Barclays PLC lifted its holdings in Coca-Cola Consolidated, Inc. (NASDAQ:COKE - Free Report) by 103.9% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 4,163 shares of the company's stock after purchasing an additional 2,121 shares during the period. Barclays PLC's holdings in Coca-Cola Consolidated were worth $5,481,000 as of its most recent filing with the SEC.

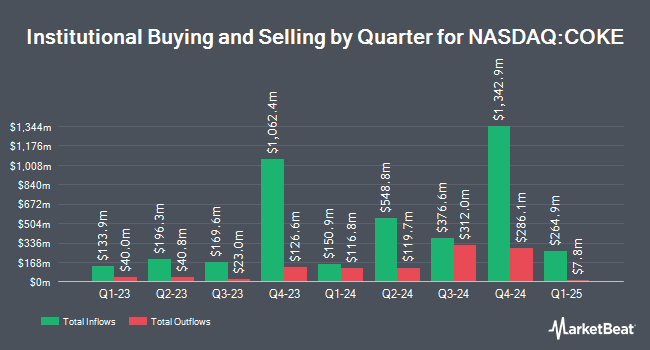

Several other large investors have also made changes to their positions in COKE. Atria Wealth Solutions Inc. boosted its stake in Coca-Cola Consolidated by 1.8% during the second quarter. Atria Wealth Solutions Inc. now owns 1,489 shares of the company's stock worth $1,616,000 after buying an additional 26 shares in the last quarter. &PARTNERS acquired a new position in Coca-Cola Consolidated in the second quarter worth about $1,021,000. First Command Advisory Services Inc. lifted its stake in Coca-Cola Consolidated by 91.7% during the second quarter. First Command Advisory Services Inc. now owns 115 shares of the company's stock worth $125,000 after purchasing an additional 55 shares during the period. AlphaStar Capital Management LLC acquired a new stake in Coca-Cola Consolidated during the second quarter valued at approximately $247,000. Finally, Pullen Investment Management LLC grew its stake in shares of Coca-Cola Consolidated by 3.0% in the 2nd quarter. Pullen Investment Management LLC now owns 974 shares of the company's stock valued at $1,057,000 after purchasing an additional 28 shares during the period. Institutional investors and hedge funds own 48.24% of the company's stock.

Coca-Cola Consolidated Price Performance

Coca-Cola Consolidated stock traded down $19.08 during mid-day trading on Friday, hitting $1,202.59. 89,501 shares of the company were exchanged, compared to its average volume of 50,077. Coca-Cola Consolidated, Inc. has a 1-year low of $800.76 and a 1-year high of $1,376.84. The company has a market capitalization of $10.54 billion, a PE ratio of 20.93 and a beta of 0.88. The business has a fifty day moving average of $1,251.13 and a 200 day moving average of $1,212.56. The company has a quick ratio of 2.15, a current ratio of 2.47 and a debt-to-equity ratio of 1.39.

Coca-Cola Consolidated (NASDAQ:COKE - Get Free Report) last announced its earnings results on Wednesday, October 30th. The company reported $18.81 EPS for the quarter. Coca-Cola Consolidated had a return on equity of 46.94% and a net margin of 7.81%. The company had revenue of $1.77 billion for the quarter.

Coca-Cola Consolidated Profile

(

Free Report)

Coca-Cola Consolidated, Inc, together with its subsidiaries, manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States. The company offers sparkling beverages; and still beverages, including energy products, as well as noncarbonated beverages comprising bottled water, ready to drink coffee and tea, enhanced water, juices, and sports drinks.

Further Reading

Before you consider Coca-Cola Consolidated, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Consolidated wasn't on the list.

While Coca-Cola Consolidated currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.