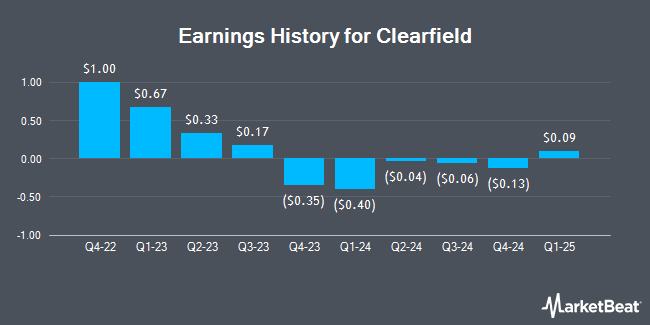

Clearfield (NASDAQ:CLFD - Get Free Report) announced its quarterly earnings data on Thursday. The communications equipment provider reported ($0.06) EPS for the quarter, beating the consensus estimate of ($0.19) by $0.13, Briefing.com reports. Clearfield had a negative return on equity of 3.06% and a negative net margin of 5.26%. The business had revenue of $46.80 million for the quarter, compared to the consensus estimate of $41.95 million. During the same period in the previous year, the business earned $0.17 earnings per share. The business's revenue was down 5.8% on a year-over-year basis.

Clearfield Trading Down 5.7 %

NASDAQ CLFD traded down $2.11 on Friday, hitting $34.69. 298,132 shares of the stock were exchanged, compared to its average volume of 155,701. Clearfield has a 52-week low of $23.45 and a 52-week high of $44.83. The firm has a market capitalization of $493.99 million, a P/E ratio of -54.85 and a beta of 1.35. The company has a debt-to-equity ratio of 0.01, a quick ratio of 5.73 and a current ratio of 8.38. The stock has a fifty day moving average price of $37.55 and a two-hundred day moving average price of $37.61.

Analysts Set New Price Targets

Several research firms recently weighed in on CLFD. Northland Securities raised their target price on shares of Clearfield from $40.00 to $45.00 and gave the company an "outperform" rating in a research note on Friday, August 2nd. StockNews.com raised shares of Clearfield from a "sell" rating to a "hold" rating in a report on Thursday. Lake Street Capital raised shares of Clearfield from a "hold" rating to a "buy" rating and upped their price target for the company from $31.00 to $47.00 in a research note on Friday, August 2nd. Needham & Company LLC reiterated a "buy" rating and set a $50.00 price objective on shares of Clearfield in a research report on Tuesday, September 24th. Finally, Roth Mkm reduced their target price on shares of Clearfield from $47.00 to $45.00 and set a "buy" rating on the stock in a report on Friday, August 2nd. One equities research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $46.75.

Read Our Latest Stock Report on Clearfield

Clearfield Company Profile

(

Get Free Report)

Clearfield, Inc manufactures and sells various fiber connectivity products in the United States and internationally. The company offers FieldSmart, a series of panels, cabinets, wall boxes, and other enclosures; WaveSmart, an optical components integrated for signal coupling, splitting, termination, multiplexing, demultiplexing, and attenuation for integration within its fiber management platform; and active cabinet products.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Clearfield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearfield wasn't on the list.

While Clearfield currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.