JPMorgan Chase & Co. boosted its stake in shares of Clear Secure, Inc. (NYSE:YOU - Free Report) by 5.7% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,769,257 shares of the company's stock after buying an additional 95,660 shares during the quarter. JPMorgan Chase & Co. owned 1.27% of Clear Secure worth $47,133,000 as of its most recent SEC filing.

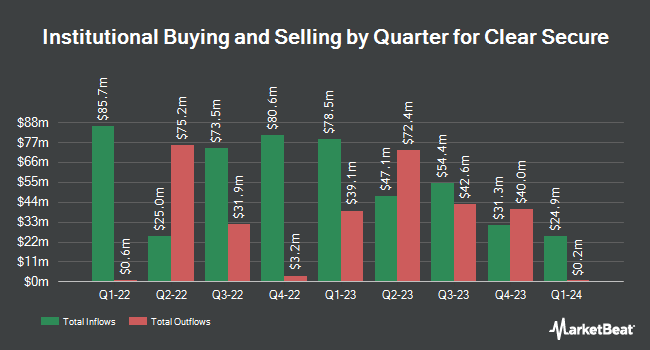

Other hedge funds also recently bought and sold shares of the company. Raymond James Financial Inc. purchased a new position in Clear Secure during the fourth quarter worth about $1,695,000. William Blair Investment Management LLC acquired a new stake in shares of Clear Secure during the fourth quarter worth about $37,697,000. Principal Financial Group Inc. lifted its position in shares of Clear Secure by 3,937.1% during the third quarter. Principal Financial Group Inc. now owns 478,760 shares of the company's stock worth $15,866,000 after purchasing an additional 466,901 shares in the last quarter. Geode Capital Management LLC lifted its position in shares of Clear Secure by 6.4% during the third quarter. Geode Capital Management LLC now owns 2,346,854 shares of the company's stock worth $77,788,000 after purchasing an additional 141,208 shares in the last quarter. Finally, State Street Corp lifted its position in shares of Clear Secure by 64.1% during the third quarter. State Street Corp now owns 3,360,945 shares of the company's stock worth $111,381,000 after purchasing an additional 1,312,419 shares in the last quarter. Hedge funds and other institutional investors own 73.80% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on YOU. Telsey Advisory Group reaffirmed an "outperform" rating and issued a $42.00 target price on shares of Clear Secure in a report on Thursday, February 27th. Stifel Nicolaus lowered their target price on shares of Clear Secure from $32.00 to $26.00 and set a "hold" rating on the stock in a research report on Thursday, February 27th. Finally, Needham & Company LLC reiterated a "buy" rating and issued a $45.00 price objective on shares of Clear Secure in a research report on Monday, March 24th. Two equities research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $34.00.

View Our Latest Research Report on Clear Secure

Clear Secure Stock Performance

Clear Secure stock traded down $0.28 during midday trading on Thursday, reaching $25.91. The company's stock had a trading volume of 139,704 shares, compared to its average volume of 1,988,448. Clear Secure, Inc. has a fifty-two week low of $16.05 and a fifty-two week high of $38.88. The stock's 50 day simple moving average is $24.66 and its 200 day simple moving average is $27.58. The firm has a market capitalization of $3.55 billion, a PE ratio of 30.13 and a beta of 1.25.

Clear Secure Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, March 18th. Shareholders of record on Monday, March 10th were issued a $0.125 dividend. This represents a $0.50 dividend on an annualized basis and a yield of 1.93%. The ex-dividend date was Monday, March 10th. Clear Secure's dividend payout ratio (DPR) is currently 32.47%.

Clear Secure Profile

(

Free Report)

Clear Secure, Inc operates a secure identity platform under the CLEAR brand name primarily in the United States. Its secure identity platform is a multi-layered infrastructure consisting of front-end, including enrollment, verification, and linking, as well as back-end. The company also offers CLEAR Plus, a consumer aviation subscription service, which enables access to predictable entry lanes in airport security checkpoints, as well as access to broader network; and CLEAR mobile app, which is used to enroll new members and improve the experience for existing members.

Featured Stories

Before you consider Clear Secure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clear Secure wasn't on the list.

While Clear Secure currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.