Clearbridge Investments LLC cut its stake in Brookfield Infrastructure Co. (NASDAQ:BIPC - Free Report) by 98.4% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 5,826 shares of the company's stock after selling 362,707 shares during the period. Clearbridge Investments LLC's holdings in Brookfield Infrastructure were worth $233,000 as of its most recent filing with the Securities & Exchange Commission.

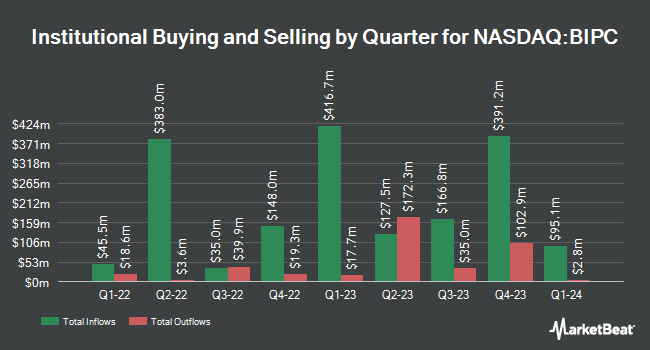

Several other large investors also recently bought and sold shares of BIPC. Norges Bank purchased a new stake in Brookfield Infrastructure during the 4th quarter valued at about $60,137,000. JPMorgan Chase & Co. increased its holdings in Brookfield Infrastructure by 61.9% in the 4th quarter. JPMorgan Chase & Co. now owns 588,649 shares of the company's stock worth $23,552,000 after buying an additional 225,143 shares during the period. Vanguard Group Inc. lifted its stake in Brookfield Infrastructure by 3.4% during the 4th quarter. Vanguard Group Inc. now owns 5,687,931 shares of the company's stock valued at $228,128,000 after acquiring an additional 187,719 shares during the period. LPL Financial LLC boosted its holdings in shares of Brookfield Infrastructure by 9.8% in the 4th quarter. LPL Financial LLC now owns 40,577 shares of the company's stock valued at $1,623,000 after acquiring an additional 3,623 shares during the last quarter. Finally, Guardian Partners Inc. acquired a new stake in shares of Brookfield Infrastructure in the fourth quarter worth $247,000. Hedge funds and other institutional investors own 70.38% of the company's stock.

Brookfield Infrastructure Price Performance

NASDAQ:BIPC traded up $0.57 during mid-day trading on Tuesday, hitting $34.10. The company's stock had a trading volume of 169,905 shares, compared to its average volume of 533,265. The business's fifty day moving average is $38.76 and its two-hundred day moving average is $40.70. The stock has a market cap of $4.06 billion, a price-to-earnings ratio of 23.69 and a beta of 1.48. Brookfield Infrastructure Co. has a 1 year low of $28.47 and a 1 year high of $45.29.

Brookfield Infrastructure Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Friday, February 28th were given a dividend of $0.43 per share. This is a boost from Brookfield Infrastructure's previous quarterly dividend of $0.41. This represents a $1.72 annualized dividend and a yield of 5.04%. The ex-dividend date was Friday, February 28th. Brookfield Infrastructure's dividend payout ratio (DPR) is currently 119.44%.

Brookfield Infrastructure Company Profile

(

Free Report)

Brookfield Infrastructure Corporation, together with its subsidiaries, owns and operates regulated natural gas transmission systems in Brazil. The company also engages in the regulated gas and electricity distribution operations in the United Kingdom; and electricity transmission and distribution, as well as gas distribution in Australia.

Featured Stories

Before you consider Brookfield Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Infrastructure wasn't on the list.

While Brookfield Infrastructure currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.