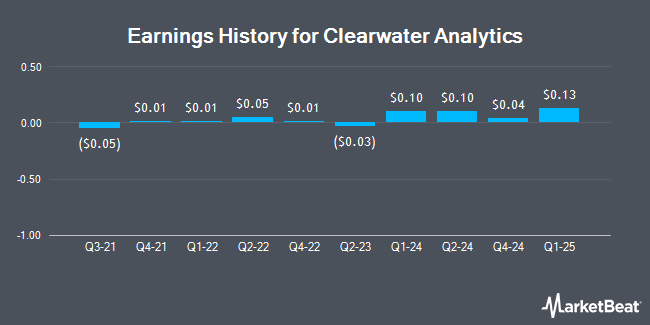

Clearwater Analytics (NYSE:CWAN - Get Free Report) issued its quarterly earnings data on Wednesday. The company reported $0.04 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.11 by ($0.07), Zacks reports. Clearwater Analytics had a return on equity of 7.11% and a net margin of 93.97%. The firm had revenue of $126.47 million during the quarter, compared to analysts' expectations of $120.34 million. Clearwater Analytics updated its FY 2025 guidance to EPS and its Q1 2025 guidance to EPS.

Clearwater Analytics Price Performance

Shares of Clearwater Analytics stock traded up $1.41 during trading hours on Friday, reaching $31.35. 5,089,250 shares of the company's stock were exchanged, compared to its average volume of 2,412,201. Clearwater Analytics has a 1 year low of $15.62 and a 1 year high of $35.71. The company has a market capitalization of $7.74 billion, a P/E ratio of 18.88, a price-to-earnings-growth ratio of 7.43 and a beta of 0.72. The business has a fifty day moving average of $28.03 and a two-hundred day moving average of $27.11. The company has a quick ratio of 4.66, a current ratio of 4.66 and a debt-to-equity ratio of 0.10.

Analysts Set New Price Targets

A number of research analysts have recently issued reports on the stock. DA Davidson raised shares of Clearwater Analytics from a "neutral" rating to a "buy" rating and cut their price objective for the stock from $35.00 to $32.00 in a research report on Tuesday, January 14th. Wells Fargo & Company lifted their price objective on shares of Clearwater Analytics from $35.00 to $37.00 and gave the stock an "overweight" rating in a research report on Thursday. Piper Sandler raised shares of Clearwater Analytics from a "neutral" rating to an "overweight" rating and boosted their target price for the stock from $28.00 to $36.00 in a research report on Thursday. JPMorgan Chase & Co. raised shares of Clearwater Analytics from a "neutral" rating to an "overweight" rating and boosted their target price for the stock from $23.00 to $33.00 in a research report on Thursday, November 7th. Finally, Oppenheimer boosted their target price on shares of Clearwater Analytics from $35.00 to $40.00 and gave the stock an "outperform" rating in a research report on Tuesday, December 3rd. One equities research analyst has rated the stock with a sell rating and nine have issued a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $33.80.

View Our Latest Report on Clearwater Analytics

Insider Transactions at Clearwater Analytics

In related news, CTO Souvik Das sold 76,844 shares of the company's stock in a transaction dated Wednesday, February 19th. The shares were sold at an average price of $30.07, for a total value of $2,310,699.08. Following the completion of the sale, the chief technology officer now owns 68,902 shares of the company's stock, valued at approximately $2,071,883.14. This represents a 52.72 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. Also, insider Subi Sethi sold 62,482 shares of the company's stock in a transaction dated Wednesday, February 19th. The shares were sold at an average price of $30.07, for a total transaction of $1,878,833.74. Following the completion of the sale, the insider now directly owns 144,973 shares of the company's stock, valued at $4,359,338.11. This represents a 30.12 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 733,431 shares of company stock valued at $21,444,493 over the last 90 days. 4.60% of the stock is currently owned by corporate insiders.

About Clearwater Analytics

(

Get Free Report)

Clearwater Analytics Holdings, Inc develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Featured Stories

Before you consider Clearwater Analytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Analytics wasn't on the list.

While Clearwater Analytics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.