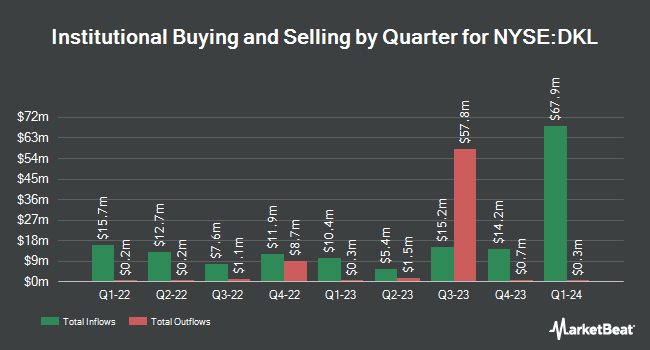

Clearbridge Investments LLC raised its holdings in shares of Delek Logistics Partners, LP (NYSE:DKL - Free Report) by 50.8% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 296,718 shares of the oil and gas producer's stock after acquiring an additional 100,000 shares during the quarter. Clearbridge Investments LLC owned approximately 0.58% of Delek Logistics Partners worth $12,539,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds have also recently modified their holdings of DKL. Easterly Investment Partners LLC bought a new position in Delek Logistics Partners in the 4th quarter worth $587,000. American Financial Group Inc. increased its position in Delek Logistics Partners by 20.0% in the fourth quarter. American Financial Group Inc. now owns 12,000 shares of the oil and gas producer's stock worth $507,000 after buying an additional 2,000 shares in the last quarter. LPL Financial LLC raised its stake in shares of Delek Logistics Partners by 35.3% in the fourth quarter. LPL Financial LLC now owns 44,447 shares of the oil and gas producer's stock worth $1,878,000 after buying an additional 11,599 shares during the period. Wealthfront Advisers LLC purchased a new position in shares of Delek Logistics Partners during the 4th quarter valued at about $506,000. Finally, Raymond James Financial Inc. bought a new position in shares of Delek Logistics Partners during the 4th quarter valued at approximately $6,050,000. Institutional investors own 11.75% of the company's stock.

Analysts Set New Price Targets

Separately, Raymond James raised their target price on shares of Delek Logistics Partners from $44.00 to $46.00 and gave the stock an "outperform" rating in a research note on Tuesday, January 28th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and three have assigned a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $44.25.

Check Out Our Latest Analysis on DKL

Delek Logistics Partners Stock Performance

Shares of Delek Logistics Partners stock traded down $1.19 during trading hours on Monday, hitting $38.55. The company's stock had a trading volume of 270,868 shares, compared to its average volume of 147,110. The company has a market cap of $2.07 billion, a PE ratio of 13.67, a PEG ratio of 1.28 and a beta of 1.62. The business has a 50 day moving average price of $42.08 and a two-hundred day moving average price of $41.30. Delek Logistics Partners, LP has a 12-month low of $37.02 and a 12-month high of $45.71.

Delek Logistics Partners (NYSE:DKL - Get Free Report) last posted its quarterly earnings results on Tuesday, February 25th. The oil and gas producer reported $0.68 EPS for the quarter, missing analysts' consensus estimates of $0.74 by ($0.06). Delek Logistics Partners had a negative return on equity of 155.77% and a net margin of 13.15%. The business had revenue of $209.86 million during the quarter, compared to analysts' expectations of $240.05 million. As a group, research analysts anticipate that Delek Logistics Partners, LP will post 3.01 earnings per share for the current year.

Delek Logistics Partners Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, February 11th. Investors of record on Tuesday, February 4th were given a dividend of $1.105 per share. This is a positive change from Delek Logistics Partners's previous quarterly dividend of $1.10. The ex-dividend date of this dividend was Tuesday, February 4th. This represents a $4.42 dividend on an annualized basis and a dividend yield of 11.47%. Delek Logistics Partners's dividend payout ratio is currently 147.83%.

Delek Logistics Partners Profile

(

Free Report)

Delek Logistics Partners, LP provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States. The Gathering and Processing segment consists of pipelines, tanks, and offloading facilities that provide crude oil and natural gas gathering and processing, water disposal and recycling, and storage services, as well as crude oil transportation services to third parties.

See Also

Before you consider Delek Logistics Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Delek Logistics Partners wasn't on the list.

While Delek Logistics Partners currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.