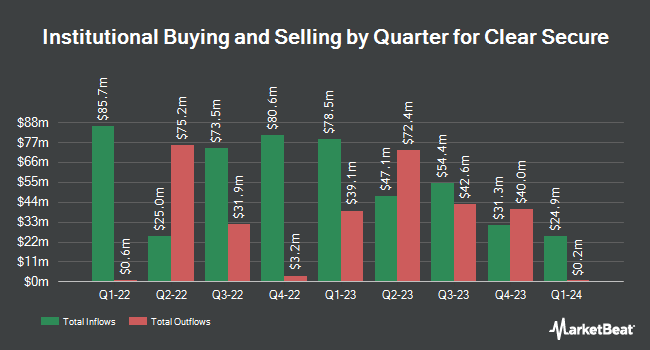

Dynamic Technology Lab Private Ltd lessened its holdings in shares of Clear Secure, Inc. (NYSE:YOU - Free Report) by 53.4% in the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 10,059 shares of the company's stock after selling 11,531 shares during the quarter. Dynamic Technology Lab Private Ltd's holdings in Clear Secure were worth $268,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in YOU. GAMMA Investing LLC boosted its position in shares of Clear Secure by 221.6% during the fourth quarter. GAMMA Investing LLC now owns 1,119 shares of the company's stock valued at $30,000 after purchasing an additional 771 shares in the last quarter. Huntington National Bank bought a new position in shares of Clear Secure in the 4th quarter worth about $35,000. SRS Capital Advisors Inc. lifted its position in Clear Secure by 56.1% during the 4th quarter. SRS Capital Advisors Inc. now owns 2,132 shares of the company's stock valued at $57,000 after acquiring an additional 766 shares during the period. Harbour Investments Inc. grew its holdings in Clear Secure by 23.0% in the fourth quarter. Harbour Investments Inc. now owns 2,405 shares of the company's stock worth $64,000 after purchasing an additional 450 shares during the period. Finally, SBI Securities Co. Ltd. purchased a new position in shares of Clear Secure during the fourth quarter valued at approximately $83,000. Hedge funds and other institutional investors own 73.80% of the company's stock.

Clear Secure Trading Down 1.9 %

Clear Secure stock traded down $0.51 during trading on Tuesday, reaching $26.81. The company had a trading volume of 675,596 shares, compared to its average volume of 1,995,056. The firm's 50-day simple moving average is $24.87 and its 200 day simple moving average is $27.42. Clear Secure, Inc. has a 52 week low of $16.05 and a 52 week high of $38.88. The firm has a market capitalization of $3.67 billion, a price-to-earnings ratio of 31.17 and a beta of 1.25.

Clear Secure Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, March 18th. Stockholders of record on Monday, March 10th were paid a $0.125 dividend. This represents a $0.50 dividend on an annualized basis and a dividend yield of 1.86%. The ex-dividend date was Monday, March 10th. Clear Secure's dividend payout ratio (DPR) is 32.47%.

Wall Street Analyst Weigh In

A number of analysts have weighed in on YOU shares. Needham & Company LLC restated a "buy" rating and set a $45.00 price objective on shares of Clear Secure in a research note on Monday, March 24th. Stifel Nicolaus reduced their target price on Clear Secure from $32.00 to $26.00 and set a "hold" rating for the company in a report on Thursday, February 27th. Finally, Telsey Advisory Group reaffirmed an "outperform" rating and set a $42.00 price objective on shares of Clear Secure in a research report on Thursday, February 27th. Two research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $34.00.

Check Out Our Latest Stock Report on Clear Secure

Clear Secure Company Profile

(

Free Report)

Clear Secure, Inc operates a secure identity platform under the CLEAR brand name primarily in the United States. Its secure identity platform is a multi-layered infrastructure consisting of front-end, including enrollment, verification, and linking, as well as back-end. The company also offers CLEAR Plus, a consumer aviation subscription service, which enables access to predictable entry lanes in airport security checkpoints, as well as access to broader network; and CLEAR mobile app, which is used to enroll new members and improve the experience for existing members.

Featured Stories

Before you consider Clear Secure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clear Secure wasn't on the list.

While Clear Secure currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.