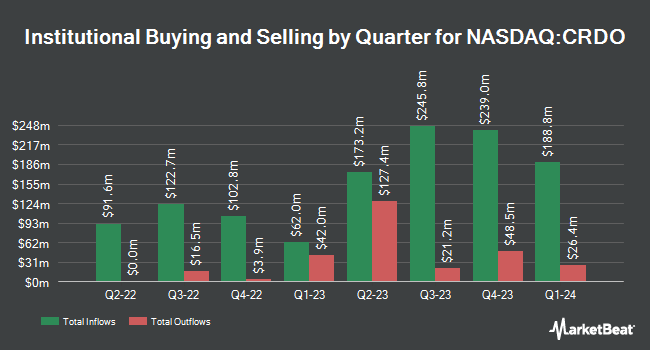

CloudAlpha Capital Management Limited Hong Kong increased its holdings in shares of Credo Technology Group Holding Ltd (NASDAQ:CRDO - Free Report) by 58.2% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 180,940 shares of the company's stock after purchasing an additional 66,546 shares during the quarter. Credo Technology Group makes up 0.3% of CloudAlpha Capital Management Limited Hong Kong's portfolio, making the stock its 21st biggest holding. CloudAlpha Capital Management Limited Hong Kong owned approximately 0.11% of Credo Technology Group worth $5,573,000 as of its most recent SEC filing.

Several other institutional investors have also recently made changes to their positions in the business. Vanguard Group Inc. grew its position in shares of Credo Technology Group by 7.7% during the first quarter. Vanguard Group Inc. now owns 15,063,781 shares of the company's stock worth $319,202,000 after purchasing an additional 1,072,301 shares in the last quarter. Driehaus Capital Management LLC grew its holdings in Credo Technology Group by 3.1% during the 2nd quarter. Driehaus Capital Management LLC now owns 3,791,392 shares of the company's stock valued at $121,097,000 after buying an additional 115,271 shares in the last quarter. Swedbank AB grew its holdings in Credo Technology Group by 873.9% during the 3rd quarter. Swedbank AB now owns 3,300,314 shares of the company's stock valued at $101,650,000 after buying an additional 2,961,454 shares in the last quarter. D. E. Shaw & Co. Inc. grew its holdings in Credo Technology Group by 9.1% during the 2nd quarter. D. E. Shaw & Co. Inc. now owns 2,431,433 shares of the company's stock valued at $77,660,000 after buying an additional 203,739 shares in the last quarter. Finally, Dimensional Fund Advisors LP grew its holdings in Credo Technology Group by 13.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,112,656 shares of the company's stock valued at $67,473,000 after buying an additional 242,428 shares in the last quarter. Hedge funds and other institutional investors own 80.46% of the company's stock.

Insider Buying and Selling

In related news, CEO William Joseph Brennan sold 143,880 shares of the business's stock in a transaction on Friday, September 6th. The stock was sold at an average price of $25.75, for a total transaction of $3,704,910.00. Following the transaction, the chief executive officer now directly owns 2,529,738 shares in the company, valued at $65,140,753.50. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. In other Credo Technology Group news, CEO William Joseph Brennan sold 143,880 shares of Credo Technology Group stock in a transaction dated Friday, September 6th. The stock was sold at an average price of $25.75, for a total transaction of $3,704,910.00. Following the completion of the sale, the chief executive officer now owns 2,529,738 shares of the company's stock, valued at approximately $65,140,753.50. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CFO Daniel W. Fleming sold 108,790 shares of Credo Technology Group stock in a transaction dated Monday, September 30th. The stock was sold at an average price of $31.10, for a total value of $3,383,369.00. Following the sale, the chief financial officer now directly owns 676,386 shares of the company's stock, valued at approximately $21,035,604.60. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 1,379,817 shares of company stock worth $45,262,336 in the last ninety days. 16.04% of the stock is owned by insiders.

Credo Technology Group Stock Performance

CRDO traded down $3.09 during trading on Thursday, hitting $42.78. 2,740,971 shares of the stock were exchanged, compared to its average volume of 2,240,941. The firm has a 50 day simple moving average of $35.00 and a 200 day simple moving average of $29.80. The firm has a market cap of $7.10 billion, a price-to-earnings ratio of -286.69 and a beta of 2.19. Credo Technology Group Holding Ltd has a 1 year low of $16.82 and a 1 year high of $48.94.

Credo Technology Group (NASDAQ:CRDO - Get Free Report) last announced its quarterly earnings results on Wednesday, September 4th. The company reported ($0.06) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.03) by ($0.03). Credo Technology Group had a negative net margin of 12.05% and a negative return on equity of 3.74%. The company had revenue of $59.71 million during the quarter, compared to analysts' expectations of $59.50 million. As a group, equities analysts anticipate that Credo Technology Group Holding Ltd will post -0.02 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research firms have weighed in on CRDO. Craig Hallum raised their price target on Credo Technology Group from $30.00 to $38.00 and gave the company a "buy" rating in a report on Thursday, September 5th. The Goldman Sachs Group raised their price objective on Credo Technology Group from $26.00 to $31.00 and gave the company a "buy" rating in a research note on Friday, September 6th. Bank of America raised their price objective on Credo Technology Group from $25.00 to $27.00 and gave the company an "underperform" rating in a research note on Thursday, September 5th. Needham & Company LLC raised their price objective on Credo Technology Group from $29.00 to $33.00 and gave the company a "buy" rating in a research note on Thursday, September 5th. Finally, Mizuho raised their price objective on Credo Technology Group from $35.00 to $41.00 and gave the company an "outperform" rating in a research note on Monday, October 14th. One research analyst has rated the stock with a sell rating, seven have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $36.56.

Get Our Latest Stock Report on Credo Technology Group

Credo Technology Group Company Profile

(

Free Report)

Credo Technology Group Holding Ltd provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally. Its products include HiWire active electrical cables, optical digital signal processors, low-power line card PHY, serializer/deserializer (SerDes) chiplets, and SerDes IP, as well as integrated circuits, active electrical cables.

Read More

Before you consider Credo Technology Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Credo Technology Group wasn't on the list.

While Credo Technology Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report