Clearbridge Investments LLC decreased its stake in Expro Group Holdings (NYSE:XPRO - Free Report) by 37.5% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,155,610 shares of the company's stock after selling 693,092 shares during the quarter. Clearbridge Investments LLC owned approximately 0.98% of Expro Group worth $14,410,000 at the end of the most recent quarter.

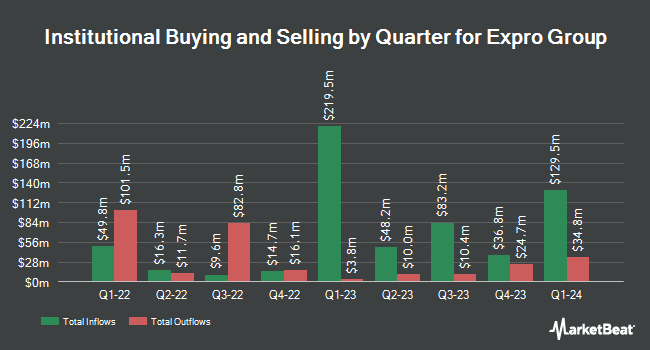

Other large investors have also recently bought and sold shares of the company. American Century Companies Inc. boosted its stake in shares of Expro Group by 32.3% in the 4th quarter. American Century Companies Inc. now owns 4,206,985 shares of the company's stock valued at $52,461,000 after purchasing an additional 1,027,825 shares in the last quarter. William Blair Investment Management LLC lifted its holdings in Expro Group by 37.0% during the 4th quarter. William Blair Investment Management LLC now owns 2,809,682 shares of the company's stock valued at $35,037,000 after purchasing an additional 758,449 shares during the last quarter. Leeward Investments LLC MA acquired a new position in Expro Group in the fourth quarter valued at about $7,026,000. Vanguard Group Inc. grew its stake in Expro Group by 2.6% during the fourth quarter. Vanguard Group Inc. now owns 10,236,260 shares of the company's stock worth $127,646,000 after buying an additional 260,914 shares during the last quarter. Finally, Yaupon Capital Management LP increased its holdings in shares of Expro Group by 318.3% during the third quarter. Yaupon Capital Management LP now owns 288,301 shares of the company's stock worth $4,950,000 after buying an additional 219,380 shares in the last quarter. 92.07% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several brokerages have recently commented on XPRO. The Goldman Sachs Group began coverage on Expro Group in a report on Friday, December 13th. They issued a "neutral" rating and a $18.00 target price on the stock. Barclays reduced their price objective on Expro Group from $17.00 to $14.00 and set an "overweight" rating on the stock in a research note on Wednesday, March 5th.

Read Our Latest Stock Analysis on XPRO

Expro Group Price Performance

Shares of XPRO traded down $0.10 during mid-day trading on Monday, hitting $7.83. 2,304,493 shares of the company traded hands, compared to its average volume of 1,179,708. The company has a current ratio of 1.98, a quick ratio of 1.62 and a debt-to-equity ratio of 0.09. The business has a 50-day moving average of $11.53 and a 200 day moving average of $13.22. Expro Group Holdings has a one year low of $7.34 and a one year high of $24.50. The stock has a market capitalization of $910.66 million, a price-to-earnings ratio of 55.90, a PEG ratio of 1.28 and a beta of 0.98.

About Expro Group

(

Free Report)

Expro Group Holdings N.V. engages in the provision of energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific. The company provides well construction services, such as technology solutions in drilling, tubular running services, and cementing and tubulars; and well management services, including well flow management, subsea well access, and well intervention and integrity solutions.

Recommended Stories

Before you consider Expro Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expro Group wasn't on the list.

While Expro Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.