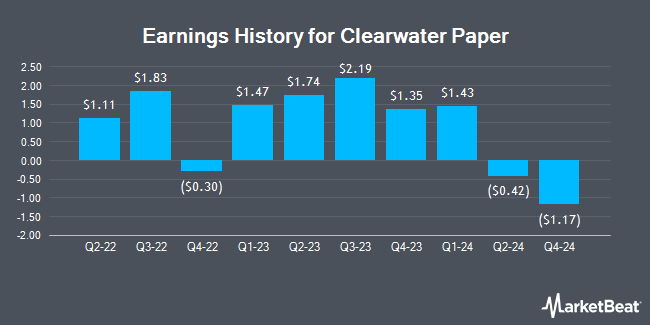

Clearwater Paper (NYSE:CLW - Get Free Report) issued its quarterly earnings data on Thursday. The basic materials company reported ($1.17) earnings per share for the quarter, missing the consensus estimate of ($0.33) by ($0.84), Zacks reports. Clearwater Paper had a net margin of 0.74% and a return on equity of 4.35%. Clearwater Paper updated its FY 2025 guidance to EPS.

Clearwater Paper Stock Performance

Shares of CLW stock traded down $2.28 on Monday, hitting $26.80. The company's stock had a trading volume of 876,873 shares, compared to its average volume of 258,884. The company has a market capitalization of $444.09 million, a PE ratio of 31.17 and a beta of 0.35. The company has a debt-to-equity ratio of 1.72, a quick ratio of 1.13 and a current ratio of 1.78. Clearwater Paper has a fifty-two week low of $23.97 and a fifty-two week high of $57.13. The stock's 50 day moving average is $29.52 and its 200-day moving average is $29.54.

Clearwater Paper declared that its board has approved a stock buyback plan on Monday, November 4th that allows the company to repurchase $100.00 million in outstanding shares. This repurchase authorization allows the basic materials company to repurchase up to 23.8% of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's board believes its stock is undervalued.

Wall Street Analyst Weigh In

Several equities analysts recently commented on the stock. Royal Bank of Canada restated an "outperform" rating and issued a $37.00 price target on shares of Clearwater Paper in a research note on Tuesday, November 5th. StockNews.com upgraded shares of Clearwater Paper from a "sell" rating to a "hold" rating in a research note on Monday.

Check Out Our Latest Report on CLW

About Clearwater Paper

(

Get Free Report)

Clearwater Paper Corporation manufactures and supplies bleached paperboards, and consumer and parent roll tissues in the United States and internationally. It operates through Pulp and Paperboard, and Consumer Products segments. The Pulp and Paperboard segment manufactures and markets bleached paperboard; Solid Bleached Sulfate paperboard that is used to produce folding cartons, liquid packaging, cups and plates, blister and carded packaging, and top sheet and commercial printing items; and hardwood and softwood pulp, as well as offers services that include custom sheeting, slitting, and cutting.

See Also

Before you consider Clearwater Paper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Paper wasn't on the list.

While Clearwater Paper currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.