end of the most recent reporting period.

A number of other hedge funds have also added to or reduced their stakes in the company. Foundry Partners LLC lifted its holdings in shares of Clear Secure by 667.5% during the third quarter. Foundry Partners LLC now owns 213,815 shares of the company's stock worth $7,086,000 after purchasing an additional 185,957 shares during the period. New York State Teachers Retirement System lifted its holdings in Clear Secure by 402.1% in the third quarter. New York State Teachers Retirement System now owns 38,376 shares of the company's stock valued at $1,272,000 after buying an additional 30,733 shares during the period. Cornerstone Wealth Management LLC acquired a new position in Clear Secure in the second quarter valued at $840,000. AQR Capital Management LLC lifted its holdings in Clear Secure by 68.8% in the second quarter. AQR Capital Management LLC now owns 453,262 shares of the company's stock valued at $8,481,000 after buying an additional 184,795 shares during the period. Finally, Meritage Portfolio Management raised its holdings in shares of Clear Secure by 108.8% during the third quarter. Meritage Portfolio Management now owns 36,450 shares of the company's stock valued at $1,208,000 after purchasing an additional 18,994 shares during the period. 73.80% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

A number of equities analysts have recently issued reports on the stock. Needham & Company LLC reissued a "buy" rating and set a $45.00 price objective on shares of Clear Secure in a research report on Friday, November 8th. Wedbush reiterated a "neutral" rating and issued a $26.00 price objective (up previously from $24.00) on shares of Clear Secure in a research note on Thursday, November 7th. Telsey Advisory Group increased their price objective on shares of Clear Secure from $34.00 to $42.00 and gave the company an "outperform" rating in a research note on Friday, November 1st. The Goldman Sachs Group increased their price objective on shares of Clear Secure from $27.00 to $31.00 and gave the company a "buy" rating in a research note on Thursday, August 8th. Finally, Stifel Nicolaus increased their price objective on shares of Clear Secure from $24.00 to $32.00 and gave the company a "hold" rating in a research note on Monday, October 28th. One research analyst has rated the stock with a sell rating, two have given a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, Clear Secure has a consensus rating of "Hold" and an average price target of $32.67.

Read Our Latest Stock Analysis on YOU

Insider Buying and Selling at Clear Secure

In other news, Director Alclear Investments Ii, Llc sold 227,021 shares of Clear Secure stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $31.05, for a total transaction of $7,049,002.05. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CFO Kenneth L. Cornick sold 250,000 shares of Clear Secure stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $32.30, for a total transaction of $8,075,000.00. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 901,500 shares of company stock worth $29,055,829. 37.85% of the stock is currently owned by company insiders.

Clear Secure Stock Down 1.2 %

Shares of NYSE YOU traded down $0.31 during mid-day trading on Thursday, reaching $27.05. 3,507,950 shares of the company were exchanged, compared to its average volume of 1,791,733. Clear Secure, Inc. has a 52 week low of $16.05 and a 52 week high of $38.88. The stock has a market capitalization of $3.77 billion, a PE ratio of 30.67 and a beta of 1.43. The company's 50 day moving average price is $31.47 and its 200 day moving average price is $25.94.

Clear Secure (NYSE:YOU - Get Free Report) last issued its earnings results on Thursday, November 7th. The company reported $0.30 EPS for the quarter, missing analysts' consensus estimates of $0.33 by ($0.03). The business had revenue of $198.40 million during the quarter, compared to analysts' expectations of $194.62 million. Clear Secure had a return on equity of 48.28% and a net margin of 10.93%. Clear Secure's revenue for the quarter was up 23.7% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.20 EPS. On average, sell-side analysts predict that Clear Secure, Inc. will post 0.98 earnings per share for the current year.

Clear Secure Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 17th. Shareholders of record on Tuesday, December 10th will be given a $0.125 dividend. This is a boost from Clear Secure's previous quarterly dividend of $0.10. The ex-dividend date is Tuesday, December 10th. This represents a $0.50 dividend on an annualized basis and a dividend yield of 1.85%. Clear Secure's payout ratio is presently 46.51%.

About Clear Secure

(

Free Report)

Clear Secure, Inc operates a secure identity platform under the CLEAR brand name primarily in the United States. Its secure identity platform is a multi-layered infrastructure consisting of front-end, including enrollment, verification, and linking, as well as back-end. The company also offers CLEAR Plus, a consumer aviation subscription service, which enables access to predictable entry lanes in airport security checkpoints, as well as access to broader network; and CLEAR mobile app, which is used to enroll new members and improve the experience for existing members.

Featured Articles

Before you consider Clear Secure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clear Secure wasn't on the list.

While Clear Secure currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.