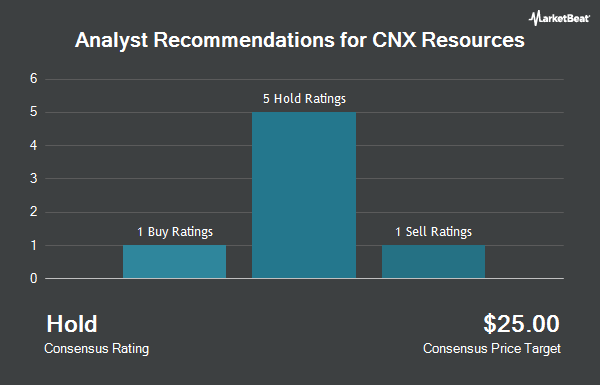

CNX Resources Co. (NYSE:CNX - Get Free Report) has been given a consensus recommendation of "Reduce" by the twelve brokerages that are presently covering the firm, MarketBeat Ratings reports. Five investment analysts have rated the stock with a sell rating and seven have issued a hold rating on the company. The average 1-year price target among brokerages that have issued ratings on the stock in the last year is $29.00.

CNX has been the topic of several research analyst reports. Stephens increased their price target on shares of CNX Resources from $26.00 to $35.00 and gave the company an "equal weight" rating in a research note on Friday, October 25th. Truist Financial cut shares of CNX Resources from a "buy" rating to a "hold" rating and reduced their price objective for the company from $38.00 to $34.00 in a research note on Monday, October 28th. Piper Sandler cut shares of CNX Resources from a "neutral" rating to an "underweight" rating and reduced their price objective for the company from $22.00 to $20.00 in a research note on Thursday, August 15th. BMO Capital Markets raised their price objective on shares of CNX Resources from $26.00 to $29.00 and gave the company a "market perform" rating in a research note on Friday, October 4th. Finally, Mizuho raised their price objective on shares of CNX Resources from $32.00 to $33.00 and gave the company a "neutral" rating in a research note on Monday, October 14th.

View Our Latest Research Report on CNX

Insider Buying and Selling

In related news, Director Bernard Lanigan, Jr. acquired 75,000 shares of the company's stock in a transaction that occurred on Monday, September 9th. The shares were acquired at an average cost of $26.81 per share, for a total transaction of $2,010,750.00. Following the completion of the acquisition, the director now directly owns 401,820 shares in the company, valued at approximately $10,772,794.20. The trade was a 0.00 % increase in their position. The purchase was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 4.65% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On CNX Resources

Hedge funds and other institutional investors have recently added to or reduced their stakes in the business. GAMMA Investing LLC increased its stake in CNX Resources by 54.1% in the 2nd quarter. GAMMA Investing LLC now owns 1,896 shares of the oil and gas producer's stock valued at $46,000 after buying an additional 666 shares during the last quarter. Blue Trust Inc. grew its position in shares of CNX Resources by 135.4% in the 3rd quarter. Blue Trust Inc. now owns 1,966 shares of the oil and gas producer's stock valued at $64,000 after acquiring an additional 1,131 shares during the period. CWM LLC grew its position in shares of CNX Resources by 77.0% in the 3rd quarter. CWM LLC now owns 2,149 shares of the oil and gas producer's stock valued at $70,000 after acquiring an additional 935 shares during the period. Natixis bought a new position in shares of CNX Resources in the 1st quarter valued at about $79,000. Finally, Innealta Capital LLC bought a new position in shares of CNX Resources in the 2nd quarter valued at about $131,000. 95.16% of the stock is currently owned by institutional investors and hedge funds.

CNX Resources Price Performance

Shares of CNX traded up $1.74 during mid-day trading on Wednesday, hitting $37.10. 4,467,336 shares of the company traded hands, compared to its average volume of 2,722,008. CNX Resources has a one year low of $19.07 and a one year high of $37.57. The company has a current ratio of 0.37, a quick ratio of 0.36 and a debt-to-equity ratio of 0.46. The business has a 50-day moving average of $31.95 and a 200 day moving average of $27.52. The stock has a market capitalization of $5.54 billion, a price-to-earnings ratio of 11.76, a PEG ratio of 1.67 and a beta of 1.37.

CNX Resources (NYSE:CNX - Get Free Report) last released its quarterly earnings results on Thursday, October 24th. The oil and gas producer reported $0.41 EPS for the quarter, beating the consensus estimate of $0.32 by $0.09. CNX Resources had a net margin of 27.79% and a return on equity of 7.54%. The business had revenue of $424.21 million for the quarter, compared to analysts' expectations of $398.33 million. During the same period in the prior year, the firm earned $0.35 earnings per share. As a group, equities analysts expect that CNX Resources will post 1.5 earnings per share for the current fiscal year.

About CNX Resources

(

Get Free ReportCNX Resources Corporation, an independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin. The company operates in two segments, Shale and Coalbed Methane (CBM). It produces and sells pipeline quality natural gas primarily for gas wholesalers.

See Also

Before you consider CNX Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNX Resources wasn't on the list.

While CNX Resources currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.