Cobblestone Capital Advisors LLC NY lowered its position in Broadstone Net Lease, Inc. (NYSE:BNL - Free Report) by 8.2% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 892,627 shares of the company's stock after selling 79,238 shares during the quarter. Cobblestone Capital Advisors LLC NY owned approximately 0.47% of Broadstone Net Lease worth $16,915,000 at the end of the most recent quarter.

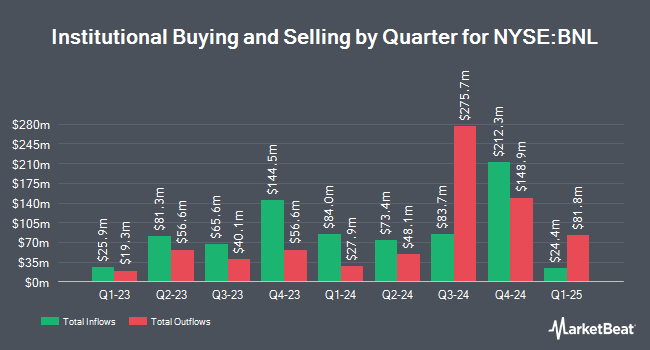

Other hedge funds also recently bought and sold shares of the company. GAMMA Investing LLC raised its holdings in shares of Broadstone Net Lease by 257.5% during the 3rd quarter. GAMMA Investing LLC now owns 1,766 shares of the company's stock valued at $33,000 after purchasing an additional 1,272 shares in the last quarter. Quarry LP raised its holdings in Broadstone Net Lease by 93.1% during the second quarter. Quarry LP now owns 2,556 shares of the company's stock valued at $41,000 after buying an additional 1,232 shares in the last quarter. Blue Trust Inc. lifted its position in shares of Broadstone Net Lease by 156.5% in the third quarter. Blue Trust Inc. now owns 3,902 shares of the company's stock worth $74,000 after buying an additional 2,381 shares during the last quarter. US Bancorp DE boosted its stake in shares of Broadstone Net Lease by 636.6% during the 3rd quarter. US Bancorp DE now owns 3,941 shares of the company's stock worth $75,000 after acquiring an additional 3,406 shares in the last quarter. Finally, KBC Group NV increased its holdings in shares of Broadstone Net Lease by 29.4% during the 3rd quarter. KBC Group NV now owns 6,220 shares of the company's stock valued at $118,000 after acquiring an additional 1,413 shares during the last quarter. 89.07% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on BNL shares. UBS Group initiated coverage on Broadstone Net Lease in a report on Thursday, November 14th. They issued a "neutral" rating and a $18.00 target price for the company. The Goldman Sachs Group upped their price objective on shares of Broadstone Net Lease from $14.50 to $16.00 and gave the stock a "sell" rating in a report on Friday, September 13th. Truist Financial boosted their target price on shares of Broadstone Net Lease from $16.00 to $18.00 and gave the stock a "hold" rating in a research report on Friday, August 16th. Finally, Wedbush began coverage on Broadstone Net Lease in a research report on Monday, August 19th. They issued an "outperform" rating and a $20.00 price target on the stock. One investment analyst has rated the stock with a sell rating, four have given a hold rating and two have issued a buy rating to the company's stock. According to data from MarketBeat, Broadstone Net Lease has a consensus rating of "Hold" and a consensus target price of $18.20.

Check Out Our Latest Analysis on Broadstone Net Lease

Broadstone Net Lease Stock Down 0.1 %

Broadstone Net Lease stock traded down $0.01 during trading hours on Friday, hitting $17.51. The stock had a trading volume of 645,606 shares, compared to its average volume of 1,100,301. The company has a 50-day moving average of $17.94 and a two-hundred day moving average of $17.20. Broadstone Net Lease, Inc. has a fifty-two week low of $14.20 and a fifty-two week high of $19.15. The company has a market cap of $3.30 billion, a PE ratio of 23.04 and a beta of 1.12.

Broadstone Net Lease (NYSE:BNL - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $0.19 EPS for the quarter, missing the consensus estimate of $0.34 by ($0.15). Broadstone Net Lease had a return on equity of 4.47% and a net margin of 33.56%. The firm had revenue of $108.40 million during the quarter, compared to the consensus estimate of $106.47 million. During the same period last year, the business earned $0.36 earnings per share. As a group, analysts forecast that Broadstone Net Lease, Inc. will post 1.39 EPS for the current fiscal year.

Broadstone Net Lease Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be paid a dividend of $0.29 per share. This represents a $1.16 dividend on an annualized basis and a yield of 6.62%. The ex-dividend date of this dividend is Tuesday, December 31st. Broadstone Net Lease's dividend payout ratio is 152.63%.

About Broadstone Net Lease

(

Free Report)

Broadstone Net Lease, Inc (the Corporation) is a Maryland corporation formed on October 18, 2007, that elected to be taxed as a real estate investment trust (REIT) commencing with the taxable year ended December 31, 2008. Broadstone Net Lease, LLC (the Corporation's operating company, or the OP), is the entity through which the Corporation conducts its business and owns (either directly or through subsidiaries) all of the Corporation's properties.

Featured Articles

Before you consider Broadstone Net Lease, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadstone Net Lease wasn't on the list.

While Broadstone Net Lease currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.