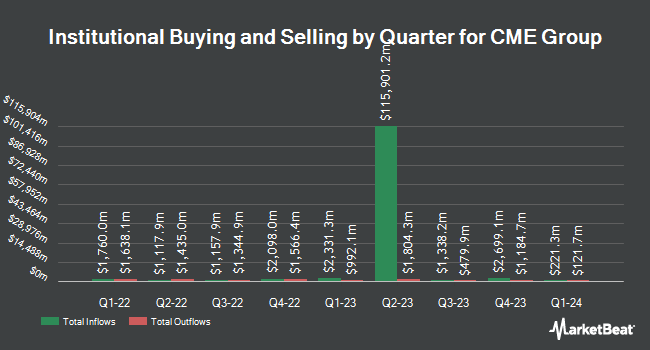

Wilson Asset Management International PTY Ltd. decreased its position in CME Group Inc. (NASDAQ:CME - Free Report) by 10.7% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 76,378 shares of the financial services provider's stock after selling 9,157 shares during the period. CME Group makes up approximately 4.6% of Wilson Asset Management International PTY Ltd.'s holdings, making the stock its 7th biggest position. Wilson Asset Management International PTY Ltd.'s holdings in CME Group were worth $17,737,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently bought and sold shares of the company. Knuff & Co LLC acquired a new stake in shares of CME Group in the 4th quarter worth approximately $33,000. EverSource Wealth Advisors LLC lifted its stake in shares of CME Group by 47.6% in the 4th quarter. EverSource Wealth Advisors LLC now owns 1,039 shares of the financial services provider's stock worth $241,000 after acquiring an additional 335 shares during the period. Sequoia Financial Advisors LLC lifted its stake in shares of CME Group by 9.2% in the 4th quarter. Sequoia Financial Advisors LLC now owns 9,996 shares of the financial services provider's stock worth $2,321,000 after acquiring an additional 845 shares during the period. HighTower Advisors LLC lifted its stake in shares of CME Group by 0.7% in the 4th quarter. HighTower Advisors LLC now owns 377,301 shares of the financial services provider's stock worth $87,621,000 after acquiring an additional 2,554 shares during the period. Finally, Moors & Cabot Inc. lifted its stake in shares of CME Group by 0.8% in the 4th quarter. Moors & Cabot Inc. now owns 27,489 shares of the financial services provider's stock worth $6,384,000 after acquiring an additional 217 shares during the period. Institutional investors own 87.75% of the company's stock.

CME Group Stock Down 0.7 %

Shares of NASDAQ:CME opened at $260.43 on Wednesday. The company has a market cap of $93.85 billion, a PE ratio of 26.93, a price-to-earnings-growth ratio of 6.76 and a beta of 0.53. The company has a debt-to-equity ratio of 0.10, a quick ratio of 1.02 and a current ratio of 1.01. The firm has a 50 day simple moving average of $241.25 and a 200 day simple moving average of $231.60. CME Group Inc. has a 52 week low of $190.70 and a 52 week high of $263.65.

CME Group (NASDAQ:CME - Get Free Report) last released its quarterly earnings data on Wednesday, February 12th. The financial services provider reported $2.52 earnings per share for the quarter, beating the consensus estimate of $2.46 by $0.06. CME Group had a net margin of 57.52% and a return on equity of 13.62%. As a group, research analysts expect that CME Group Inc. will post 10.49 earnings per share for the current year.

CME Group Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, March 26th. Shareholders of record on Friday, March 7th will be paid a $1.25 dividend. This represents a $5.00 annualized dividend and a yield of 1.92%. The ex-dividend date is Friday, March 7th. This is a positive change from CME Group's previous quarterly dividend of $1.15. CME Group's dividend payout ratio is currently 51.71%.

CME Group announced that its board has initiated a stock buyback program on Thursday, December 5th that permits the company to buyback $3.00 billion in shares. This buyback authorization permits the financial services provider to repurchase up to 3.4% of its shares through open market purchases. Shares buyback programs are often an indication that the company's management believes its shares are undervalued.

Analyst Upgrades and Downgrades

A number of analysts have recently weighed in on CME shares. Oppenheimer upped their price target on shares of CME Group from $258.00 to $269.00 and gave the stock an "outperform" rating in a research note on Thursday, February 13th. JPMorgan Chase & Co. increased their target price on shares of CME Group from $209.00 to $212.00 and gave the company an "underweight" rating in a research note on Thursday, February 13th. Raymond James raised shares of CME Group from a "market perform" rating to an "outperform" rating and set a $287.00 target price for the company in a research note on Monday. Royal Bank of Canada increased their target price on shares of CME Group from $235.00 to $269.00 and gave the company a "sector perform" rating in a research note on Thursday, February 13th. Finally, Barclays increased their target price on shares of CME Group from $257.00 to $263.00 and gave the company an "equal weight" rating in a research note on Thursday, February 13th. Four research analysts have rated the stock with a sell rating, eight have given a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat.com, CME Group presently has an average rating of "Hold" and a consensus price target of $238.93.

View Our Latest Stock Analysis on CME

Insider Buying and Selling at CME Group

In other news, COO Suzanne Sprague sold 1,500 shares of the stock in a transaction on Monday, March 3rd. The shares were sold at an average price of $256.83, for a total transaction of $385,245.00. Following the transaction, the chief operating officer now owns 8,036 shares in the company, valued at $2,063,885.88. This represents a 15.73 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Hilda Harris Piell sold 3,984 shares of the stock in a transaction on Thursday, February 27th. The stock was sold at an average price of $250.47, for a total transaction of $997,872.48. Following the transaction, the insider now owns 27,046 shares in the company, valued at approximately $6,774,211.62. This trade represents a 12.84 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 17,076 shares of company stock worth $4,271,496. 0.30% of the stock is currently owned by company insiders.

About CME Group

(

Free Report)

CME Group Inc, together with its subsidiaries, operates contract markets for the trading of futures and options on futures contracts worldwide. It offers futures and options products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals, as well as fixed income and foreign currency trading services.

See Also

Want to see what other hedge funds are holding CME? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CME Group Inc. (NASDAQ:CME - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CME Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CME Group wasn't on the list.

While CME Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report