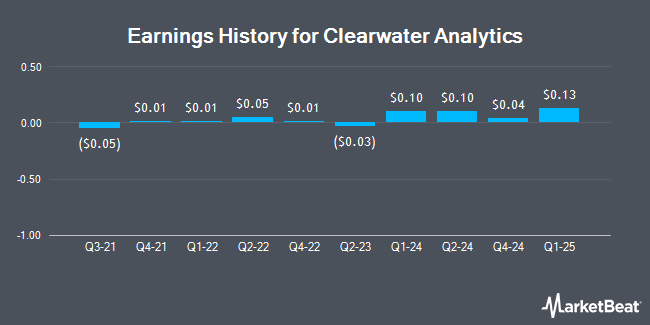

Clearwater Analytics (NYSE:CWAN - Get Free Report) released its quarterly earnings results on Wednesday. The company reported $0.04 earnings per share for the quarter, missing the consensus estimate of $0.11 by ($0.07), Zacks reports. Clearwater Analytics had a return on equity of 7.11% and a net margin of 93.97%. The business had revenue of $126.47 million during the quarter, compared to the consensus estimate of $120.34 million. Clearwater Analytics updated its FY 2025 guidance to EPS and its Q1 2025 guidance to EPS.

Clearwater Analytics Price Performance

Shares of NYSE:CWAN traded up $1.41 during midday trading on Friday, reaching $31.35. 5,089,250 shares of the company were exchanged, compared to its average volume of 2,158,487. The company has a current ratio of 4.66, a quick ratio of 4.66 and a debt-to-equity ratio of 0.10. The stock has a market cap of $7.74 billion, a PE ratio of 18.88, a price-to-earnings-growth ratio of 8.23 and a beta of 0.72. The business's fifty day moving average is $28.03 and its two-hundred day moving average is $27.11. Clearwater Analytics has a one year low of $15.62 and a one year high of $35.71.

Analyst Upgrades and Downgrades

CWAN has been the topic of several analyst reports. UBS Group lifted their target price on Clearwater Analytics from $36.00 to $38.00 and gave the company a "buy" rating in a research report on Thursday. DA Davidson raised Clearwater Analytics from a "neutral" rating to a "buy" rating and lowered their price objective for the company from $35.00 to $32.00 in a research report on Tuesday, January 14th. Royal Bank of Canada increased their target price on shares of Clearwater Analytics from $30.00 to $36.00 and gave the stock an "outperform" rating in a report on Thursday. Morgan Stanley restated an "overweight" rating and set a $36.00 target price (up previously from $34.00) on shares of Clearwater Analytics in a research note on Friday. Finally, JPMorgan Chase & Co. upgraded shares of Clearwater Analytics from a "neutral" rating to an "overweight" rating and upped their price target for the stock from $23.00 to $33.00 in a research report on Thursday, November 7th. One analyst has rated the stock with a sell rating and nine have given a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $33.80.

Check Out Our Latest Stock Analysis on CWAN

Insiders Place Their Bets

In related news, CEO Sandeep Sahai sold 50,000 shares of the business's stock in a transaction on Monday, January 13th. The shares were sold at an average price of $25.89, for a total value of $1,294,500.00. Following the sale, the chief executive officer now owns 615,855 shares in the company, valued at approximately $15,944,485.95. The trade was a 7.51 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CFO James S. Cox sold 18,700 shares of the business's stock in a transaction on Monday, December 16th. The stock was sold at an average price of $29.65, for a total transaction of $554,455.00. Following the completion of the sale, the chief financial officer now owns 214,044 shares in the company, valued at $6,346,404.60. This represents a 8.03 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 733,431 shares of company stock worth $21,444,493 in the last 90 days. 4.60% of the stock is currently owned by corporate insiders.

Clearwater Analytics Company Profile

(

Get Free Report)

Clearwater Analytics Holdings, Inc develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

See Also

Before you consider Clearwater Analytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Analytics wasn't on the list.

While Clearwater Analytics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.