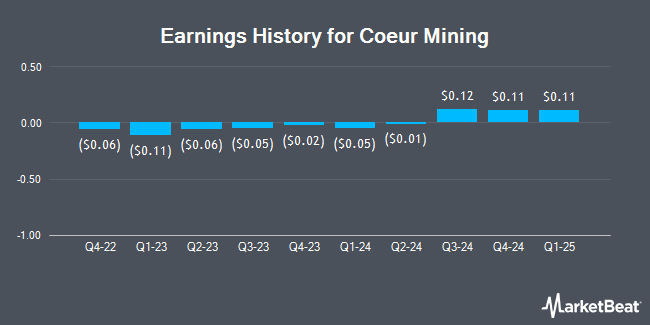

Coeur Mining (NYSE:CDE - Get Free Report) is expected to be issuing its quarterly earnings data after the market closes on Wednesday, February 19th. Analysts expect the company to announce earnings of $0.11 per share and revenue of $314.32 million for the quarter. Parties interested in registering for the company's conference call can do so using this link.

Coeur Mining Stock Performance

Shares of CDE traded down $0.61 on Friday, reaching $6.62. The company's stock had a trading volume of 29,836,358 shares, compared to its average volume of 11,334,689. The company has a debt-to-equity ratio of 0.53, a current ratio of 1.09 and a quick ratio of 0.39. The stock has a market capitalization of $2.64 billion, a P/E ratio of -220.43 and a beta of 1.59. The stock's 50 day simple moving average is $6.39 and its two-hundred day simple moving average is $6.39. Coeur Mining has a 12-month low of $2.42 and a 12-month high of $7.72.

Analyst Ratings Changes

Several equities analysts have weighed in on the stock. Cantor Fitzgerald raised shares of Coeur Mining from a "hold" rating to a "strong-buy" rating in a report on Thursday, November 7th. Roth Mkm reaffirmed a "buy" rating and set a $8.50 price target (down previously from $9.00) on shares of Coeur Mining in a report on Friday, November 8th. Finally, StockNews.com raised shares of Coeur Mining from a "sell" rating to a "hold" rating in a report on Friday, November 8th. Two investment analysts have rated the stock with a hold rating, four have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $7.81.

Check Out Our Latest Stock Analysis on CDE

About Coeur Mining

(

Get Free Report)

Coeur Mining, Inc explores for precious metals in the United States, Canada, and Mexico. The company primarily explores for gold, silver, zinc, and lead properties. It markets and sells its concentrates to third-party customers, smelters, under off-take agreements. The company was formerly known as Coeur d'Alene Mines Corporation and changed its name to Coeur Mining, Inc in May 2013.

Featured Stories

Before you consider Coeur Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coeur Mining wasn't on the list.

While Coeur Mining currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.